Does Technical Analysis Work? Here’s Proof! (Part 6)

Posted by Mark on April 23, 2021 at 07:03 | Last modified: March 12, 2021 10:45Like a bloodhound, I’m now hot on the trail of “Janny Kul” after reading the comments following his TDA article with the same title as this blog mini-series.

An internet search reveals a longer article about what happened to the first commenter. He writes:

> As I was doing my research into crypto bots, I came across articles

Interestingly, I came across Kul when searching on “technical analysis.” I had no idea he was involved with Bitcoin until he suddenly shifted gears and started writing about it as reported in the seventh paragraph of Part 4.

> written by Janny Kul (https://www.linkedin.com/in/janny-kul/). The

> articles came across very solid and I contacted Janny over the email

> stated on credium.io. He came across as a trustworthy individual with

> respectable experience in traditional finance. We exchanged a few

Remember what I said about [phony] online sources that appear to be reputable (fourth and final paragraphs here). Kul has impressive credentials on LinkedIn, the tone of his writing sounds professional, and in digging deeper I even found an article written about his success by a seemingly qualified author.*

> emails after which I received a solicitation email from Credium advising

> that they have opened up 50 positions for new investors to come in. So

Always watch out for scarcity marketing! Here is a crash course.

> I deposited the funds in July 2020.

If this is fraud then it is very sad. I have written about the subject many times in this blog.

Further investigation reveals a lot more reasonable doubt regarding the sanctity of “Janny Kul.” I did an internet search for “credium scam janny kul” and found a number of international links:

- “The Best Crypto Trading Bot & Platform On The Cloud” is .ru (Russia)

- “Best Tested Crypto Trading Bots” is .belarus.kuhnya.ru

- “Binance Day Trading Bot Forex Millionaires” is .pe (Peru)

- “Exchange Differences Trading Bot Replication Strategy” is .in (India)

- “250 Minimum Bitcoin Auto Bot Trading Bitcoin Price How To Buy” is .fr (France)

- “Like what you’re reading? the best cryptocurrency trading bots in 2020” is .it (Italy)

Janny Kul is mentioned as the author of most of these articles, which gives the impression he is a real expert. Clicking on more than one of these brings me to an article “How a 26-Year-Old College Dropout Makes $15,000 a Month With Bitcoin and Cryptocurrency Without Breaking a Sweat,” which is a red flag. In case I was still not convinced, clicking on the links of some of the Facebook comments at the end of the article brought me—not to Facebook, but rather to a landing page:

This is a major red flag (and do not try this at home without running a scan for malware afterward).

In the end, I got a couple good ideas out of “Janny Kul’s” online article on technical analysis. I’m not falling for anything more, though, and I’m certainly not going to be investing any money with him.

* — Some further digging suggests this to be a legitimate website although I

would encourage everyone to scrutinize such websites that review targets

in question as they may sometimes be fake themselves set for the express

up purpose of shining a positive light on fraudulent people or services.

Does Technical Analysis Work? Here’s Proof! (Part 5)

Posted by Mark on April 20, 2021 at 07:09 | Last modified: March 12, 2021 10:18In this blog mini-series, I have been presenting commentary and analysis of Janny Kul’s TDS article with the same title.

I concluded discussion of Kul’s article last time.

I originally found the article very interesting and continued on to the comments. The first one is an eye-opener:

> ATTENTION. The article is solid and I personally bought for it and

> deposited funds into credium.io in July 2020 following an email

> exchange with Janny Kul. Since the deposit has been made there has

> been no response from him or anyone else at credium.io. The

> deposited funds are reported as deposited, but not yet invested.

> The fund stopped reporting its performance in May 2020. A

> withdrawal hasn’tbeen possible either since the initial investment.

>

> If you search for “credium” on Medium, Google, Facebook, Twitter,

> you would find a large number of people who publicly reported being

> unable to make a withdrawal for months. Some individuals only

> managed to have funds returned after reporting to the police. Others

> resorted to other means including attacking social media channels as

> [seen] in this very comment section.

“Credium?!” I never heard of that and don’t know anything about it.

Another comment below (could be from the same or different person):

> SCAM SCAM SCAM JANNY, CREDIUM ALL SCAM. SEND MONEY TO

> CREDIUM AND THEN DISSAPEAR. NO ANSWER, NO INVESTMENT, NO

> WITHDRAWL. LOST MY MONEY, DO NOT HEAR FROM THIS PEOPLE

Wow. What about the next comment?

