Richard Weissman’s Trading Rules

Posted by Mark on March 30, 2017 at 06:43 | Last modified: December 11, 2016 14:33Over three years ago, I read an article on Richard Weissman’s top trading rules. Weissman has written articles, books, and supposedly consults and/or trains people. What I think is more important is a comment I wrote after these 10 rules: are there situations where every cliché rule does not apply? Let’s go through these one at a time in order to find out.

1) Trade the market, not the money

Is the “market” a technical chart? Is it my unrealized gain/loss? Is “money” a technical indicator or is it my gain/loss? I can come up with a number of contradictory interpretations here.

2) When there’s nothing to do, do nothing

I like this. Overtrading is a frequently-discussed problem. Some people feel they have to trade and get nervous when they don’t. If it’s a consistent problem then a therapist or counselor/coach might help one to feel more at ease during downtime.

3) Stop adjustments can only be used to reduce

reduce risk, not increase it

I think this is a recommendation to only narrow stops and never widen them. If one is using a trading system then I see a potential problem with changing the stop in either direction. Trade like you backtest and do not deviate either way.

4) There are only two kinds of losses: big

losses and small losses. Given these

choices, always choose small losses.

I disagree. Not only are “big” and “small” subjective, the occasional large loss may be part of a viable business model.

5) Don’t anticipate, just participate

I disagree. “Prepare for war in a time of peace.” Anticipate what you are going to do in all cases because if you don’t then when the time arrives to participate you may be like a deer in the headlights.

6) Buy the strongest, sell the weakest

This does not always apply (e.g. option trading).

7) Stagger entries & exits

I like this but it also seems to be personal preference. A workable business plan need not stagger.

8) Look for low risk, high reward, high

probability setups

I think this is one possible trading style but certainly not the only viable one.

9) Correlations are for defense, not offense

Pair traders may disagree because they use correlations to make money (offense). I disagree because during market crashes, even non-correlated markets tend to move together.

10) Be disciplined in risk management and flexible

in perceiving market behavior

I’m not entirely sure how these two fit together. I agree with the former. Whether risk is managed at entry (limiting position size) or with stops, it should be disciplined because catastrophic loss could occur the one time I’m sloppy. With regard to the latter, I’m not a big believer in forecasting future market moves under any circumstances. I would suggest being disciplined when interpreting market behavior and then apply the plan consistently.

Out of 10 trading rules I agree with 1.5 of them. Not great but could be worse. Your mileage, like mine, may vary.

Categories: Wisdom | Comments (0) | PermalinkStatistical Manipulation

Posted by Mark on March 27, 2017 at 06:05 | Last modified: November 15, 2016 12:21Peter Berezin, chief strategist for BCA Research, wrote an article for the September 2016 issue of AAII Journal. Near the end he made some comments about statistics:

> Statisticians like to say that if you torture

> the data long enough, it will confess to

> anything. This old adage is especially relevant

> to the study of stock market anomalies. First,

> there is the risk that any anomaly that is

> unearthed will simply end up being the product

> of data mining. Second, even if an anomaly

> turns out to be genuine, there is a risk that

> it will be arbitraged away once the investment

> community becomes aware of it.

I argued for an increased use of inferential statistics here and I later relayed the opinion of a financial adviser as to why inferential statistics may be relatively uncommon.

I still believe inferential statistics are useful to offer an apples-to-apples comparison but Berezin makes a good point that statistics may be used to manipulate. We can never be sure of an investigator’s underlying motives and unless we do the research ourselves, we also cannot be sure the statistics were correctly computed.

I do believe we can do a couple things to avoid these statistical issues. Data mining involves searching a large collection of data with the purpose of finding significant results. This should be avoided. Give me an indicator and enough data and I can find a snippet of price action for which the indicator works fabulously (fallacy of the well-chosen example). This is unlikely to be profitable in live trading, however. One way to avoid this involves searching the surrounding parameter space for a high-plateau rather than a spike region of profit.

With regard to market edge being arbitraged out over time, I need to monitor my system and have criteria indicating when it might be broken. Walk-forward analysis can help to keep a strategy current thereby increasing the probability it will work with live trading. I may also monitor total profit/loss and stop trading the system when this value falls below the equity moving average. This should be developed through proper validation methodology.

Categories: Wisdom | Comments (0) | Permalink2016 Performance Update

Posted by Mark on March 16, 2017 at 07:10 | Last modified: October 13, 2017 11:04I am very past due for a performance update.

