Debunking the Williams Hedge (Part 6)

Posted by Mark on September 13, 2021 at 07:01 | Last modified: June 10, 2021 06:39Today I will continue discussion of the Williams Hedge (WH), which I introduced here.

Last time, I did some analysis of small delta differences before realizing multiple reasons to question the accuracy of data. Inaccurate data is not sufficient to support meaningful claims.

Surprisingly, while accuracy may be lacking, at least liquidity should be good. OI on those DOTM contracts is well into the thousands—even five digits in some cases.

To continue the WH campaign in the midst of the 2020 crash conditions is to say “the market has already crashed 30% and it could crash another 44-65% in the next seven days” (for the 1300 and 800 strike, respectively). Nothing like this has ever happened, but that’s not to say it can’t and perhaps someday it actually will.

If you absolutely believe there’s no chance in hell of this happening then you might as well not buy the LP in crash conditions and/or you won’t have the personality to ride out this strategy through crash time.

Some sort of stop could save the WH from catastrophic losses along with the slow bleed from extra LPs. What this does to hedging efficacy when it does actually work would then be the big question.

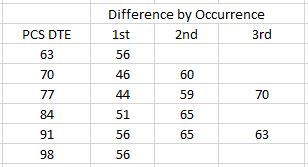

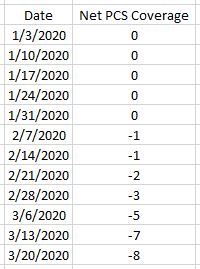

Getting back to the comparison between SPX IV and Difference, we can clear things up by studying how LP DTE varies when PCS DTE is held constant:

This chronologically groups Difference (PCS DTE minus LP DTE) by DTE occurrence. For each DTE value with multiple occurrences, Difference increases from Jan to Mar.*

As SPX IV skyrockets and term structure goes into backwardation, we see the LP leave greater exposure to the [losing] PCS.

Had I moved everything back one week and sold from 70-105 DTE rather than 63-98 DTE, the spreads would have been a bit farther OTM. The LPs would also have been a bit more OTM and perhaps I could have bought longer-dated LPs to decrease Difference and retain coverage. This is mere speculation, though.

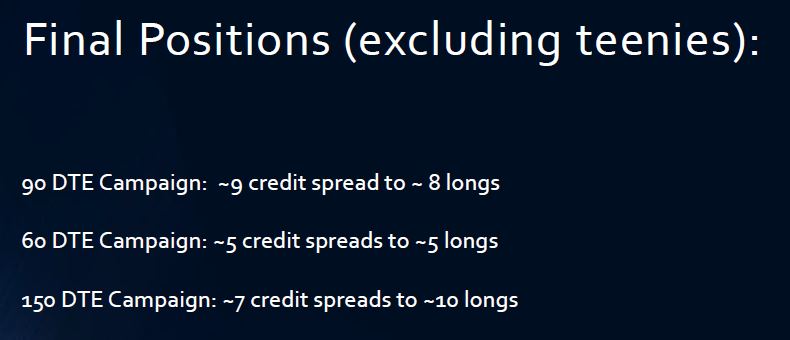

The WH course—once available for ~300 USD—says nothing about changing guidelines in backwardation. The course says nothing about ever having a substantial deficit in PCS coverage. Even worse, they hammer this home with a slide:

Bad, bad, bad. I have shown this to be completely false. Everything I have discussed amounts to this:

I will pick up here next time.

* — This comparison would be a bit more robust had I sold 70 DTE instead of 98 DTE and 91 DTE

instead of 63 DTE since 98 DTE and 63 DTE only occurred one time each.