Calendar Backtesting the COVID-19 Crash (Part 5)

Posted by Mark on December 21, 2021 at 07:07 | Last modified: November 6, 2021 09:04Today I continue discussing my impressions from calendar trade backtesting the 2020 COVID-19 crash.

The bigger point with which I left off is that a cursory check (at least) to authenticate a backtest should always be done. No backtest is Truth and live trading is often not exactly per guidelines. Some traders are more discretionary than others and some couldn’t replicate a set of backtested trades even if they really wanted to. Nevertheless, in a backtest like this or this with a limited number of trades and a short time horizon, one mistake can materially affect results.

I’m not sold on double calendars (DCs) because overall, they don’t seem to grow profit as quickly as singles. This is subjective and anecdotal, but I’m going to try and put some reasoning behind it.

DCs are more risky than single calendars for two reasons. First as mentioned in Part 4, being established through adjustment implies less time to recoup transaction fees. Second, being established later means more gamma risk where substantial market moves can result in big losses. DCs need not be riskier from a margin standpoint, but the greater gamma risk is pervasive and insidious. This matters in the face of large market moves, which are a reality in trading.

To control gamma risk, I could implement a minimum DTE limit beyond which only closing contracts and re-entering farther out in time would be permitted. Theoretical determination of this optimal drop-dead date would be very challenging.

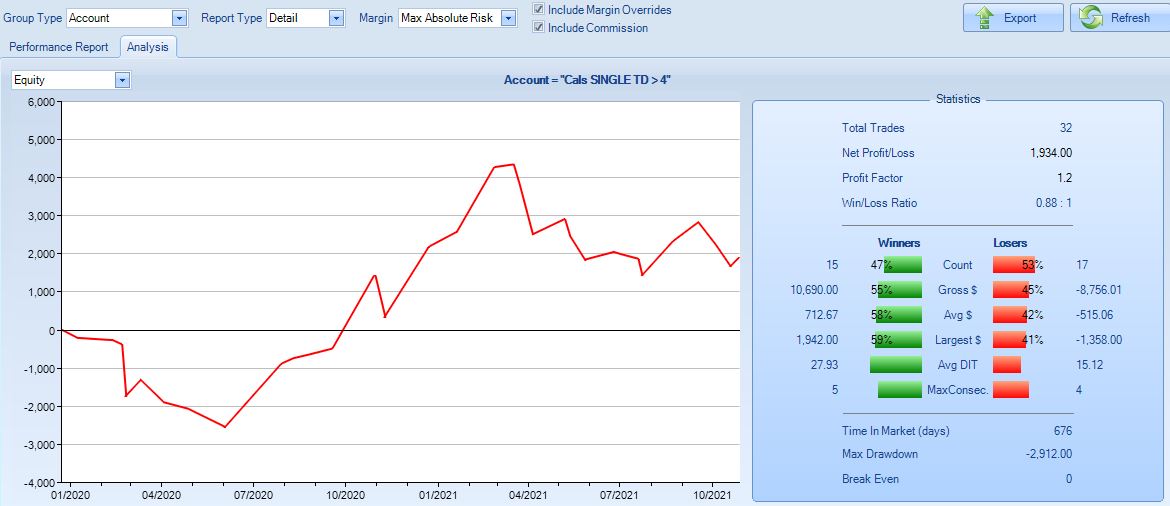

Another possibility would be to allow just single calendars. When an adjustment point is hit, exit and enter anew with at least 56 DTE. Here are the OptionNet Explorer (ONE) results of such a single calendar backtest:

This is not encouraging. Profit factor (PF) is only 1.2 and number of losers exceed number of winners.

In running this backtest, I felt the market often moves around too much for a single calendar to contain it. This led to more frequent whipsaws than backtest #2 (Part 3) where DCs are permitted.

In running this backtest, I also became very cognizant of how quickly a single can lose money when the market moves away from the strike. DCs looks appealing with the wide profit tent, but one calendar is always losing money as the market trends. This may explain why profit seems to develop slowly. Day steps would do a better job at revealing extent to which the expiration curve is mere mirage. This is usually the case with my option trading, but perhaps it’s more pronounced here.

I will continue next time.