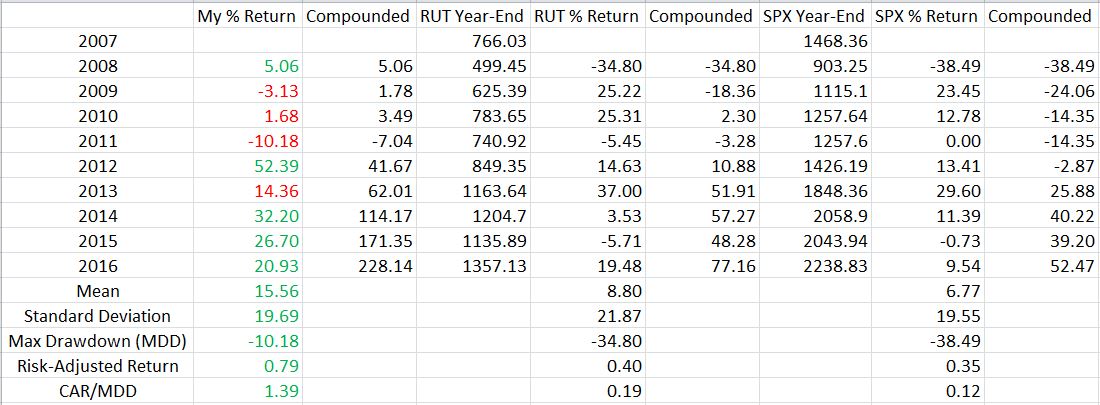

I will focus discussion on the following table:

My first full-time year was 2008, which means I now have nine years of trading history. Through that time I have tried a few different things, backtested a lot, and learned tons. Hopefully I have learned most from my mistakes. Only the future can reveal whether that is true.

The table includes three sets of data. I start with my yearly performance and the compounded total return. I then repeated these calculations for the small-cap and large-cap indices. Green (red) numbers indicate where I outperformed (underperformed) the benchmark. Standard deviation is a measure of risk (as discussed here and here) along with max drawdown (MDD) (as discussed here). Risk-adjusted return is total return divided by standard deviation. CAR is compound annualized return, which makes CAR/MDD another risk-adjusted metric.

I have outperformed the benchmark in five out of nine years.

I have generated profit in seven out of nine years.

My average return significantly outpaces the indices. Mostly for that reason, the risk-adjusted returns are much better too.

My biggest disappointment is the relatively high standard deviation. To this end, my 2012 return of +52.39% hurts. I can’t say exactly what was going on with my trading that year without looking back and scrutinizing the records. Yes it’s a great number but my preference would be to have stable returns like I have the last few years.

I very much like the fact that my worst year was limited to just over a 10% loss. This is the kind of stability somewhat lacking to the upside. I experienced three catastrophic losses over the last nine years and the overall performance suggests I have bounced back quite well.

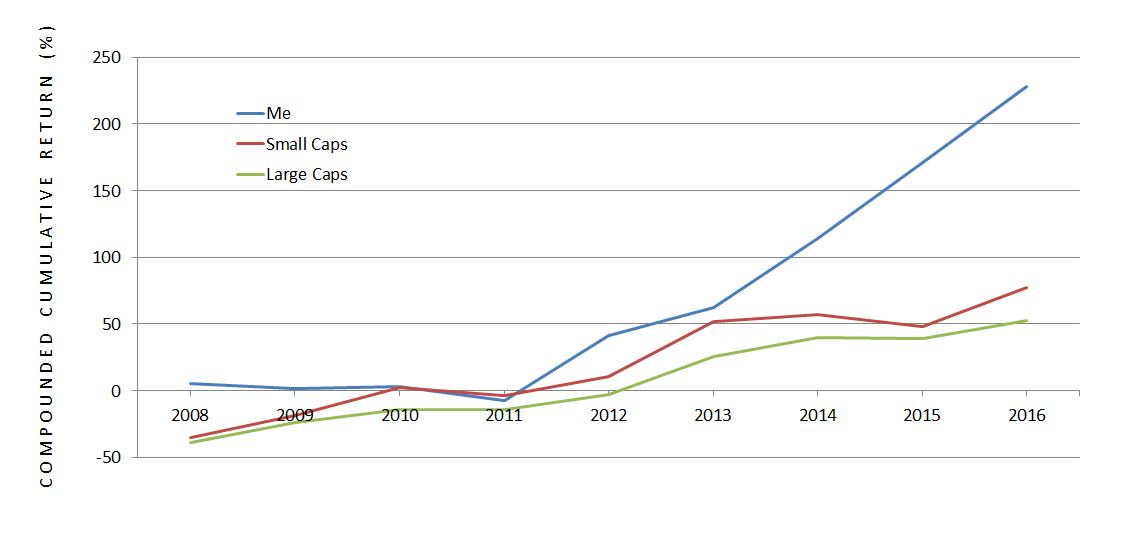

Graphically, the comparison looks like this:

The outperformance is clear.

Although I was in negative territory and underperforming after four years, my preference is to have a relatively flat equity curve in volatile markets as opposed to a curve more jagged than the coastline of Buzzards Bay, MA. This is something I have managed to accomplish thus far.

Categories: About Me | Comments (1) | PermalinkOn the Need for Improved Financial Literacy

Posted by Mark on March 13, 2017 at 05:54 | Last modified: September 20, 2017 10:49The need for improved financial literacy nationwide is conventional wisdom: a simple internet search will bear that out. I challenged this in my last post because people seem to have little interest.

Although I criticized this challenge based on limited sample size, it may have some merit. People are generally uneducated about investing and they seem quite willing to let professionals do the job for them. In terms of value, financial literacy differs from functional literacy. Many people who cannot read or write have felt the squeeze over their lifetime from those around them including prospective employers. Hiring financial advisers is much more socially acceptable than functional illiterates asking others to read/write for them.

This pertains to a blog post I wrote in January where I decided it wasn’t the result of a brainwashing perpetrated on the American public by the financial industry. Rather, the decision to hire investment advisers is a delegation of duty. The cost of this delegation includes management fees and lower investment returns.

We could ask whether the real issue regards a need for improved financial literacy or a choice about how people wish to invest. I don’t think the average person has enough education to decide on the latter so perhaps it does come back to financial literacy. I could also argue that most financial professionals don’t know as evidenced by the fact that so many of them do not employ options.

In the last post I pointed out that trader education is a subset of financial literacy. One can know a lot about finance, understand the role of investment advisers, and know how to interview/select a knowledgeable adviser. Even someone educated in finance may elect not to take that next step and manage his/her own investments.

I think the basics of financial literacy aim to keep people out of a “paycheck-to-paycheck” struggle. This involves how debt works, proper budgeting, savings/interest, etc. Investment management pertains to savings above and beyond that needed for annual living expenses. Getting a large proportion of the working class to establish and maintain a rainy day fund would represent a significant move higher in terms of financial standing. Having surplus capital available for trading and investing, though, is still a whole other level.

For those in possession of surplus investment capital, financial literacy may be channeled into a business. This is what I have done in order to retire from Corporate America. The pharmacist in me would point out a similarity to the way some have turned “medical literacy” about dietary supplements into a business. Despite having no customers, I would argue that my product is supported by data whereas many claims regarding dietary supplements are baseless and invalid.

Categories: About Me | Comments (0) | PermalinkGiving Back (Part 3)

Posted by Mark on March 10, 2017 at 07:41 | Last modified: December 20, 2016 11:35Before continuing forward, I want to clean up a couple things—the first being the need versus achievement debate. I’m not really in a position to assess achievement. You could also make the case that I’m not really in a position to assess need. I therefore will not be deciding whom to teach based on those criteria.

I have discussed two monetary factors with regard to a trader education program. I have the previously stated reasons for charging a per-session fee. I would also recommend having ample savings to eventually open a real account. Both of these are included to try and prevent students from dropping out, which would result in time wasted for me [preparation of presentation material] and for them [education never applied].

I have thought about giving back by taking an entirely different avenue: teaching high school students. Kids are generally means-challenged so I would not charge a per-session fee. Neither are they likely capable of opening live trading accounts. They do have a solid potential for future income, however, which is wealth they could later manage on their own. Because option pricing models and considerations of probability and statistics all fall under the “advanced/theoretical mathematics” category, I would target advanced math students. This would also get me academically-disciplined students to work with who would be more likely to complete the program.

