Planning My Next Meetup [hopefully not MIS] Adventure (Part 5)

Posted by Mark on July 30, 2019 at 06:42 | Last modified: January 28, 2019 05:55After further review, I like the Meetup proposal I wrote last time. One concern is that its intensity may scare people off. I discussed this in the paragraph following the first excerpt here as well as the third-to-last paragraph here.

Another possible approach is to lighten it up by leaving specifics for an initial orientation meeting. I would then be using the website to get people in the door for a detailed PowerPoint (?) presentation. I might also be able to do some screening at the orientation by going around the room and having people answer a couple questions about what stokes their interest, past experience (if any), and available time for group work.

I can imagine one potential downside being attendance only by people for whom time and place is convenient. I can try and offset this by crafting an alluring pitch to encourage sign up. I can also offer the orientation different times in varied locations. Since the bulk of our activities will be online (something to explain at the orientation but not on the website per paragraph #2 of Part 4), I don’t want geographic distance to rob me of potential group members.

Here’s a rough draft for a revised Meetup pitch:

A pharmacist by training, I have been trading options full-time for a living in my own account for the last 11 years. I have been happy with my overall results, but I aim to be better.

Such is the motivation for the Michigan Option Trading Work Group. The purpose of this group is to teach option trading strategies and to develop option trading systems.

I believe this group has lots to offer beginner and advanced traders, alike.

Regardless of experience level, this group needs people who will participate on a regular basis. Those planning on lurking in the shadows and gleaning pearls of wisdom will not be welcomed.

This group also needs people with spreadsheet, programming, and/or statistical expertise. Data analysis and backtesting will be cornerstones for our trading system development.

In return for your participation, I hope to deliver substantial education about the fundamentals and intricacies of option trading and investing. Nobody can guarantee profitability (see SEC website), and I will not be trading for you. However, if the content discussed and activities pursued do not help you understand self-directed investing on a whole new level, then I will truly consider the group to have failed.

My vision for this is like no other trading group I have seen in 15 years. Since prediction is an endeavor that sees professionals fail time and time again, we will spend little time discussing events pertaining to world economies or debating stock selection. Instead, we will spend our time planning actionable trading strategy to prepare us for whatever the market throws our way.

The sentence in bold is debatable. I think it is honest. If I want to make this more enticing, then perhaps I leave it out. On the other hand, perhaps leaving it in will give people more confidence by preventing them from misinterpreting the group as being something it’s not.

Categories: Networking | Comments (0) | PermalinkPlanning My Next Meetup [hopefully not MIS] Adventure (Part 4)

Posted by Mark on July 25, 2019 at 07:26 | Last modified: January 23, 2019 13:38After some effort, Meetup finally admitted that my group idea does not fit their guidelines.

Nevertheless, their ambivalent tone (first sentence of this first excerpt) makes me think the opportunity exists to start a group with some caution. I want to avoid obvious red flags such as the phrase “online work group” (see sentences 3-4 of excerpt just linked). I will avoid charging a large upfront fee (see here), which might be viewed as a product sale. I will omit reference to a selective interview process and small number of members, which may suggest limited revenue for Meetup.

The time has come to compose a rough draft of what I have in mind:

The purpose of this group is to teach, to analyze data, and to develop option trading systems.

We will teach through use of simulated trades that we design and monitor. We will couple our observations with discussion and analysis. We will rinse and repeat. By practicing a finite number of option trading strategies over and over, my goal is to become comfortable with common approaches that can be used to invest real money for those interested in doing so.

Lots of ideas from financial professionals and investment gurus sound good, but I believe the only way to understand what has truly worked is to analyze the data. I have many research questions that cater to spreadsheet analysis. If you have spreadsheet expertise and want to learn about investing, then this group is calling your name.

Development of option trading systems–the third area of focus—will depend on available programming skill in the group. I have specifications for what I seek in an automated backtester. I also have a detailed research plan. Results from this backtesting will help us to create (modify) the simulated trades mentioned two paragraphs above and offer a much broader context than following one trade after another in real-time. If you have programming expertise and are interested to learn about option trading, then this group is calling your name, too!

