Short Premium Research Dissection (Part 37)

Posted by Mark on June 27, 2019 at 07:02 | Last modified: January 8, 2019 05:53In this “most up-to-date” section (see end Part 31), our author has explored time stops, delta stops, and now profit targets.

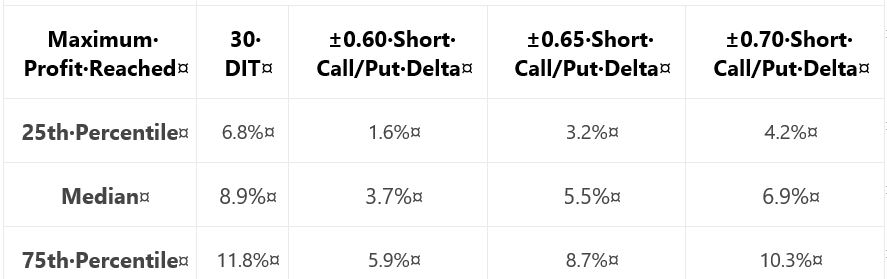

As a prelude to determine what profit targets are suitable for backtesting, she gives us this table:

Recall from the end of Part 35 that when something changes without explanation, the critical analyst should ask why. She did not include the 0.65-delta stop last time: why? In this case, it’s no big deal. I like backtesting over a parameter range and having three values across the range is better than two. If only for the sake of consistency, I would have liked to see 0.65 data both times because it feels sloppy when things change from one sub-section to the next.

Adding to the sloppiness, she is once again lacking in methodology detail. I like the idea of probing the distribution to better understand where profit might land. If we can’t replicate, though, then it didn’t happen. Did she backtest:

- Daily trades?

- Non-overlapping trades?

- Winners?

- Winners and losers?

- Any [combinations] of the above?

These factors can all shape our expectations for sample size (which determines how robust the findings may be) and magnitude of averages (e.g. winners will have a higher average max profit than winners and losers. See Part 24 calculations).

She writes:

> Based on the above table, it appears profit targets

> between 5-10% seem reasonable to test for all of the

> approaches except the ±0.60 delta-based trade exits.

She then proceeds to give us “hypothetical portfolio growth” graph #17 with [hypothetical computer simulated performance disclaimer and] 30 DIT, 5% profit target or 30 DIT, and 10% profit target or 30 DIT.

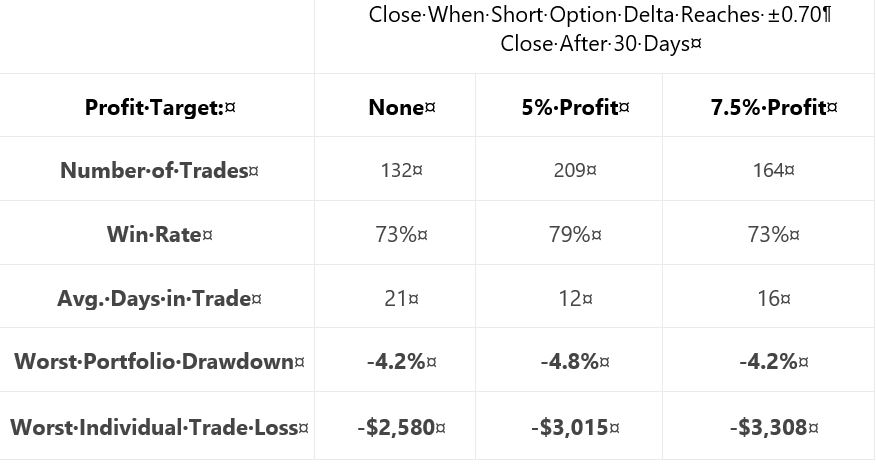

Next, she gives us a “hypothetical portfolio growth” graph and table each for 0.65- and 0.70-delta stops. The graphs are all similar with no allocation, no inferential statistics, and nebulous profitability differences. The tables take the following format:

This falls far short of the standard battery and also lacks a complement of daily trade backtesting (see fourth-to-last paragraph here). We still don’t know her criteria for adopting trade guidelines, either. I therefore like her [non-]conclusion:

> After analyzing the various approaches and management

> levels, it seems you could pick any one of the variations

> and run with it. Consistency seems to be more important

> than the specific numbers used to trigger your exits.

She also writes:

> Interestingly, not using a profit target with the ±0.70

> delta-based exit was the ‘optimal’ approach historically.

For this reason and because she did not test [all permutations of] each condition[s], I remain uncertain whether a delta stop is better than any or no time stop. I would say the same about profit target: too much sloppiness and too few methodological details [and transaction fees as discussed at the end of Part 36] to know whether it should make the final cut.

I will continue next time.

Categories: System Development | Comments (0) | Permalink