When Performance is Irrelevant (Part 1)

Posted by Mark on April 18, 2017 at 07:26 | Last modified: November 18, 2016 12:45Plenty of reasonable doubt suggests traditional reporting of financial performance is irrelevant and serves only to mislead.

I am not saying reporters of financial performance are aiming to mislead. This post is not categorized optionScam.com. Reporters may occasionally attempt to mislead but certainly not always. I also believe financial reporters often mean well and do exactly what their compliance teams require (e.g. for mutual funds or hedge funds). This can still fall short of the mark, however, which is why society as a whole needs increased levels of financial literacy.

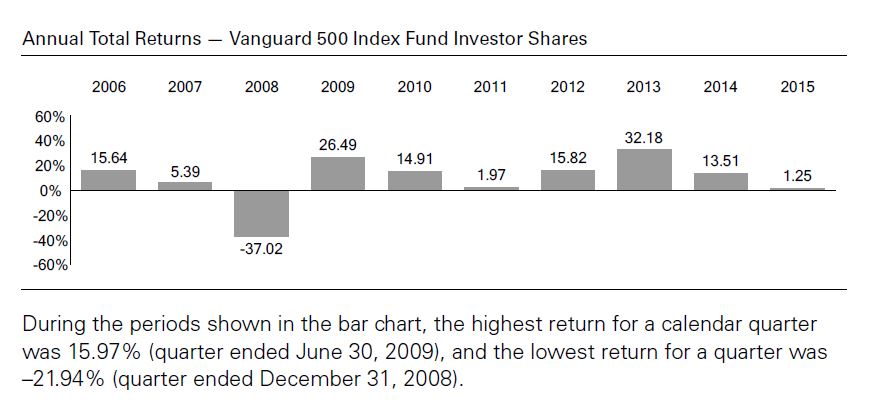

I begin by taking a look at how investment performance is presented today. I did a search for “mutual fund prospectus” and took three hits from Google page 1. Let’s start with the Vanguard 500 Index Fund:

The main critique I have of these numbers is that each year includes only one sample. We don’t see any [standard] error [of the mean] bars here: each number is exactly what the fund returned during that calendar year. People tend to give samples created from a linear combination of historical data added weight and sometimes these historical samples (as opposed to simulated trials) are the only ones people recognize. Statistically speaking it is one and only one sample, however, which makes it the tiniest sample size available aside from zero. I had the same criticism for Craig Israelsen.

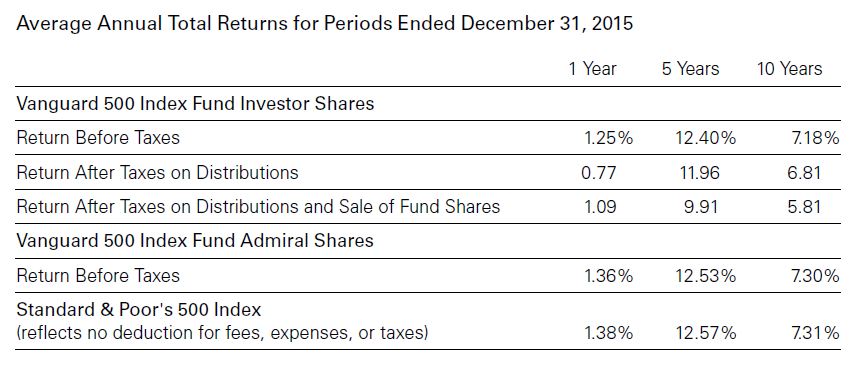

The prospectus also includes the following table:

Nowhere does it state that transaction fees are included in the performance numbers. Transaction fees are mentioned in the last row where benchmark performance is given. While this may imply the fees are taken into account above, we cannot assume this.

I will make one tangential observation here about relative performance. The fund underperforms the benchmark for all three time frames whether looking at Investor Shares or Admiral Shares. Critics of actively managed funds sometimes emphasize large losing margins against the benchmarks. The only way to ever beat the benchmark is to actively invest. A passively managed fund is guaranteed to lose every time because of the fees—regardless of how small those fees might be.

I will continue with two more examples in the next post.

Comments (3)

[…] The bar graph only shows performance for two years since the fund opened May 2012. Instead of 10 tiny samples (Vanguard), here we have two tiny […]

[…] blog mini-series started out with some mutual fund prospectus examples (here, here, and here) to understand and critique how investment performance is reported. Today I […]

[…] claims, and overall chicanery than finance. I have written about this subject extensively (e.g. here, here, here, and here). In designing a business plan and sticking to it one must avoid being […]