Advanced option traders can benefit from this group. You’re only as good as your last drawdown. To that end, you probably seek improvement just like I do. As an experienced trader myself, we can discuss various facets at a very high level.

Beginners can certainly benefit from this group. I could never guarantee profitability, but I can promise the potential to learn a great deal about the fundamentals and intricacies of option trading and investing. The information from this group will be shiny arrows for your financial quiver(s).

Regardless of your experience level, I want all members to participate. As I think back across the many trading groups I have attended over the years, most members lurk in the shadows with the hope of gaining free knowledge for themselves. In this group, even beginners can participate through things like daily trade tracking and/or data collection, monetary contribution, or IT support. I want us to be a community—a team of which everyone is an integral member.

And let me reiterate: if you have expertise with spreadsheets and/or programming, then I want you! We can do beautiful work together, and you can walk away with the skills to become a self-directed investor. Few can escape the fetters of the financial industry (i.e. AUM fees, expense ratios, etc.). This group has the potential to provide those essential tools.

My vision for this is like no other trading group I have seen in 15 years. Since prediction is an endeavor that sees professionals fail time and time again, we will spend little time discussing events pertaining to world economies or debating stock selection. Instead, we will spend our time planning actionable trading strategy to prepare us for whatever the market throws our way.

Categories: Networking | Comments (0) | PermalinkPlanning My Next Meetup [hopefully not MIS] Adventure (Part 3)

Posted by Mark on July 22, 2019 at 07:32 | Last modified: January 21, 2019 10:53Following my e-mail posted last time, Meetup responded:

> Hi there, sounds like a great potential group! Many groups

> cover metro areas, and not just a single city. Meetups should

> be offline and in real life. but online meetings are okay as

> long as they’re not the majority of the group’s events.

I was really describing multiple metropolitan areas (Ann Arbor, Detroit, and Lansing).

> Perhaps you could have a Slack group for your online

> correspondence and use Meetup to access our community

> and gain new members, and plan in-person events?

I replied:

> Thanks for your input.

>

> From what you describe, though, would this be acceptable for

> Meetup? The purpose of this group is to learn and/or help each

> other with their trading by working together on trades. Trading

> really lends itself to screen sharing, screenshots, and other

> things that can be posted on something like Slack, Yahoo! Groups,

> etc. Most of our regular work would therefore be online. The

> Meetups would perhaps be quarterly to allow us the chance to

> visit in-person those people with whom we work every day. My

> hope is that Meetup can bring us together in the first place.

Meetup replied:

> While we’re not able to offer specific advice or coaching on

> creating on your group, we recommend closely reviewing our

> Meetup Group Policies to ensure when you create your group it

> adheres to… [our] guidelines…

>

> Once you submit your new group, a member of the Community

> Experience team will review the group for approval.

I felt like we were once again miscommunicating as described in the first paragraph of the excerpt here. Their initial response (second paragraph, above) clearly expressed a conflict, but they seemed to be encouraging me to go forward regardless.

I responded:

> I’m not looking for advice or coaching. I’m trying to figure out

> if my group meets your guidelines. You wrote, “perhaps…

> [use]… a Slack group for your online correspondence and use

> Meetup to access our community… gain new members, and plan

> in-person events?” That is exactly what I would like to do.

> However, the previous paragraph says “online meetings…

> [cannot be] the majority of the group’s events.” That is

> problematic since the group would mainly be a daily online

> work group. Occasional in-person events would also give us

> the opportunity to meet face-to-face people with whom we

> have been doing daily work.

