0 DTE Iron Condors (Part 2)

Posted by Mark on August 13, 2021 at 04:55 | Last modified: May 12, 2021 14:21Last time, I detailed backtesting for an intraday option strategy I recently viewed online. Today I will discuss results.

The initial backtest covers every trading day from 12/30/2020 through 5/10/2021: 89 trades total. This is a relatively small sample size studied over a limited time interval.

Over this period, the average trade is -$5.90 with a standard deviation of $203. The largest winner (loser) is $338 (-$679). 62% of trades are winners, but the average win (loss) is $134 (-$232). The maximum number of consecutive wins (losses) is 7 (5). Profit factor (PF) clocks in at 0.93.

An inauspicious beginning…

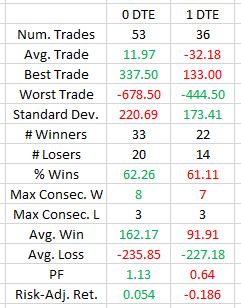

Remember from Part 1 that 0 DTE trades are different from 1 DTE trades. 1 DTE trades take place on Tuesdays and Thursdays. Despite the theoretical consideration given last time, one thing we know for sure is they cannot experience near-100% decay as intraday trades. Comparing the two:

With three days per week instead of two, the number of trades is expectedly larger for 0 DTE. While winning percentage is about the same, average trade and PF both show 0 DTE trades to be profitable whereas 1 DTE trades are not. With a larger sample size, I would perform hypothesis testing to verify statistical significance.

While 0 DTE trades seem to be better than 1 DTE, a PF of 1.13 implies only the slightest of edge. Kudos to me for including (some would say liberally) transaction fees (see third-to-last paragraph here), but average trade (just slightly ahead of commissions + exchange fees) is still close to a serious debacle being barely positive over a short period.

Although this is an IC backtest, I can still extract some information about vertical spreads.

Vertical spreads have a greater probability of profit than iron condors (IC). Theoretically at expiration, a 10-delta IC has ~80% probability of profit while a 10-delta put or call credit spread has ~90% probability of profit. As a potential tradeoff, the credit received for constant-delta verticals will be less because only one side is sold. Risk will be roughly equal since spread width is determined the same way for verticals and ICs.

I would expect more trades to be stopped out on the call than put side for two reasons. First, the market generally has an upward bias. Second, same-delta options are NTM in terms of points (or percentage of underlying) on the call versus put side as a result of vertical skew. Altogether, 16 (18) trades are stopped out on the put (call) sides. For 0 DTE, nine (11) trades are stopped out on the put (call) sides. For 1 DTE, seven trades each are stopped out on either side.

Despite a small sample size, these are balanced distributions offering no hint that trading just the puts or calls should be more advantageous than the other.

And based on PF, it’s hard for me to be overly encouraged by any of these short-term trades.

Potential directions for further study include:

- Selling farther OTM (e.g. NTM option with delta 5 or less) to decrease frequency of stop-loss (SL)

- Selling farthest OTM over threshold premium to normalize influence of any single trade on the average trade

- Selling naked shorts rather than spreads, which limit margin exposure at the cost of long-option premium

- Varying the SL trigger from 3x to 4x, 5x, 2x, or 1.5x

- Comparing mean realized loss in excess of SL trigger on either side to study directional edge on a more granular level

- Backtesting a longer time interval and/or different market environments