> It was a success, I got my lost funds recovered am happy to share

This seems to be related since she is talking about recovering lost funds. Reading on, though:

> my experience so far in trading binary options have been

> losing and [emphasis mine]

Neither the article nor the comments are about binary options so where does that come from?

> finding it difficult to make a profit in trading for a long time, I

> traded with different trading companies but I couldn’t earn profits

> and I ended up losing the whole live-saving I gave up on trading

> until I meet [Raymond Susy] who help me and gave me the right

> strategy and winning signals to trade and earning process and also

Is this an advertisement for “Raymond Susy?”

> I was able to get all my lost fund back from all the brokers and

> trading companies I traded with, now I can make profits anytime I

I see nothing specific here mentioning Janny Kul or credium (dot io).

> place a trade through her amazing masterclass strategy feel free

> to email her on mail {XXXXXXXXXXXXX@gmail.com} her WhatsApp

> contact +YYYYYYYYYYYY

Although the other comments have raised my suspicion about “Janny Kul,” I think this comment is unrelated spam.

I will conclude next time.

Categories: optionScam.com | Comments (0) | PermalinkProprietary Indicators

Posted by Mark on April 24, 2020 at 07:13 | Last modified: April 26, 2020 13:23Proprietary indicators sometimes serve a sketchy purpose in finance.

Check out an article out yesterday (April 23, 2020) on marketwatch.com. The article quotes Sophie Huynh, a Société Générale’s multiasset strategist, who says “investors have likely gotten ahead of themselves… [because] this tech-led recovery… is not sustainable.”

She offers some reasoning to support this prediction. Only in retrospect will we know if she was right or wrong, though, and we will never be able to do anything more than hypothesize as to why.

The article continues:

> Huynh is keeping a close eye on a proprietary indicator that

> tracks positioning of big money managers over a range of

> perceived riskier assets, and so far they are not throwing in

> the towel. “What we’re seeing at the moment is there are no

> signs of capitulation compared to levels seen in 2008, but

> there’s some risk-off that’s settled in,” she said.

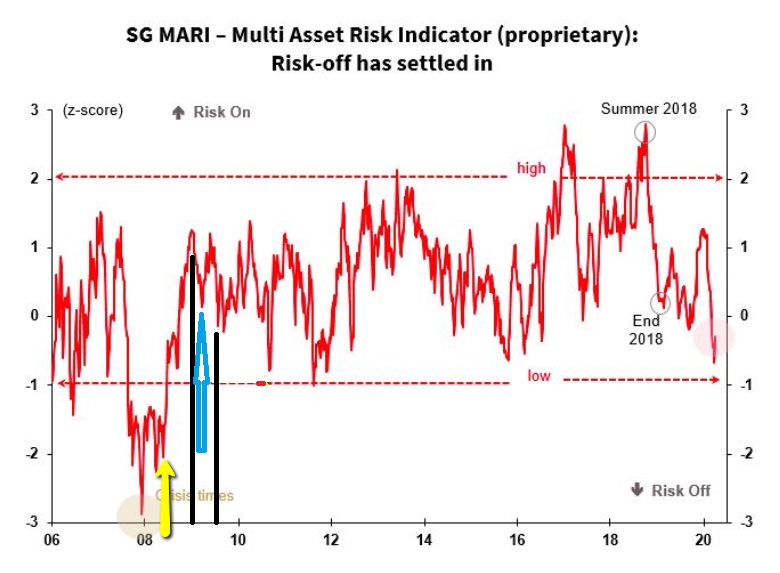

Here’s a chart of the indicator:

At the end of Dec 2007, the indicator bottomed out near -3. I’ll give benefit of the doubt here because the biggest selling occurred in the first couple weeks of 2008 when the indicator had rebounded (albeit to to a still-very-low value).

Because the current indicator (roughly -0.25) is nowhere near the 2008 levels, Huynh is claiming we are not at the bottom.

Can we believe in the indicator, though? Let’s check some values to find out.

The spike lows near the yellow arrow (down to roughly -2.25 and -2.0, respectively) occurred in the first six months of 2008 (around or before 1/4 of the distance between the ’08 and ’10 hashmarks on the x-axis). This seems discrepant because the heavy selling in 2008 came in Q4 (Oct – Nov).

Looking forward, I inserted the black lines to bracket the first half of 2009. This bear market bottomed out with the two weeks ending March 9, 2009. The lowest value of the indicator around that time is highlighted by the blue arrow where it sits in slightly positive territory. That doesn’t seem right.