>

> I’ve been attending Meetups for over 10 years and I see

> Meetup as the perfect tool for this. I looked at your

> Standards document, though, and saw: “Be Local. Meetup

> is intended for building local community. Meetup should

> not be used primarily for scheduling online meetings,

> conference calls, or WEBINARS ACROSS GEOGRAPHIES…

> Meetup’s features should be used to build the group’s

> capacity and create opportunities for meaningful connections

> within a local community.” [emphasis mine]

>

> That also suggests this would not be a viable Meetup. As

> mentioned in my initial inquiry, I feel the need to cast a

> wider geographic net to find the few people who would really

> be interested/benefit from a group like this.

Meetup replied:

> The focus of a Meetup group would be in person interactions,

> and at least 50% of the interactions should be local and

> face to face.

Finally, a resolution! Meetup is not a direct solution for the kind of blended (online and face-to-face) group I wish to create.

Categories: Networking | Comments (0) | PermalinkPlanning My Next Meetup [hopefully not MIS] Adventure (Part 2)

Posted by Mark on July 19, 2019 at 06:58 | Last modified: January 18, 2019 09:16I previously discussed a potential Meetup model where members with sufficient expertise to present [advanced material] about option trading would have meeting/membership fees waived.

That concept, along with the rest of my thoughts from the last post, have gotten me thinking about trying to organize again. To that end, it might help to review my last attempt and why it was rejected.

I recently contacted the folks from Meetup online. I wrote the following:

> I’ve had some fits and starts with Meetup in the past so I

> want to go over my idea and see if it would be appropriate

> per your community guidelines.

>

> I want to network with serious options traders (or those

> interested to learn who would be serious about committing

> time to work together) to create a trading team where we

> consistently study simulated trades.

>

> This sort of community is badly needed. Independent traders

> like myself operate in a very isolated landscape often preyed

> upon by vendors of various types looking to profit under the

> guise of trying to help and support us.

>

> Independent traders are uncommon (most with investible assets

> hire professionals to manage their money). Option traders are

> a fraction of the fraction, which makes them even harder to

> find. I might have success in a big city like New York or

> Chicago where the trading exchanges are. In Ann Arbor, Detroit,

> or Lansing, though, I have found it to be really tough sledding.

>

> The group I envision will do most of its work online through

> something like Yahoo! Groups, Slack, or GoToMeeting. I hope

> to have daily online activity with trade monitoring and

> creation. Disciplined, consistent participation establishes

> accountability necessary to become a good trader.

>

> I would like to have a periodic in-person meeting to

> actually see and shake hands with the people we’ve been

> working with so regularly. This is where the traditional

> Meetup comes into play.

>

> Initially, I would open the group online. I would then

> like to interview each member to assess whether they are

> serious and have something to offer. I want people to

> either have expertise or time (which will eventually

> result in expertise) they can commit to studying trades.

>

> If I can find 3-10 people then I will create a virtual

> meeting of some sort to get us started. I would have

> them pay a small fee (maybe around $50) to cover Meetup

> expenses and/or anything else (including renting space

> for periodic physical Meetups down the road).

>

> Finally, I would like to focus this on the Ann Arbor,

> Lansing, and Metro Detroit area. This is bigger than a

> city: [as discussed above] I feel the need to cast a wider

> geographic net to have a real chance of finding interested

> parties. It’s all within a 90-minute driving range, though,

> which is hopefully not too large for members even at the

> extremes to make a quarterly or semi-annual

> face-to-face get-together.

>

> Any feedback would be appreciated!

I will continue with their response next time.

Categories: Networking | Comments (0) | PermalinkPlanning My Next Meetup [hopefully not MIS] Adventure (Part 1)

Posted by Mark on July 16, 2019 at 06:33 | Last modified: January 18, 2019 08:20Today I am “jotting down” some other related ideas to this blog mini-series I wrote last year.

Flashing back to the end of last year, I was aware that coming into 2018, I had some New Year’s resolutions that I aimed to fulfill. I was not happy with the progress.

With regard to work, my hope was to “get more involved” in 2018. I was thankful to have survived into my eleventh year trading full-time for a living, but I missed my pharmacy co-workers and patients (see fourth paragraph here). I had searched high and low for other full-time retail option traders but had yet to make lasting connections for a variety of reasons.

