Dynamic Iron Butterflies (Part 6)

Posted by Mark on April 4, 2017 at 06:42 | Last modified: May 26, 2017 12:53In the spirit of “who ever said making a business out of trading should be easy,” today I will present results on a 50% stop-loss (SL) applied to the dynamic iron butterfly (DIBF).

Backtesting this was actually not too difficult. Once I got started, it did not take much time to redo 526 backtrades. I did have to verify the cost of each trade because over the first few years of the data series, OptionVue had a lot of missing data (filling in with theoretical values is variable because it does so according to what data is in computer memory at that given moment). Thanks, as always, to Ken Dole for expert technical support when needed.

Here are some observations from redoing 526 backtrades:

–Nine trades came up winners

–Upon third check, only four of nine were winners

–Multiple trades would have been setup differently upon replication

These observations are due mostly to the inconsistencies described above. I did not change any backtrade results but I did remove four backtrades because the 50% SL was not triggered upon replication.

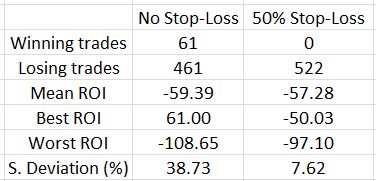

Here are some trade statistics with and without the SL:

The 50% SL marginally improves results on average as the mean ROI improved 2.11% (all ROI’s are percentages).

Looking at the best and worst trades is an indication of how the range contracted with the SL. This is strongly affirmed by the standard deviation (SD), though, which becomes much smaller. Once again, SD is a measure of risk so this is meaningful.

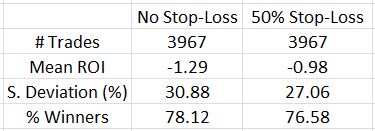

How does this impact the overall backtest?

The SL improved the average trade by 0.31% and decreased the SD by over 10%. That’s definitely a win-win despite a lower number of losing trades.

One further thought I had about limiting losses was that the upside on an asymmetrical butterfly already has limited loss. If the SL is not implemented on the upside, trades that would otherwise go on to be winners would not be stopped out for losses. As it turned out, only eight of 61 trades that went on to hit the 10% profit target or went on to be profitable at expiration after being stopped out were hurt on the upside. Four of those butterflies were balanced, though. Not implementing the SL on market moves to the upside where the DIBF was asymmetrical only improved mean ROI by 0.5%. It also increased SD to 9.60%.

Although it did not improve trade statistics much (or at all), I think it makes sense to not implement an upside SL on an asymmetrical DIBF.