Testing the Noise (Part 1)

Posted by Mark on August 30, 2019 at 07:41 | Last modified: June 9, 2020 15:23A lot of ideas sound really good but don’t play out as we might theoretically expect. This recurring theme applies to many disciplines but is particularly important in finance where the direct consequence is making money (e.g. second paragraphs here and here). Today, I want to focus this consideration on the Noise Test.

The Noise Test may be implemented as part of the trading system development process. The idea is that most overfit strategies are fit to noise (see second paragraph here). In order to screen for this, change the noise and retest the strategy. If the strategy still performs well then we can be more confident it is fit to actual signal.

One system development platform offers a Noise Test that works in the following way. For any underlying price series, a user-defined percentage of opens, highs, lows, and closes are varied up to another user-defined percentage maximum. The prices are recomputed some user-defined number of times and the strategy is re-run on these simulated price series. Original backtested performance is overlaid on the simulated performance. If the strategy is fit to noise then performance will degrade.

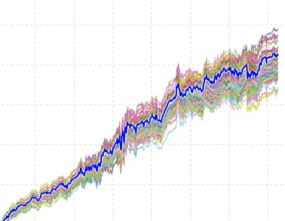

The software developers offer some examples as part of the training videos. This is supposedly a good result:

Note how concentrated the simulated equity curves are around the original backtest (bold blue line). Note also how the original backtest is centered within the simulated equity curves. In theory, both bode well for future performance.

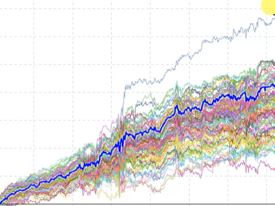

Here is another good result:

The simulated curves are more spread out, which translates to less confidence the strategy is actually fit to signal rather than overfit to noise. However, the outlier with windfall profits (on top) suggests a possibility that modulating noise can actually result in significantly better performance. The developers say this is a win and therefore a good result for the Noise Test.

Statistically speaking, I challenge this for two reasons. First, we have no idea whether this strategy is profitable going forward. Second, without a larger sample size I don’t know what to think about the profitable outlier. The Noise Test may be run on 10,000 different strategies without ever seeing this again. I can never draw meaningful conclusions from pure randomness.

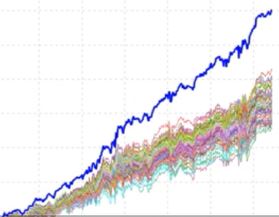

The developers deem this a poor result of the Noise Test:

All simulated equity curves fare much worse than the original backtest, which suggests the original performance was fluke.

I will continue next time.

Categories: System Development | Comments (0) | PermalinkImplied Volatility Spikes

Posted by Mark on August 27, 2019 at 07:16 | Last modified: May 14, 2020 11:14One of my projects next year will be to clear out my drafts folder. Most of these entries are rough drafts or ideas for blog posts. This is one of 40+ drafts in the folder: a study on incidence of IV increase.

For equity trend-following (mean-reversion) traders, IV spike is a potential trigger to get short (long).

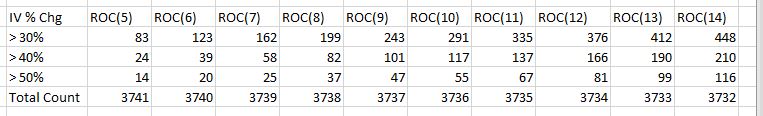

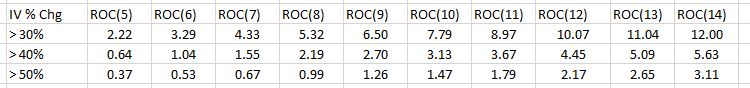

This was a spreadsheet study I did in December 2016. I looked at RUT IV from 1/2/2002 – 11/17/2016. I calculated the number of occurrences IV increased by 30% or more, 40% or more, and 50% or more over the previous 5 – 14 trading days.