One way to become more involved would be to organize a group. As already described (in addition to link from the first paragraph, see here, here, and here), previous groups [planning] failed to bear fruit.

A different kind of group would be an educational experience for high schoolers (see third paragraph here). To this end, I reached out… but I will save this discussion for a separate post.

Here are some things that I know:

- Trading for a living is held in high esteem and described by some as the Holy Grail (e.g. trading from the beach to pay the bills without a worry in the world).

- I have searched high and low for other full-time traders with little success (e.g. fourth paragraph here).

- One trading guru opined: “people like to be spoon-fed strategies or trades. Better yet, just drop bags of cash in their lap as they sit on the couch watching TV.”

- Beginners in trading group attendance are often hoping to get free knowledge that will pay dividends.

- Most members of trading groups and forums lurk quietly without participating.

With regard to the latter, I think people who share advanced knowledge should be admitted to the group at no or minimal cost. Such a trading community currently exists. They broadcast weekly trade webinars. Anyone can attend for free, and for a monthly fee I am able to view any webinar in their entire collection on demand. If I present at one of their weekly meetings, then I get membership free for one year.

I like this model because while I believe everyone should contribute (i.e. second paragraph here), I do not wish to discriminate against beginners who are not yet able. Monetary contributions are different from sharing expertise, but they become quite important if you believe the organizer should (at least*) be partially reimbursed for expenses. Done this way, experts’ costs are covered by beginners in exchange for a sharing of experience.

I will continue next time.

* The extent to which I should be compensated as an organizer is an enticing topic for

an entirely separate blog mini-series. As discussed in the second paragraph of the

excerpt here, fees are as much for accountability as anything else. Honestly, if I knew

the next group I create would be long-lasting and hit my objectives, then I would

happily pay for it myself because my resultant trading profits would more than cover

the expense (this is a potential marketing angle, too).

Short Premium Research Dissection (Part 41)

Posted by Mark on July 11, 2019 at 06:09 | Last modified: January 15, 2019 09:57I e-mailed our author giving some general feedback about the report.

The first paragraph was the focus of my discussion from last time:

> I’ve gone over it extensively and there’s a lot I have to

> say. I don’t have solutions for some of the concerns and

> it’s possible that these particulars have no correct answers

> at all. It’s a complicated project with many permutations.

>

> I would like to see a consistent set of statistics provided

> after every single backtest. The “hypothetical portfolio

> growth” graph template is consistent. The statistics vary

> widely. I often wanted more than what you provided.

Part of this standard battery should have been PnL per day, which our author did not really discuss.

> I would also like to see complete methodology given for

> every backtest. The methodology should allow me to

> replicate your study and get the same/similar results.

>

> No explanation was given for the disappearance of

> 2007-9 data in Sct 5… It really should be in the report…

> because it could otherwise be construed as curve fitting…

> 2008 provided one of the great market shocks of all

> time and we could really benefit by seeing how the

> final trading system performed during that time.

I have since learned the data was lost because she switched from ETF to index data. The latter was only available from 2010 onward. If it meant losing 2007-9, then I think she should have stuck with the ETF.

> I wondered why some components of Scts 3-4 were not

> in Sct 5 and vice versa. How would time and delta stops

> have fared in Sct 3? How would a VIX filter and rolling

> up the put performed in Sct 5? It’s hard to compare

> Sct 5 with Scts 3-4 because of these key differences

> (along with the missing 2007-9 data).

She does not include transaction fees in the backtesting. This is a fault. I mentioned this in the second-to-last paragraph of Part 36 and the fourth paragraph of Part 38.

On several occasions (e.g. paragraph after sixth excerpt here and paragraph after first table here), I wrote “when something changes without explanation, the critical analyst should ask why.” She should be ahead of this and check herself for such inconsistencies throughout. A proofreader could help.

