Testing the Noise (Part 1)

Posted by Mark on August 30, 2019 at 07:41 | Last modified: June 9, 2020 15:23A lot of ideas sound really good but don’t play out as we might theoretically expect. This recurring theme applies to many disciplines but is particularly important in finance where the direct consequence is making money (e.g. second paragraphs here and here). Today, I want to focus this consideration on the Noise Test.

The Noise Test may be implemented as part of the trading system development process. The idea is that most overfit strategies are fit to noise (see second paragraph here). In order to screen for this, change the noise and retest the strategy. If the strategy still performs well then we can be more confident it is fit to actual signal.

One system development platform offers a Noise Test that works in the following way. For any underlying price series, a user-defined percentage of opens, highs, lows, and closes are varied up to another user-defined percentage maximum. The prices are recomputed some user-defined number of times and the strategy is re-run on these simulated price series. Original backtested performance is overlaid on the simulated performance. If the strategy is fit to noise then performance will degrade.

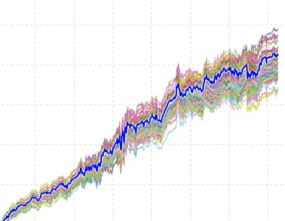

The software developers offer some examples as part of the training videos. This is supposedly a good result:

Note how concentrated the simulated equity curves are around the original backtest (bold blue line). Note also how the original backtest is centered within the simulated equity curves. In theory, both bode well for future performance.

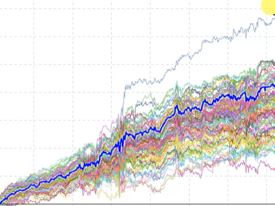

Here is another good result:

The simulated curves are more spread out, which translates to less confidence the strategy is actually fit to signal rather than overfit to noise. However, the outlier with windfall profits (on top) suggests a possibility that modulating noise can actually result in significantly better performance. The developers say this is a win and therefore a good result for the Noise Test.

Statistically speaking, I challenge this for two reasons. First, we have no idea whether this strategy is profitable going forward. Second, without a larger sample size I don’t know what to think about the profitable outlier. The Noise Test may be run on 10,000 different strategies without ever seeing this again. I can never draw meaningful conclusions from pure randomness.

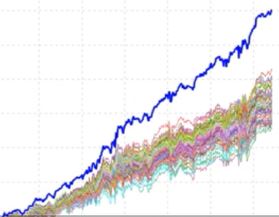

The developers deem this a poor result of the Noise Test:

All simulated equity curves fare much worse than the original backtest, which suggests the original performance was fluke.

I will continue next time.

Categories: System Development | Comments (0) | Permalink