Put Diagonal Backtest (Part 2)

Posted by Mark on September 30, 2021 at 07:00 | Last modified: June 20, 2021 13:37Today I continue with commentary and impressions from my first ever put diagonal backtest.

I left off with mention of selling for greater than TEV in a discretionary manner; this was done for a couple reasons. First, I wanted to offset any additional slippage that might not have been covered by the $0.16/contract. As described in Part 1, this may not have been necessary because I have effectively included $0.32/contract slippage total.* Second, I wanted to offset the occasional overrun, which cannot be avoided (defined below as “LIVOC”).

To give the best chance of realizing fully-financed insurance, TEV should be recalculated after an overrun to make up for lost ground. Efficacy can be calculated once the insurance is closed by subtracting net change in the insurance premium EV from total short-option EV sold. If the difference is zero or positive then I have fully financed the insurance (else I should carry over the deficit to the next contract). The only caveat is that all short options must be held to expiration (EV = zero). If this is not the case, then I must subtract from the total short-option EV any EV paid to close.

This last paragraph may be confusing. Feel free to e-mail with questions if so inclined.

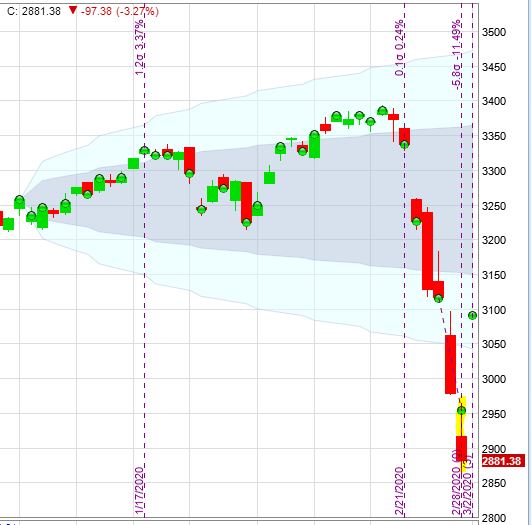

I backtested one contract from Jan 2, 2020, through Jun 16, 2021 (531 days):

The market finished up 29.7% in just under 18 months after being down 31.3% within the first three months. Please excuse the green dots that signify trades.

Maximum drawdown (MDD) for the trade occurred on 2/28/20:

Here are some backtesting statistics:

- Initial cost for 3250 put (max value $325,000): $28,678

- MDD: -$9,333 (on 2/28/20, 57 DIT)

- Final PnL: +$127,899

- Market down 8.29 SD (maximum value) at 81 DIT

- Market up 3.17 SD (maximum value) at 529 DIT

One of the bigger challenges in managing this trade is avoiding what I will call Lost Intrinsic Value Opportunity Cost (LIVOC). This occurs when a SP is closed OTM. The option is sold with intrinsic value (the “IV” of LIVOC) that is converted to unrealized gains as the market moves higher [and becomes realized when the position is closed]. Had I sold at a higher strike, the additional upward movement could have been profit as well (the “OC” of LIVOC).

With regard to guideline (4) from Part 1, I feel temptation to lower the strike and collect more EV when EV < TEV: especially with EV ridiculously low (e.g. under ~$0.20). Use caution because underlying market price overtaking the SP strike is what can hurt this trade the most. The LP---hedged by the SP---is vulnerable to upside movement. The hedge runs out soon after going OTM, which occurs once EV is gone. If this occurs, then LIVOC will be realized when closed (and/or at expiration).

I will continue next time.

* — A call has been placed to my broker for confirmation since I have never done this before.