Calendar Backtesting the COVID-19 Crash (Part 4)

Posted by Mark on December 16, 2021 at 07:41 | Last modified: November 5, 2021 11:40I left off asking about a subtlety that would probably be identified by only serious option traders. Submitted for your approval is a question about why one backtested calendar is ~30% more expensive than all the others. Were you able to explain it?

The nuance here is that calendars generally get more expensive when purchased closer to expiration. To lower the cost, I would generally go farther from expiration, but that is not the case with the Sep/Oct calendar I mentioned in the second-to-last paragraph of Part 3. The calendar I backtested was an Oct 3225 put priced at 24.09% IV and a Nov 3225 put priced at 26.24% IV. Is that normal contango? I’d have to survey a large sample size to find out but my guess is no.

I suspect two factors have contributed to make this calendar atypically expensive. First, it is 35 days wide. This happens four times per year [(4 * 5 weeks in between mos) + (8 * 4 weeks in between mos) = 32 + 20 = 52 weeks for the full 12 mos] and it means paying for one extra week of extrinsic value in the long leg.

Second, and what I believe to be of greater importance, is the 2020 presidential election. I think the Nov options are priced rich due to election uncertainty.* On 7/31/20, IV for Nov and Dec are 24.55% and 24.66%, respectively (beyond which term structure decreases). Purchasing the Nov/Dec 2020 112/140 (DTE) calendar would cost $4,650: much less than the $8,840 seen here. The horizontal skew on the Nov/Dec would be -0.19, which is much lower in magnitude than -2.15 for the backtested Oct/Nov. Term structure rises steeply through November and then starts to trail off. This is unusual.

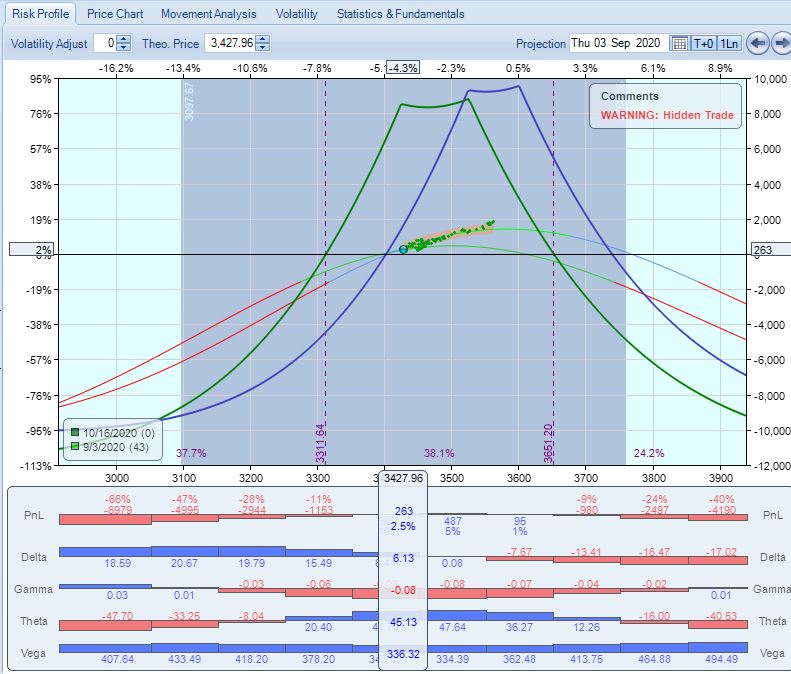

Incidentally, I’m puzzled why I exited this adjusted DC at 43 DTE when a third adjustment point was hit on 9/3/20 to open a single Nov (78 DTE)/Dec calendar. I could have rolled to ATM, as the presenter’s guidelines suggest (green):

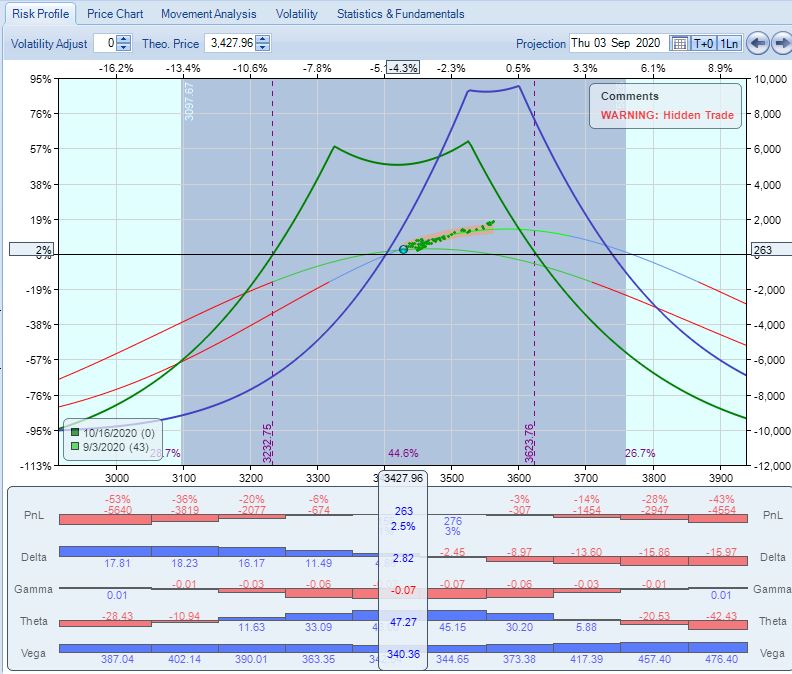

I could have also gone an extra 100 points OTM (green):

Theta is comparable for both and cost is slightly less for the latter. TD is even higher for the latter (17 vs. 7). Either of them look doable. Every time I adjust a calendar, PnL gets dragged down a bit by transaction fees. Since it usually takes a few days of positive theta to recoup that, maybe I should never adjust too close to my drop-dead 21 DTE. That is no excuse here with 43 DTE and plenty of time left.

I will continue next time.

*—As an exercise for another post, I should plot this term structure in Python. An additional

detail would be to scale the x-axis properly since data points start one month apart and

later increase to points that are three months apart.