Here are the raw data:

Here are the percentages:

If I’m going to test a trade trigger, then I would prefer to find one with a large sample size of occurrences. Vendors are notorious for the fallacy of the well-chosen example (second-to-last paragraph here). This is a chart perfectly suited for the strategy, system, or whatever else they are trying to sell. When professionally presented, it looks wondrous; little do we know it represents a small sample size and is something that has rarely come to pass.

This trigger may avoid the small sample size categorization. Even in the >50% line (first table), periods of 8 – 14 show at least 30 occurrences. Some people regard 30 or more as constituting a sufficiently large sample size. I think length of time interval is relevant, too. We have roughly 15 years of data here. 30 occurrences is about twice per year. If I want four or more occurrences per year, then perhaps I look to >40% (period at least eight) or >30% as a trigger.

With regard to percentages, my mind goes straight to the 95% level of significance. Any trigger that occurs <5% of the time represents a significant event. I still don’t want too few occurrences, though. 1.5 standard deviations encompasses 87% of the population so maybe something that occurs less than 13% of the time or ~6.5% of the time (one-tailed) could be targeted.

Another consideration would be to look at the temporal distribution of these triggers. Ideally, I would like to see a smooth distribution with triggers spread evenly over time (e.g. every X months). A lumpy distribution where triggers are clustered around a handful of dates may be more reflective of the dreaded small sample size.

The next step for this research would be to study what happens when these triggers occur. Once the dependent variable is selected, we have enough data here to examine the surrounding parameter space (see previous link).

Categories: Backtesting | Comments (0) | PermalinkPlanning My Next Meetup [hopefully not MIS] Adventure (Part 8)

Posted by Mark on August 19, 2019 at 06:52 | Last modified: March 14, 2019 14:29Further deliberation over the promotion for this Meetup still leaves me skeptical.

I could therefore try for something more to the point:

In 2002, I got my Doctor of Pharmacy degree and began work as a retail pharmacist.

For the last 11 years, though, I have been trading options full-time out of a home office. One

thing I miss is my patients and co-workers, and I have had little success finding other

advanced traders with whom to collaborate.

Since I can’t find such traders on my own, perhaps I can help to create some. For those who

have been interested in learning to trade and invest for yourselves, my challenge is your gain.

Welcome to the Michigan [Index?] Option Trading Workgroup.

The goal of this group is to present some basic option income strategies and to practice them

repeatedly until we feel comfortable employing them in personal accounts (if so desired).

I am happy to teach what I know. Beyond that, there’s still plenty for all of us to learn.

I strongly encourage data science practitioners along with programmers and statisticians to

look into this group. Beyond practicing individual trades, I have more advanced research

planned that can really help to develop existing strategies for live trading. In exchange

for expertise, this group can teach you the ins and outs of option trading and

self-directed investing.

Cost for this group will be $12/month, which should cover group expenses. In addition,

you may choose to buy or lease third-party analytics software to study/track simulated

positions. We will talk about ways to do this without purchasing software, however.

Spots will be limited. You should be highly motivated and able to commit regular time to

this group. Those with the technical expertise described above will be given priority

[free] admission. With regular participation and diligent effort, I expect those who

participate can become capable option traders within a relatively short period of time.

Please answer the profile questions and send contact (phone or Skype) information

when you join. Before we begin, I want to make sure the group is as good a fit for you

as you can be for the group.

Thanks, and good trading!

Categories: Networking | Comments (0) | PermalinkJames Cordier: Tragedy or Laughingstock? (Part 2)

Posted by Mark on August 16, 2019 at 06:50 | Last modified: March 5, 2019 11:19Last time, I began telling the catastrophic fate suffered by clients of James Cordier and his service OptionSeller.com.

We don’t know the full story, and most articles and/or comments I have read on the matter have failed to acknowledge this. “Illini Trader (IT),” from my last post, claimed Cordier made 60% the year before IT first looked into investing with him. Their stated target was 20-25% p.a. so longer-term investors may have still come out ahead despite the events of Nov 2018.