Moving forward, the period around the Flash Crash (May 2010) is accompanied by a spike down to roughly -0.9. That’s good.

The period around the 2011 summer selloff (US debt downgrade) is accompanied by a spike down to roughly -1. That’s good.

Around August 20-24, 2015, the Brexit selloff is accompanied by a spike down to roughly -0.7.

Around Feb – Mar 2018 when the market corrected over 10%, the indicator looks to be in positive territory. Not good.

Around Oct – Dec 2018 when the market corrected over 10%, the indicator looks to be in positive territory. Not good.

Overall, this indicator is 50/50 based on a small sample size of occurrences in terms of matching up with major “risk off” market declines. A theoretical coin flip would do just as well.

I see many “proprietary indicators” when reading articles in the financial media. I don’t know if such indicators have been accurate in the past (in this case, I was able to do some cursory backtesting). I don’t know if they have been tested for validity. I wouldn’t know what to look for in terms of validity testing—all because they are proprietary (undisclosed). The article is often marketing for some sort of business. In that case, I certainly want to be on the lookout for the fallacy of the well-chosen example (see middle paragraph here).

Red flags fly, for me, whenever I see something labeled proprietary. Too often, this seems to give authors license to write anything convenient.

Categories: optionScam.com | Comments (0) | PermalinkBitcoin Trading Hoax?

Posted by Mark on March 26, 2020 at 07:57 | Last modified: May 14, 2020 09:03A recent study suggests Bitcoin trading to be a hoax: can we believe this?

An analysis published by Bitwise this week claims 95% of bitcoin spot trading is faked by unregulated exchanges. The study is consistent with regulators’ concerns that cryptocurrency markets are manipulated.

Bitwise found the average bitcoin spread to be about one penny at Coinbase Pro. This exchange reports about $27 million in average daily volume.

In comparison, they found the average spread to be about $15 at CoinBene. This is the largest reported exchange on CoinMarketCap.com. Yes, that is 15 dollars (compared to cent, above). Bitwise also found other extreme examples of exchanges with spreads upwards of $300. “It is surprising that an exchange with almost 18 times the volume of Coinbase Pro would have a spread that is 1,500 times larger,” Bitwise said.

Surprising indeed!

No sensible trader* would transact on an exchange with such huge spreads when Coinbase Pro is available. The volume listed at such exchanges must therefore be bogus.

Exchanges certainly have underlying motives to report fake volume. Volume is attractive for new initial coin offerings. The latter would want their cryptocurrency listed on an exchange where maximal trading takes place. Fees for these new initial coin offerings can run from $1 million to $3 million per listing: nice profit for the exchanges.

It all makes sense…

…except who is this Bitwise? I don’t want to blindly accept any conclusions before checking the source.

Bitwise is an asset manager in the process of trying to issue the first-ever bitcoin ETF. They recently met with the SEC to discuss the application and submitted analysis they thought would be helpful to regulators.

I see a clear conflict of interest here. If people can’t trust what they see from the exchanges or brokerages, then they may not trade bitcoin. Alternatively, they may choose to trade bitcoin in a “safer” vehicle that is professionally managed—presumably by someone able to navigate apparent volume to get good execution. This would be a reason for some to use a bitcoin ETF.

Personally, I neither agree nor disagree with the study. I simply think the investigator has underlying motives when reporting these conclusions. As a result, I would want to see the numbers myself for verification.

* — “Smart money” is responsible for the majority of volume; I’m not mentioning institutions here, though,

because I honestly don’t know how much the intstitutions trade bitcoin at this early stage.

The Disgrace of Karen “Supertrader” Bruton (Part 3)

Posted by Mark on February 21, 2020 at 05:06 | Last modified: May 7, 2020 06:52Today I conclude my transcript of the Karen Bruton “Distinguished Alumni” award video by Wake Forest University in 2014 (before filing of SEC complaint).

———————————-

JH: The other hope is Hope Investments, which she created after several years of Just Hope Internationl (JHI) and she’s taking her profits from this and she’s created a foundation that is feeding JHI. And that’s really exciting. Especially for me who always looks at not-for-profits as wanting more and more money, this is going to be self-generating.

JC: Karen’s facilitating all that so she’s creating a structural systemic change to a region not just simply going in and trying to make a difference for a period of time.