I have mentioned proofreading a couple times (e.g. Parts 36 and 38) and sloppiness many times in this review. Absence of that “hypothetical computer simulated performance” disclaimer was sloppy and plagued me throughout much of the report. A proofreader should have caught this.

A proofreader educated about trading system development could have flagged sloppiness suggestive of curve fitting (e.g. second paragraph below table here) and future leaks (e.g. this footnote and third paragraph below last excerpt here).

Sample sizes should always be given and the report (e.g. third paragraph below third excerpt here and first bullet point below table here) would be better with inferential statistics [testing] to identify the real differences (e.g. third paragraph below first table here and second paragraph below final excerpt here). Criteria for adopting trade guidelines should be detailed at the top. Control group performance would also be useful (e.g. paragraph below graph here and third paragraph following table here).

In conclusion, I think the report would be better described as a trading strategy than a fully developed system. With regard to the latter, though, the report is a great educational piece and a valuable springboard for further discussion.

Categories: System Development | Comments (0) | PermalinkShort Premium Research Dissection (Part 40)

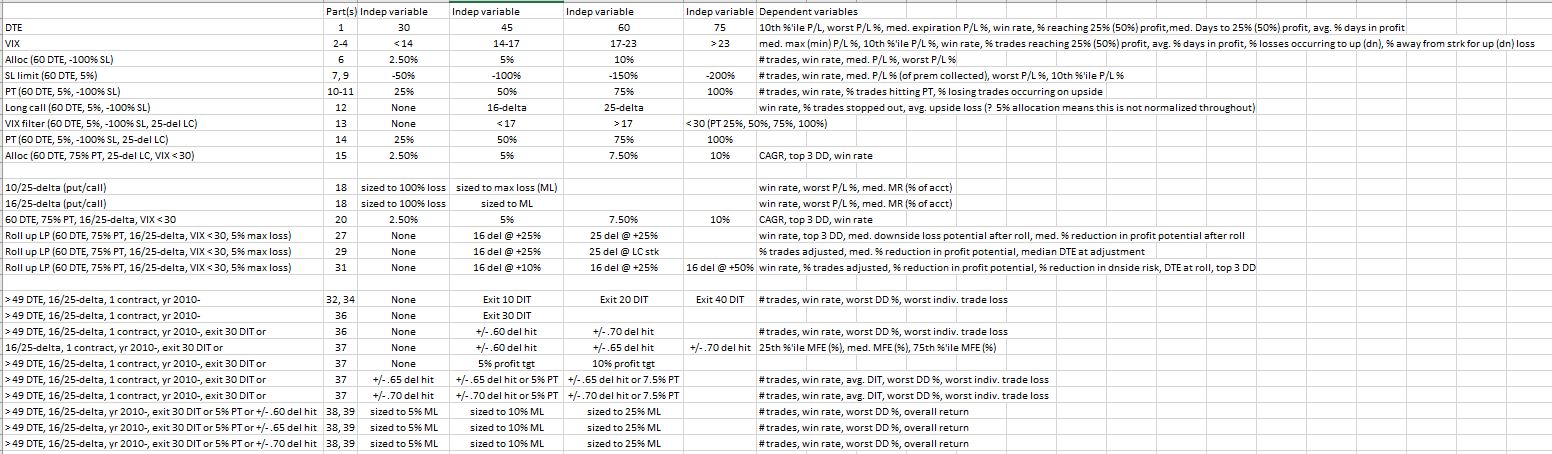

Posted by Mark on July 8, 2019 at 07:14 | Last modified: January 11, 2019 09:18By way of recap, let’s begin by doing an updated parameter check (see second paragraph here). Get your reading glasses:

The second column shows in what part of this blog mini-series each study is discussed.

This is too complex to be a definitive exercise in trading system development. Numerous independent variables, dependent variables, and criteria of all sorts have been covered. With all the degrees of freedom represented, only a fraction of the total number of permutations are actually explored.