Appropriate client allocation would also put a totally different spin on the situation. Allocating a small fraction to Cordier’s firm would have been a responsible thing to do, and we can hope all/most of the 290 investors did just that.

Appropriate disclaimers to ensure clients knew in advance what they were signing up for would have facilitated appropriate allocation. Cordier should get off scot-free if he gave clients my “worst sales pitch ever” (see second paragraph here). He needed to be absolutely clear in explaining this as a high risk/high reward situation that could leave them in negative territory (being separately managed accounts rather than a hedge fund). Accepting only accredited investors might further bolster Cordier’s defense from damaged investors.

We simply do not know what took place beforehand. This puts us in a strained position from which to judge.

I have since decided that Cordier is just a business and not worthy of our tears. He previously worked under a different name (why?) and he’ll probably work this space again (unless found guilty of mass deception?). Depending how much he has earned in the past and built up in savings and investment, it’s hard not to think that he’ll be fine. Indeed, some viewers have criticized his gall in wearing a Rolex watch while giving a tearful apology seen in the video.

I want to make one final comment about leverage.

Some gurus have criticized Cordier’s excessive leverage, but I don’t think that is specific enough to be meaningful. I can sell ten 2700/2600 vertical spreads for $100,000 gross risk. I can also sell one 2700/1700 vertical spread for the same. The former can easily get wiped out whereas the latter is very unlikely to be.

In Cordier’s case, it was specifically the futures leverage associated with his total number of contracts that resulted in catastrophic loss. The total number of contracts generated a huge drawdown that triggered a margin call. Selling fewer contracts NTM could have prevented this occurrence (see fourth paragraph here).

Categories: Option Trading | Comments (2) | PermalinkJames Cordier: Tragedy or Laughingstock? (Part 1)

Posted by Mark on August 13, 2019 at 06:57 | Last modified: March 2, 2019 11:14Today I want to discuss the title of this post.

To give some background, James Cordier and OptionSellers.com director of research Michael Gross co-authored three editions (last in 2014) of The Complete Guide to Options Selling. The book discusses the potential rewards of selling naked options and tells investors they can produce consistent results with only slightly increased risk. Cordier has also advocated the approach in articles published in Futures magazine and Seeking Alpha.

Unfortunately for Cordier and his investors, natural gas experienced a Black Swan event in November 2018 that led to more than complete losses for his 290 clients (totaling over $150,000,000 per one lawyer’s estimate). He published a video apology on YouTube discussing his mistake. The video was taken down soon after, but it was reposted by others. As of this writing, you can do an internet search for “James Cordier nat gas video” to find it.

My initial reaction to the video was horror and sadness. I walk around with constant awareness that I could lose everything on any given day. This is one reason I am so grateful (see first paragraph here) for what I have and why I would be so hesitant to trade other people’s money with some of the same strategies I have employed for myself. This has been discussed (see second paragraph here).

On the flip side, some outspoken commentators have been heavy on criticism in viewing the situation entirely different. Financial parties on Twitter were very “I told you so” about what they called an exceedingly risky option strategy lacking proper hedges to make such a collapse “inevitable.” One macro hedge fund founder blamed Cordier and his investors. He claimed the strategy to be one where you slowly make money until you eventually blow up with the probability of total loss being “fairly significant.” He believes Cordier “took advantage of guys who didn’t know any better.”

Retail investors usually don’t know any better, which is why they hire professional money managers (for better or for worse).

On the Elite Trader investing forum, “Illini Trader” (IT) dissected the day-by-day progression of natural gas (NG) prices and concluded Cordier’s catastrophic loss did not have to be.

IT first claimed communication with Cordier eight years previous while working for a different firm. Cordier then indicated closing positions upon reaching 1x loss (i.e. down the initial credit of the trade).

Fast forwarding to 2018, with NG closing at 4-year highs the week of November 9, at 3.724, IT observed the position was probably around 1x loss. November 12 took NG to 3.935, which certainly would have triggered 1x loss. Even on November 13 with NG closing at 4.072, Cordier had plenty of opportunity to close the position. Holding to the next day when the parabolic move took NG to 4.93 is what sealed his fate:

> He chose to jump in front of a freight train hoping it would stop.