BT: I have heard her speak of her life and her experience growing up in North Carolina, her academic achievements—all of it was preparing her for the work that she would do in trading and non-profit through Just Hope and that’s in circles where you guys aren’t around listening but she’s saying it anyway.

JC: As students and as constituents of the Wake Forest community, we all appreciate the fact that we hear about President Nasante, we see it etched in stone on the walls, we read about it in the magazine every now and then… but to see someone who has grabbed a hold of it and has really made it a model for their life like Karen has is truly remarkable. It’s amazing to see someone who has dedicated their entire life to that. She would tell you that she sees it as a grand adventure… and she wants as many people to be affected by it but she also wants many people to participate in that.

Sosnoff: You’re talking about a very rare person. This is not somebody who had a liquidation event like an IPO or something for hundred million or a billion or $10B. This is somebody that is incredibly self-made at a certain point in life when it’s incredibly difficult to reach that level of achievement and then to turn around and to make the contribution that she’s made to good will? Pretty amazing…

JH: Karen, I’ve known you for at least 30 years and I’ve known you to be an adventurous type—very smart—but I never imagined you’d be where you are today. I know you’ve completed many things on your bucket list—Andrea Bocelli concert in Italy, Brooks and Dunn in Las Vegas, the Eagles—but I know nothing means as much to you as the word “hope” and I’m so proud of you and sorry that I can’t be with you tonight but I know you are most deserving of this award.

BT: Karen congratulations on your award. I cannot think of a more deserving person. I am blessed and privileged not only to know you as a person, to consider you like family, but to work under your leadership and to partner with you in this great adventure.

RH: I’m very very proud to support, endorse, and congratulate Karen on this distinctive honor that she is receiving from Wake Forest, which is so well deserved. Thank you.

MWS: Hey Karen… congratulations on your prestigious award from Wake Forest… very impressed by your work how you’ve brought the for- and non-profit world together. I celebrate your life tonight all the way from Franklin, TN. I wish I could be there in person. I hope it’s a great night and one that you’ll never forget. You’ve inspired so many and I’m one of those people.

———————————-

To say “this did not age well” would be a vast understatement.

Categories: optionScam.com | Comments (0) | PermalinkThe Disgrace of Karen “Supertrader” Bruton (Part 2)

Posted by Mark on February 18, 2020 at 14:52 | Last modified: May 7, 2020 06:49Today I continue with my transcript of the Karen Bruton “Distinguished Alumni” award video by Wake Forest University in 2014 (before filing of SEC complaint).

To protect the innocent, I am rescinding most of the participant names (you already know about Tom Sosnoff). The shock value here is how wrong these people were about their hero, Karen Bruton, much like I (and so many others!) have been duped throughout history by public heroes that none of us really know.

———————————-

BT: At face value, just looking at Karen you see professionalism. She exudes a confidence and an inner strength. You might, if you knew that she was an accountant, a CPA, form an opinion or a picture of her that couldn’t be more inaccurate [emphasis mine].

Tom Sosnoff: Here’s… another nice person, ridiculously smart, that really wants to learn… she’s serious and very true-to-form. She’s very professional but she does not take herself too seriously.

JC: I mean she’s a CFO, right? She’s a financial personality and she’s a CPA. She’s a little bit reserved and conservative in her approach but frankly that’s part of the charm and I think that’s a strong component of her success whether it’s investing, whether it’s philanthrophy in a conservative manner… she’s able to utilize those skills and enjoy success because of that.

BT: Any and all success that Just Hope has seen is attributable to Karen Bruton. Prior to 2013, Karen was Just Hope. What you had was a sole proprietorship, basically. Karen said, “I’m stepping away from my professional career. I’m giving my life to this work. I’m going and I’m gonna carry out these acts of service.”

RH: Now this is a major undertaking: building the organization, engaging the people to help her, taking full responsibility for financing her efforts…

JH: She came to me to explain her wanting to start a not-for-profit called Just Hope International (JHI). That was a dream she had and I didn’t know that dream. She asked me to serve on her board… and I’ve been so happy to watch it grow.

RH: After having visited other places, she decided on Sierra Leone—one of the most remote and hostile areas in the world… determined to improve the quality of life for the people living there.

JC: The fact that she’s over in places like Thailand, Sierra Leone—where nothing works the way that it should… and she’s not accepting that. She’s saying “I’m going to go make a difference. I’m going to go provide opportunity to places and to people that have not had opportunities before.”

RH: They’re raising… pineapple… 100 acres and they will eventually have one million pineapple plants and the prospects of this continuing for a long time—hopefully indefinitely—are very real.

