2021 Performance Review (Part 5)

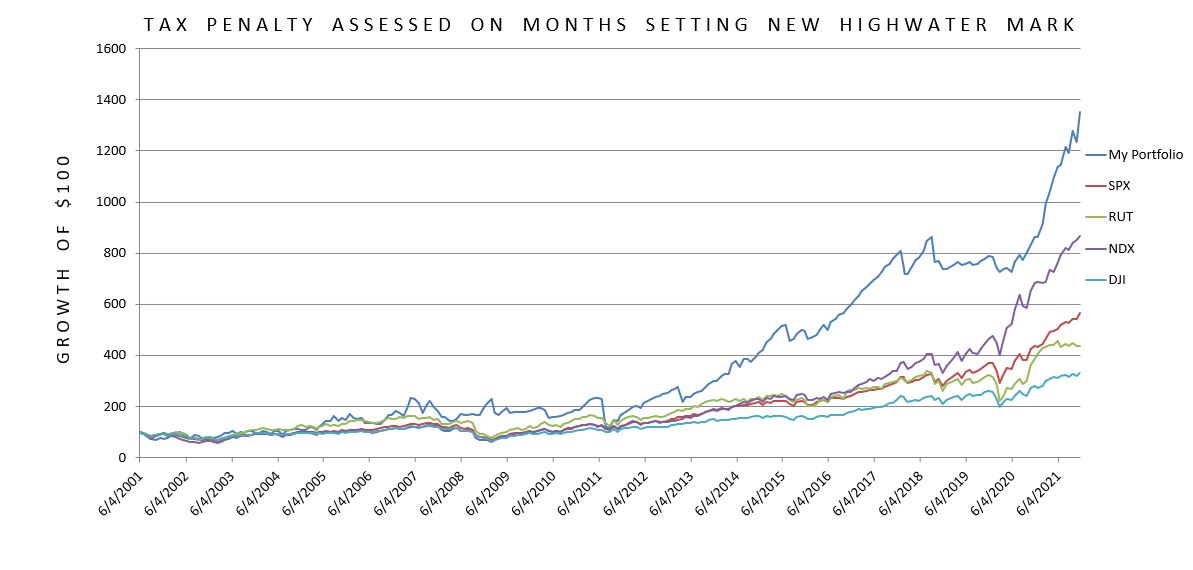

Posted by Mark on April 7, 2022 at 06:48 | Last modified: February 9, 2022 15:17I left off suggesting a revision to my global tax penalty for short-term trading, which will hopefully allow me to err conservatively while not diminishing my performance too much.

Rather than penalizing every positive month (method 1), what happens if I penalize only those months resulting in a new highwater mark being reached (method 2)?

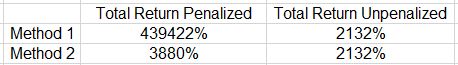

Done this way, I still come out ahead of the set of index benchmarks. To check my work, I multiply together the returns of all penalized months. I do not include the penalty itself because the intent is to determine what total return is being penalized.

Here is a comparison of method 1 and method 2:

Despite sounding reasonable, even method 2 penalizes too much. I think this happens for two reasons.

First, method 2 does not mind the edges. Suppose the highwater mark is 1048 and last month closed at 1000. If I gain 5% this month, then I achieve a new highwater mark (1050) by 0.19%. Method 2 assesses the tax penalty on the full 5%, however. That’s a big discrepancy.

Second, method 2 evaluates the highwater mark monthly rather than annually. Suppose for the first 11 months of a year, I make 3% each month only to lose 28% in the last month. In actuality, I end up down 0.3% for the year and would owe no tax. Method 2 would assess a tax penalty on 1.03 ^ 11 ~ 38%. That’s another big discrepancy.

I could resolve this by removing the penalty on select months to bring that 3880% closer to 2132% thereby lessening the overcharge. This would be completely legitimate, but for now I will resist the temptation. I can at least feel confident knowing I have insurance against some unforeseen oversight that might result in my performance numbers being artificially inflated.

In the end, if I [overly] err on the side of conservatism and still come out smelling like a rose, then my ultimate goal is achieved. I may be off to a good start because at first glance, the graph above has me sitting comfortably on top.

I still have a couple other things to address with the first being stock versus option trading. I mentioned in the second paragraph here a bit about the different types of trading I have done over the years. 2008 seems to be a major demarcation for two reasons: this is when I started trading full-time as well as when I started trading Section 1256 contracts.

Here’s the big question: should 2001 – 2007 be included in the analysis or left out?

That is something I will be sleeping on tonight.