2021 Performance Review (Part 4)

Posted by Mark on April 4, 2022 at 06:37 | Last modified: February 8, 2022 16:55I left off discussing the inclusion of a tax penalty given that my trading is short-term whereas the benchmark indices represent long-term buy-and-hold. How to err conservatively in such a way to spare myself the task of having to look up every tax code change since 2001 and the precise tax rates that accompanied them?

The answer is to determine an across-the-board tax penalty high enough to cover most months even if it ends up being a bit too high overall.

Let’s work from the 2021 tax rates table I composed in Part 3. Since I like to be optimistic and visualize maximum profits, I will use the highest tax bracket with 20% LTCG and 37% tax on ordinary income (short-term). As a blended 60/40 tax rate: (20% * 0.6) + (37% * 0.4) = 26.8%. Rounding up, that is a 7% higher tax rate than LTCG for a buy-and-hold benchmark. I will therefore multiply the monthly return by 0.93 anytime my portfolio posts a profitable month.

I was not trading Section 1256 contracts before 2008. That tax penalty is 37% (being optimistic so as to assume maximal tax rate) minus 20% = 17%. I will therefore multiply each profitable month from 2001 – 2007 by 0.83.

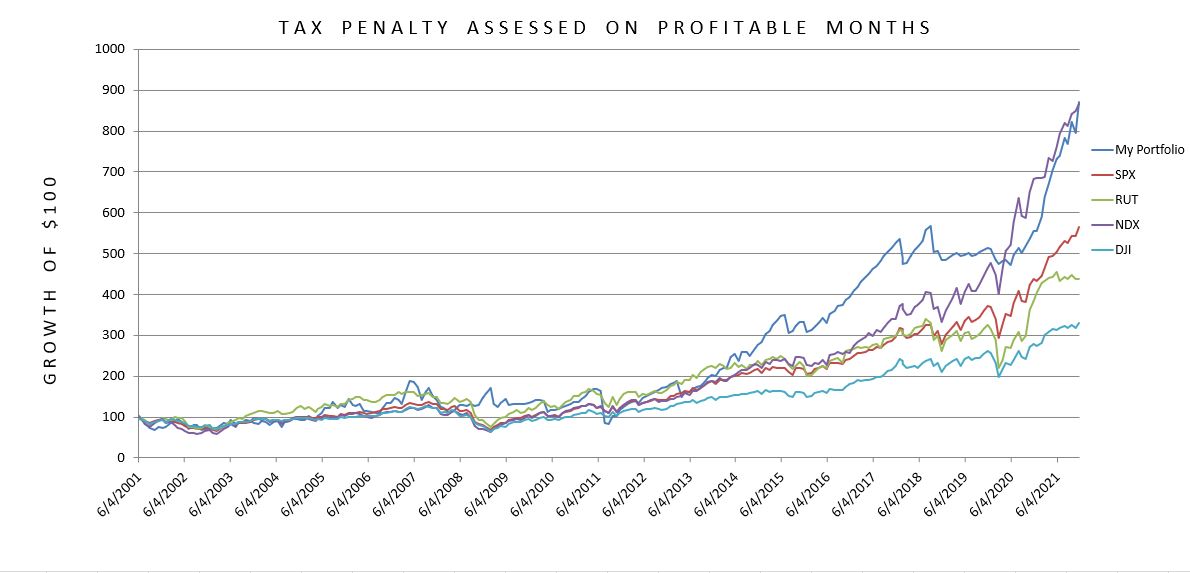

Compare this closely with the graph shown in Part 2:

Big difference! My cumulative return has been cut from 2,032% to 771%. Furthermore, my trading edge over a set of major indices has all but evaporated.

To check my work, I multiply together all the positive months to get the cumulative return. This represents the profits on which a tax penalty has been assessed. The previous graph showed this cumulative return to be 2,032% sans tax considerations. Here, the cumulative return is 439,322%.

By charging myself the tax penalty on all positive months and giving no credit for negative ones, I overshoot by a huge margin! No wonder the trading edge is nullified.

This business is tricky because while I’m all about erring to the side of conservativism (as discussed in Part 2), I don’t want to be so conservative that I fool myself into believing I have a losing or mediocre trading strategy when in fact it may be decent or good. Depending on how one looks at it, statistics deems this a type I error (false positive) or type II error (false negative): neither of which is advised. In this case, I penalized myself far more than I should have for short-term trading.

Going back to the second paragraph above, let’s fine-tune this by changing the last sentence. Rather than penalizing all positive months, I will penalize months where the final account value makes an all-time high. This is much more realistic. When my year-end account value is higher than the previous year-end account value, I pay taxes on that profit. If the year-end account value is lower, then I pay no taxes and the losses carry over to offset profit (at least partially) in future years.

This is really where I should tell you to consult a tax professional for specifics since your situation may vary.*

I will continue next time.

* — I might also suggest exploring trading as an entity if you are more active.