BT: She has an enormous heart. But it’s not just a tug at the heart: it’s a plan in the head. She applies business skills and principles to serving the poor in the world today. Part of the systemic issue that we’re dealing with in some of these areas is the fact that the handout model simply does not work and the whole concept behind JHI and what Karen is trying to do is… to give people a hand up not a hand out.

RH: Together with that sharing she started an orphanage in the same area bringing a much better life to the children… giving them a better opportunity to have a better future, to have hope for the future…

BT: When going in and working with some of the poorest people in the world, it is very easy to do things that make us feel good. The hard part is going in and doing work that is really about the people you’re serving. Plant seeds, growing those trees–you don’t intend to sit in the shade.

———————————-

I will conclude next time.

Categories: optionScam.com | Comments (0) | PermalinkThe Disgrace of Karen “Supertrader” Bruton (Part 1)

Posted by Mark on February 13, 2020 at 06:38 | Last modified: May 6, 2020 15:20Over the years, I’ve seen some of my greatest personal heroes fall prey to greed. Barry Bonds and Lance Armstrong are two who were eventually found to be using performance enhancing drugs to cheat sport and gain edge on all competitors. In the process, they also lied to the public with skill that would make a psychopath proud. Much of this is common in the world of fraud, chicanery, and the CNBC television show American Greed—all of which have made frequent appearances in this blog.

In September 2018, Hope Advisors Inc.—the financing arm of a Tennessee nonprofit that promoted economic development in third-world countries—settled fraud charges with the with the Securities and Exchange Commission for $1.5M. You may be more familiar with the name of Hope Advisors owner Karen Bruton. I blogged about this in 2016 with a three-part mini-series starting here.

The current blog mini-series was drafted in August 2016 but never completed. In Part 2 of the current mini-series, I will present a transcript of clips from the video referenced in Part 3. The video has since been taken down—presumably after Bruton’s fraud was discovered. The video featured several people speaking to a “Distinguished Alumni” award given to Bruton from Wake Forest University in 2014.

Categories: optionScam.com | Comments (0) | PermalinkDoes Any Technical Analysis Work? (Part 6)

Posted by Mark on December 5, 2019 at 07:53 | Last modified: April 22, 2020 11:40Today I conclude with my internet sample of opinions on whether technical analysis (TA) can actually work.

Here’s an excerpt from an article by Proinsias O’Mahony:

> While TA remains widely used, that doesn’t mean it’s not bunkum.

> Indeed, many technical traders would be the first to accept that

> the field is full of charlatans. As bond expert and author Martin

> Fridson has written: “The only thing we know for certain about

> TA is that it’s possible to make a living publishing a newsletter

> on the subject.”

See my post here.

> Such newsletters are full of references to obscure Japanese

> candlestick chart patterns, Elliott Wave theory, Fibonacci

> numbers, and all kinds of other vague and unverified assertions.

I wrote about some of this here.

After all the opinions in these five posts, what do we have?

The four excerpts from Part 2 are optimistic and give me hope.

The two excerpts from Part 3 suggest that anything we find in books, seminars, or on the internet will not work.

The commentary from Part 4 suggests that no simple indicators will work and that bots available for purchase will not work over the long term. The latter is not new because I don’t expect any system to work forever.

[9] – [11] in Part 5 argue that no bots for sale will ever work, no .pdf guidelines or strategies based in TA will work, no simple TA-based systems will work, and that institutions advertising advanced TA-based departments with oodles of computing power and academic doctorates are really for marketing purposes only.

Today’s excerpts argue against TA like most of the others I have surveyed.

Of all this, I have to hope [1] – [4] is correct. It may not be easy, though. Although my initial impressions do not concur, at least one prolific writer in the algorithmic trading space says simple strategies are all we need.

As an aside, O’Mahony also provides some ammunition in case I ever want to sound off on fundamentals again (see second-to-last paragraph here):

> The same can be said of fundamental analysis, however.

> Billionaire investor Mark Cuban once scoffed that “fundamentals

> is a word invented by sellers to find buyers… metrics created

> to help stockbrokers sell stocks, and to give buyers reassurance

> when buying stocks.”

>

> That may be cynical, but it’s a documented fact that most

> fundamental managers underperform the markets. Most investors

> would be better adopting a buy-and-hold approach rather than

> painstakingly studying stockbroker notes in a futile attempt

> to gain an edge.

