Calendar Backtesting the COVID-19 Crash (Part 6)

Posted by Mark on December 24, 2021 at 07:27 | Last modified: November 8, 2021 07:32Today I continue discussing my impressions from calendar trade backtesting the 2020 COVID-19 crash.

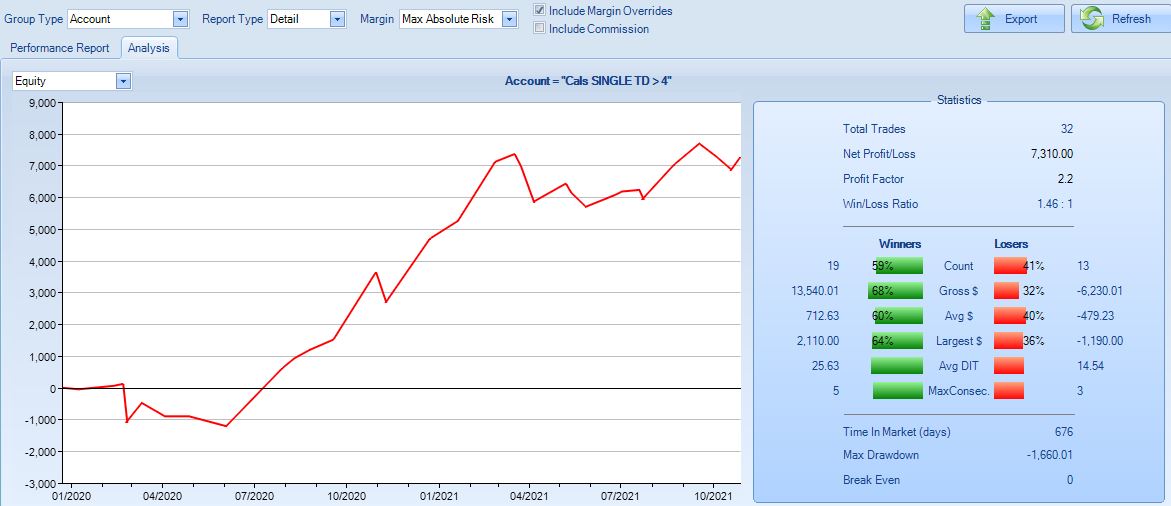

I left off showing results for a single-only calendar strategy, which is a contrast to guidelines from Part 1. When I said these results are not encouraging, I was comparing with backtest #2 (summarized in Part 3) whose ONE results look like this:

PF is 2.2 and average win is 2.5x average loss. Net profit is much better. I would certainly consider trading this. The DC allows me to hold a losing calendar longer because it also includes one that is winning.

I’m still not totally sold on DCs. Perhaps single calendar results can be improved if I hold a losing trade longer.

This is really suggesting a directional bet. Holding a losing calendar longer means dropping the TD > 4 criterion. This usually happens when the market is above or below the calendar strike, which implies a bearish or bullish bet, respectively.

Given directional choice, I would certainly bet bullish. I mentioned the upward bias to equities in the fourth paragraph here, in the last paragraph here, and in the tenth paragraph here.

Before I decide how to implement this, I want to consider how even the ONE results shown above might be improved. Number of losers still exceeds number of winners, which is not ideal. Also, profitability is concentrated between Apr 2020 through Feb 2021 (10 months). The rest is equity curve chop, which makes me question consistency. A larger sample size of years leading up to 2020 would broaden the context.

I should check to see what directional bias I already have in the trade. I did not intend any, but starting each trade at the nearest 25-point strike implies a tiny bit. Number of times I leaned bearish and bullish should roughly balance out.

I will continue next time with backtesting a bullish calendar trade.

Incidentally, I clicked [the lower box] to see the following ONE results:

Compare this to the graph shown above. This also has a PF 2.2 and number of winners exceeds number of losers. This appears to be a more consistent strategy.

Unfortunately, these results are a mistake. I accidentally turned off commissions, which eliminates transaction fees. This is fantasyland and we have known this for a long time (see third-to-last paragraph here and fourth-to-last paragraph here).

If I significantly overestimated slippage, then the single-only calendar strategy with no directional bias might be worth doing. This would then be another instance like that described in the second paragraph here. Any backtest where I stack the odds against and performance still comes shining undeniably through is a strategy with which I really want to go live.