I discussed my concept of trading system development in the paragraphs #2 and #3 below the excerpt here. As mentioned in the second and third paragraphs of Part 11, thousands of different permutations is too complex. The scary thing is that in some instances (e.g. paragraph after graph here and paragraph #2 here where I discussed failure to explore range extremes), I have actually been clamoring for more parameter values to be studied.

I believe each independent variable should be studied separately to understand its impact on performance.* “Independent variable” is easily confused with words like entry/exit criteria, profit target, filters, stops—when in fact they all probably represent degrees of freedom. The total number of permutations is multiplicative across the number of potential values for each independent variable. I tracked this earlier (final sentence of Part 11) before the research went in too many directions with too many inconsistencies and too much sloppiness.

Some of the tested variables are more about position sizing than trade setup. I’m talking about delta selection for long options. Narrower spreads carry lower margin requirements and allow for greater leverage (see discussion beginning here). This makes delta a factor in position sizing, which goes hand-in-hand with allocation: something she does study.

An entire knowledge domain exists to solve the problem of optimization. I have yet to write about this subject.

For now, it will suffice to say that although I think our author has failed to undertake a valid system development process, I do not have the solution to right her ship. The approach seems too multi-dimensional. In my gut, I sometimes feel that not everything needs to be thoroughly explored. For example, why not just stick with 60 DTE rather than having to look at 30, 45, and 75 DTE? This is precisely the rationale for studying daily trades (second-to-last paragraph here), though, as a check to ensure results aren’t fluke. It’s really all about cutting through the laziness.

I will conclude next time.

* This is easier said than done as interaction effects (see this footnote) should also be identified.

Categories: System Development | Comments (0) | PermalinkShort Premium Research Dissection (Part 39)

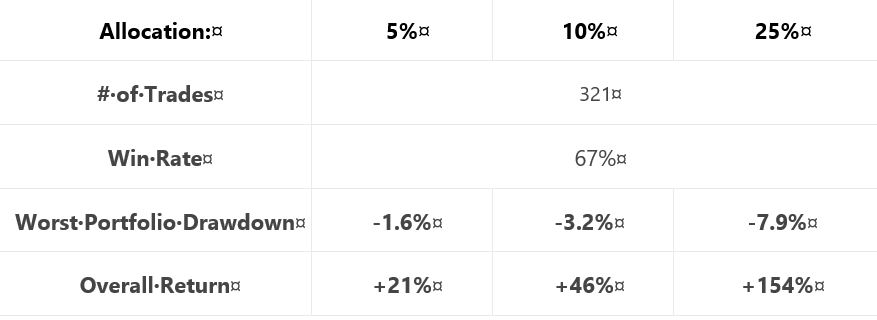

Posted by Mark on July 5, 2019 at 07:03 | Last modified: January 11, 2019 08:33Continuing on with our author’s final analysis, she presents two “hypothetical portfolio growth” graphs for each of three delta stops: one with curves for 5% and 10% allocation and one with a curve for 25% allocation. Y-axis values and derived percentages are therefore relevant (see second-to-last paragraph here). None of these final graphs has a referent for the asterisk,* which we now know corresponds to the “hypothetical computer simulated performance” disclaimer shown here.

For each delta stop, she provides the usual table that falls short of the standard battery (second paragraph):

Similar to tables included previously (e.g. Part 15 and Part 20), a couple differences are noteworthy. First, she includes only the biggest rather than top 3 drawdowns (discussed in paragraph #2 below excerpt #1 here). This is characteristic of all tables in this final section (along with the lost 2007-2009 data, which was discussed in these final three paragraphs).

The other difference is inclusion of overall return rather than CAGR. As described in the paragraph below the first table here, things are sloppy when inconsistent from one sub-section to the next. This is the first time we are seeing “overall return.” Also as discussed in that same paragraph, the critical analyst should ask “why” when something changes without explanation. It’s no big deal here either, though. While overall return impresses more (larger in magnitude), CAGR works fine.