Do you know if any successful traders even exist?

Next time, I will come back to discussion of my personal experience thus far.

Categories: optionScam.com, System Development | Comments (0) | PermalinkDoes Any Technical Analysis Work? (Part 4)

Posted by Mark on November 28, 2019 at 07:39 | Last modified: April 22, 2020 09:28One can do an internet search on “does technical analysis work” and find lots of discussion on the topic.

JA wrote:

> …I know if someone discovers a profitable strategy he won’t share

> it… I was asking about “public and very common strategies using

> TA,” like RSI, Fibonacci etc, because if they work, why aren’t a

> lot of bots out there making money really easy with that? And my

> comment about people selling courses is because it confuses me

> when I see people I trust telling me they use those techniques

> with good results. How is that possible? Do you think they work?

CF responded:

> ok dude. you know the “public and very common strategies like

> RSI, Fibonacci etc.” Those are absolutely total trash. Like: a joke,

> just a total joke. It’s quite confusing to me that you seem to be

> saying “many people think those work…” If you ask 1000 working

> daytraders… they will just smile. Those things are equivalent to

> the “lose weight!” systems you see sold on informercials you know?

>

> With regard to people telling you they use those techniques with

> good results, those people are: liars. Even if it’s your brother

> or something, non-working traders often get really confused, sort

> of exaggerating their own trade results for the better! [7]

Not to be lost on the humor (remember back to [6]! The internet parlance “ROFL” comes to mind right now) is this claim that the standard indicators commonly discussed as the basics of TA do not work.

AJ writes:

> …any developer can program a bot to trade using TA… and there

> are a lot of bots out there, and none of them are working. I did

> a lot of backtesting myself using multiple strategies and none

> of them work long term… do you really think there is some bot

> out there that can make a good profit through automated trading

> and is actually being sold?? Yeah sure, so I coded a bot to make

> millions when I’m sleeping and I’m publishing it as open source

> or selling it for $500. Just name ONE that makes guaranteed

> profit. [8]

He absolutely may be right about this!

On another note, I’m not at all convinced that he knows “none of them are working.” I’m not convinced he’s ever purchased/leased a single bot to try for himself. I’m not convinced he has had real conversation with [credible] others who have. He may be one to spend lots of time in the forums and read what others (also potentially with limited experience like himself) have to say. Back from [7], does anybody know 1,000 working daytraders?” Lots of people say lots of things. We have to evaluate the source, too, and assess what we really don’t (and what they can’t) know.

Again, AJ makes some really good points to consider. As mentioned in the fifth paragraph here, I’ve just started testing multiple strategies over the long term. None have really worked thus far.

To be continued next time.

Categories: optionScam.com, System Development | Comments (0) | PermalinkDoes Any Technical Analysis Work? (Part 3)

Posted by Mark on November 26, 2019 at 07:40 | Last modified: April 22, 2020 07:18Today I want to continue discussing some other internet opinions I’ve found about whether TA can actually work.

> There are a lot of people giving signals to buy or sell based on some

> indicator or price pattern. There are a lot of people selling courses

> about how to make profit trading using these well known strategies.

> And I don’t mean a really… [obscure and esoteric genius strategy]…

> I mean all these Fib retracements, RSI, MA, etc. I can’t understand why

> those strategies exist. They are public and they are easy to implement

> with a bot, so they cannot work right?

>

> No you’re not missing anything, if it worked it wouldn’t be on sale.

> But that’s not a wholesale indictment of TA. [5]

Lots and lots of empty claims exist out there with very little supporting data. All this is to say we need to generate the data ourselves. We need to test everything else run the risk of being duped by something that sounds good and is marketed well.

A “bot,” by the way, is a computer executing algorithmic trading code.

On one forum, I saw someone repeat my observation given in the second paragraph of the above-linked post. Here is another’s response to that:

> You must be joking man, there are a lot of people selling books on

> how to lose weight! Good grief! [6]

Made me laugh!

Not only is this a great analogy, though, I suspect it may be true. Judging by how many diets have crossed the screens and shelves over the years, how many can really be said to work? Different diets work for different people here and there, but most diets probably have a low success rate overall. The same is probably true for TA because emotionless systems are very hard to maintain through times of famine and decline. Unless someone has done thorough trading system development, fear will probably own the day forcing said trader to sit alone on the sidelines licking psychological wounds from locked-in losses.

I will continue next time.

Categories: optionScam.com, System Development | Comments (0) | Permalink