On a totally different note, I was tempted to argue against the “improve financial literacy” battle cry because people simply did not seem interested based on my recent exercise of getting 11 responses from 54 messages sent. Cost could have been a confounding variable; people may have been unwilling to pay a stranger. I also have no way of knowing how many of my 54 messages were actually received. Over the years, I have gotten poor response rates over the Meetup.com website. For all I know, only 11 people were even aware they received a message.

I do have other reasons for thinking people may not have much interest in learning to trade. Over the years I have approached a few different libraries about conducting a trader/investor program. This was met with lukewarm response because they had not found investing programs to be well-attended in the past. This was the same reason the Ann Arbor District Library gave for discontinuing their subscription to Value Line a few years ago.

Learning to trade, though, is only one subset of financial literacy. I cannot conclude from this that people have little interest in the latter.

Categories: About Me | Comments (1) | PermalinkGiving Back (Part 2)

Posted by Mark on March 7, 2017 at 06:14 | Last modified: December 16, 2016 15:54The current topic under debate is whether I should give back by trying to teach those without the resources to pay or those who have demonstrated achievement.

I think a significant discount qualifies as “giving back” even if it is not free. I thought about charging per meeting as motivation to stick with the program (it’s harder to abort once we have begun to commit). $20 per monthly meeting would be $240 for a year, which is far less than programs costing thousands of dollars. I would also encourage people in the group to study and practice (paper trade) together. Anytime they have questions I would be happy to answer. This would be a dynamite training package for a steal of a deal.

I am quite convinced that no matter how small, participants must have some skin in the game. I can’t force them to trade and I don’t want to do anything that might put me in an “investment advisor” role because I am not a registered investment advisor. A per-meeting fee helps them—by providing motivation to get through—and it helps me by lowering the probability of dropout. I would be extremely disappointed if I were to compose presentations only to later be deserted by my audience.

People who cannot afford a nominal fee face an additional problem. One must have savings in order to trade. I would probably suggest opening at least a $10,000 account to learn. I would expect interest to wane for someone unable to open a real account. Discouragement would build when trader education could not be converted into actual profits.

This is strike two against giving back to those without means. First, no fee means no front-loaded motivation to get through the course. Second, no savings means no application for the education itself.

I recently messaged people from Meetup asking if they would be interested in a trader education group. I suggested monthly meetings with a charge of up to $20 per meeting to cover expenses and to establish some accountability. From 54 messages sent, two said they would be interested, one person was a definite maybe, and eight declined.

Of the eight who declined, two said they wouldn’t pay $20 per meeting. This could also be a reason more people did not respond. While it may be healthy skepticism toward a stranger, I doubt anybody could find a complete curriculum delivered by a full-time trader for less. And what they don’t know they don’t know is that offering this for free would be doing them a greater disservice.

Categories: About Me | Comments (1) | PermalinkGiving Back (Part 1)

Posted by Mark on March 2, 2017 at 06:59 | Last modified: September 21, 2018 07:00Over the years I have found little interest among people in learning to trade options. I am thankful for what success I have had with my trading and for the freedom my entrepreneurial trading business affords me. I have given significant thought to how I might be able to “give back” as an expression of my gratitude.

I want to begin by addressing a potential contradiction between giving back, which implies free, and teaching people to undertake a for-profit enterprise. As an inextricable component of the tremendous business opportunity I have cultivated for over nine years, I believe trader education is extremely valuable. Maybe this is not something to be given for free lest its value be undercut. With the domain being strictly financial, an upfront investment seems more fitting with the goal of consistent profit over time. No investment is free and therein lies the contradiction.

I perceive a significant difference in subject matter between offering people what is essentially business training (trader education) and volunteering to tutor after school kids. I also believe the story would be different if the trader education were used to generate profits for charity.

Perhaps academic scholarship can help determine whether trader education should be free or for sale. Scholarships are generally awarded based on need or merit (i.e. achievement). The latter often includes people who would not otherwise qualify based on need. If I want to give back, should I teach financially-challenged or high-achieving individuals?

I believe consumers of expensive trader education services are more likely to stick with the program than those without obligation. I have previously discussed how traders can be a very fickle lot (myself occasionally included). Over the years I have seen people come and go through various Meetups and trading groups. This stands in stark contrast to many students I have seen motivated to complete programs for which they paid a hefty bill up front.

With many trader education programs costing thousands of dollars, people who attend are generally not those in need.

To whom should I “give back?” Score one point for merit-based because those with nothing to pay are lacking a key motivator to get through.

I will continue next time.

Categories: About Me | Comments (3) | Permalink