> IF he had only followed his own rules he would still be in business.

I will continue next time.

Categories: Option Trading | Comments (1) | PermalinkPlanning My Next Meetup [hopefully not MIS] Adventure (Part 7)

Posted by Mark on August 8, 2019 at 06:58 | Last modified: March 12, 2019 14:58Propelled by some serious writer’s inspiration, I want to take one more stab at this option trading Meetup proposal.

For 11+ years, I have traded options full-time for a living. I work independently and trade only my account without the help of a financial adviser.

Over the years, I have searched high and low to find others like me with whom to collaborate. You could say I miss my pharmacy patients and co-workers. Whatever it is, the struggle is real (see here, here, here, and here).

Since I can’t find similar traders out there, perhaps I can create my own. If you have been interested in learning to trade/invest for yourself, then my challenge is your gain.

Submitted for your approval is the Michigan Self-Directed Option Trading Syndicate (MSDOTS).

The first goal of MSDOTS is to teach option trading strategy. You can pay several [tens of] thousands of dollars on trader education programs. One thing I have learned is the most critical lessons will not be gained from any such class no matter how much they charge. I will present several commonly-employed strategies in addition to discussion about why the more exotic strategies may offer no added benefit. We certainly do not need to reinvent the wheel.

One thing we must do, however, is stick with said strategies and repeat them over and over. The second goal of MSDOTS, therefore, is to practice. I will present ideas on how we can make this happen in simulated (paper trading) accounts and collectively study the results. Working together will give you the support and accountability necessary to trade real money in your personal accounts if so desired.

The final goal of MSDOTS is to research. I want to further develop related option trading strategies. To that end, I have written an entire automated backtester research plan. In order to accomplish this, I need people with data science and/or financial engineering expertise (e.g. working with spreadsheets, programming, and statistics). I have basic skills in some of these areas, but I need more to carry it through completely.

For the initial attempt, I want to limit MSDOTS to 10 people. No experience is required as long as you are motivated and committed to learning. Advanced traders, who may be able to work with me as content contributors, are also welcome. Preferential selection will be given to those with data science/financial engineering expertise as discussed above. I strongly encourage women to join as well. Much has been written about how trading/investing has traditionally been a male-dominated endeavor (see here, here, here, here, here, here, and here), and I would like to do my part here to challenge the status quo.

If you join, then please schedule a voice call for further discussion. Once we have enough people, I will arrange the first Meetup where we will structure activities.

Thanks for your interest, and as is often said in these circles, “good trading!”

Categories: Networking | Comments (0) | PermalinkStatus Update

Posted by Mark on August 5, 2019 at 07:54 | Last modified: January 30, 2019 10:16Today I will detail my current tasks and projects.

I want to do more butterfly backtesting, but I’ve found this extremely cumbersome to do in OptionVue, which drains my motivation in a hurry.

Instead, I will go back 12-14 months and start backtesting several different strategies.* I will track various parameters in a spreadsheet and generate equity curves for the whole portfolio. The goal is to see what is working and to try and get a sense how they perform together.

Strategy #1 will be the NP. I will sell 1 SD NPs (if backtesting alone, then I would do one contract per day to minimize margin or concentration concerns). I will close at 2x. I will watch for IV increasing by 30% or first backwardation in 30 days (arbitrary) as a signal to hedge (e.g. close half the position). Exit at 21 DTE.

Strategy #2 will be a 16/25 IBF. Consider requiring UEL to be no more than 5% LEL (arbitrary). Watch for IV increase of 30% or first backwardation as signals for potential exit or adjustment. One potential adjustment is to buy LP to cut NPD by 67% on a 1.6 SD (arbitrary) or larger downmove. I will close LP on a move (close?) above the high of the entry candle. If market falls and remains outside BE for three days (arbitrary), then close trade. Profit target 10% with max loss 15%.