I have been calculating CAGR/MDD throughout this mini-series (e.g. Parts 33, 25, 22, 21, 20, 15). To convert from overall return, I’d have to approximate the backtesting interval (she never gives us the exact dates). I could then calculate CAGR/MDD, although it would not be comparable to previous sections due to the unexplained lost data.

Another source of significant sloppiness is passive disappearance of the VIX filter. The VIX filter was used in generating the final graph of the previous section (shown here). Like the lost data, the VIX filter has been absent in these “most up-to-date trading rules.” If the filter only comes into play for the 2008 crash, then it may represent curve fitting. Some explanation should be given for its sudden omission to preserve our author’s credibility.

With regard to sizing this strategy per individual risk tolerance, she unfortunately does not backtest an expanded parameter range (Part 38, paragraph #2) to help us truly understand allocation limits.

In the final sub-section, she presents a recent trade that probably serves a marketing purpose more than anything else. It’s always nice to hit the profit target after only five days. Beginning November 2, 2018, it probably was not included in the historical backtesting, which is fine (less fine is the omission of backtesting dates). I think something current stokes confidence more than something stale. I often wonder how many people click to order reports, trading systems, trader education products, etc., from websites with content a few years old at best. The graphs always look good. Only when you look close and dig deeper are you well-poised to identify errors and expose the fiction.

I will begin to wrap things up next time.

* The rare +1 she scored in Part 38 paragraph #4 is effectively offset.

Short Premium Research Dissection (Part 38)

Posted by Mark on July 2, 2019 at 07:22 | Last modified: January 8, 2019 06:42In paragraph #2 below the first table, I said I liked our author’s exploratory backtest to assess the [MFE] distribution.

What I don’t like about this approach is a failure to explore the extremes. I mentioned this in the paragraph after the graph here. Backtesting over a range where results are directly proportional is of limited utility. Backtesting over an expanded range can illustrate floor and ceiling effects, which defines the profitable range. With regard to delta stops (profit target), I would have liked to see 0.60 (2.5%) along with 0.75 – 0.80 (10% – 15%) rather than just 0.65 and 0.70 (5% and 7.5%).

Not only is study of the extremes* useful, I can argue for it to be essential. Exploring the tails can help us understand whether we have a normal, thin-, or fat-tailed distribution. I could imagine our author giving the excuse she wanted to avoid “overwhelming” us with lots of excess data (second paragraph below table here). It’s not excessive, though, and without it we have no reason to think she actually checked it herself. Not checking would be sloppy, superficial research indeed.

In the next sub-section, our author discusses trade sizing and the commission benefits of index vs. ETF trading. Once again (as discussed near the end of Part 36), she promotes a brokerage, which signifies a clear conflict of interest. Discussing commissions but not slippage is, if you think about it, very sloppy. These are the two biggest components of transaction fees, but slippage likely dwarfs commissions. The only place slippage is even mentioned is the “hypothetical computer simulated performance” disclaimer shown here and included in all such graphs this section (+1 on consistency, for once).

The next sub-section is titled “final strategy backtests… with various allocations.” Are we now going to see what trade guidelines have made the final cut?!

No.

She proceeds by showing us “hypothetical performance growth” graphs and cursory trade statistics for a 5% profit target managed at 30 DIT or delta stops of 0.60, 0.65, or 0.70 with allocations of 5%, 10%, or 25%. She then tells us to decide based on our own individual risk (drawdown) tolerance.

For each of the three delta stops, she gives the following [incomplete] methodology:

> Expiration: standard monthly cycle closest to 60 (no less than 50) DTE

> Entry: day after previous trade closed

> Sizing: 5%, 10%, 20% Allocations [emphasis mine]

This is a typographical error: 20% should be 25%. As with the first paragraph below the first excerpt of Part 36, maybe the proofreader fell asleep? Sloppiness has been a recurrent theme throughout.

> Management: exit after 30 days, 5% profit, or at ±0.60 short delta

I will continue next time.

* Incidentally, backtesting over an expanded range would preclude the need for an exploratory

test to determine MFE distribution.