Strategy #3 will be a monthly ATM calendar. Profit target 10% with max loss 15%. I can adjust into DC if market moves to BE (or down 7% on the trade).

Strategy #4 will be a 30-64 DTE ATM straddle. As above, I will monitor for IV increase by 30% or first backwardation as signals to hedge (e.g. close half the position, neutralize delta, close puts). Exit at 21 DTE.

Strategy #5 will be a 1 SD strangle. As above, I will monitor for IV increase by 30% or first backwardation as signals to hedge. Exit at 21 DTE.

Strategy #6 will be a LP unbalanced IC per my guidelines.

Each strategy needs to be allocated appropriately (perhaps 10% of account for 50% total). While diversified with regard to time, they are not diversified with regard to underlying and they are all delta neutral (or bullish).

In addition to backtesting, I want to pursue leads at both U of M and MSU. Once the move is complete, I should be more focused and able to concentrate my time in one place.

I will continue trying to assemble a trading group, as I have discussed.

Finally, I will once again look into ONE as December approaches because my OV subscription will expire.

* I initially wanted to backtest daily trades on four strategies, but this really makes for a

headache. I tried entering the respective trade ID for each strategy in OptionVue, but it

defaults to “all” upon every refresh. I also find there to be too much stuff to monitor

on each day: 20-30 trades per day per strategy and multiple parameters on each trade.

If I want to get a sense of trading a portfolio together, then the best way is probably

to keep it to the six open trades at a time. I can get decent portfolio diversification

by opening positions for each strategy every 4-5 trading days.

Planning My Next Meetup [hopefully not MIS] Adventure (Part 6)

Posted by Mark on August 2, 2019 at 07:24 | Last modified: January 28, 2019 06:02I will conclude the mini-series with this post to muse about a couple loose ends.

On January 25, I spoke with someone who has connections at the business school. I told him I have interest in forming a group to research, discuss, and teach option trading (see here). I said this would be great information for business students. He gave me a couple names and asked me to let him know if I have any trouble making the connections.

I need to be clear about my endgame in order to take these steps forward.

I have many research questions in need of answering to further my own personal trading. I can’t believe everything I see on TV because people get things wrong (see past blog mini-series here, here, and here). Long-time readers will recognize this as one of my fundamental theses (it’s #2 here). Doing this research should give me the confidence required (see second-to-last paragraph here) to stick with trading systems through challenging times (third-to-last paragraph here).

Others can certainly benefit from this research along with me. Many conclusions will be clear to all, and different individuals will draw further conclusions particularly meaningful to them.

The additional piece I would enjoy throwing into the mix is time spent teaching. I tutored math in high school, and I have often thought that in another life, I was probably a math teacher. This would absolutely fulfill that desire: nothing selfish about it. I don’t want to change the world (probably couldn’t even if I tried), but people have a ton to learn when it comes to options (e.g. mini-series here and here) and from what I have seen, the old-school financial industry isn’t helping much.

On a different note, Michigan Option Traders—while not a complete misadventure—was my group that did not last. In the second paragraph here, I discussed issues I had with the other experienced trader in the group and thoughts about failing to discuss losses in general.

My advanced-level compatriot never talked about large losses, which should have occurred due to volatile markets at that time. I interpreted this as a reflection of inflated ego. You can only get lucky so many times. Over the years, I have often heard things like “I wasn’t around in August 2015 because I was on vacation” or “I didn’t trade in February 2018 because work was too busy and I had scaled back.” Survivorship bias may explain it: those stepping forward to present successful trading are those lucky enough to have missed the rough markets. I do not pretend to have missed them (e.g. here and here) and I think most pretenders will eventually meet their maker and [all too often] disappear from the landscape altogether (third-to-last paragraph here).

While perhaps a slight oversimplification, as an innocent bystander the trader services/education landscape appears to be different strategies pitched by a relentless march of traders who are either lucky enough to miss ugly market environments or who have (inadvertantly?) inflated performance by curve-fitting measures.

Categories: Networking, Trader Ego | Comments (0) | Permalink