Trading System #1–SPY VIX (Part 3)

Posted by Mark on October 2, 2012 at 08:01 | Last modified: September 21, 2012 09:21In http://www.optionfanatic.com/2012/10/01/trading-system-1-spy-vix-part-2/ (10/1/12), I continued the discussion of evolutionary operation by reviewing optimization. Today I will begin the optimization process for the trading system.

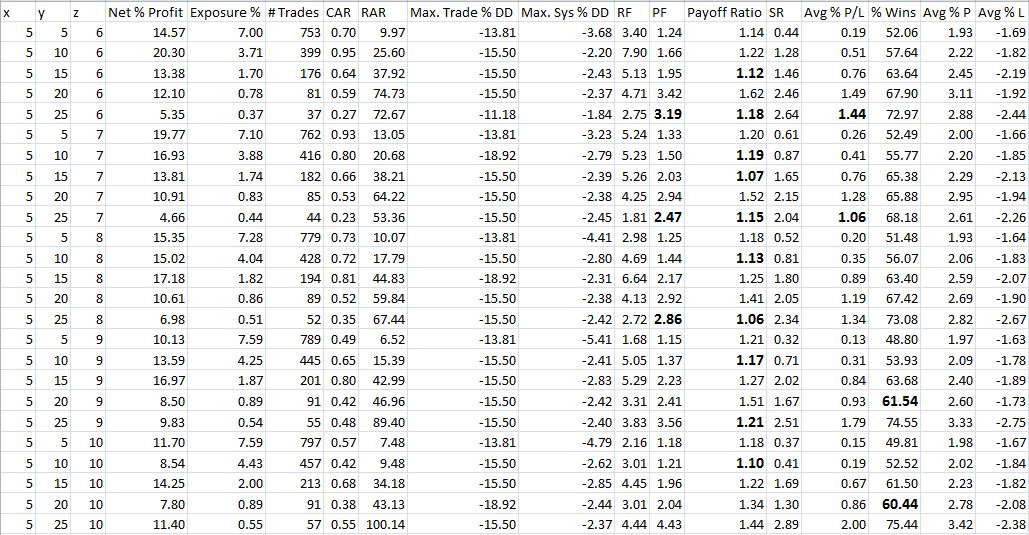

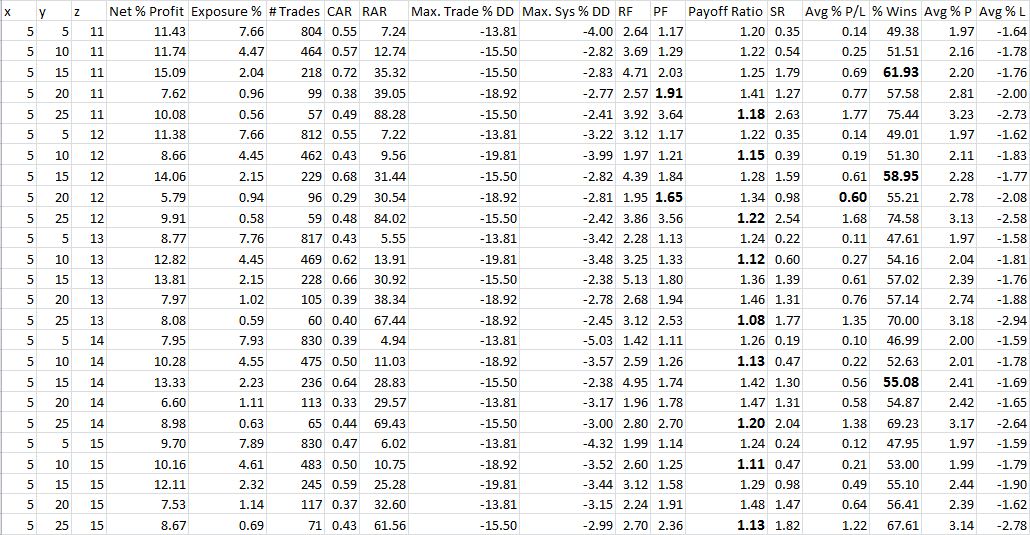

For the initial backtest, I am going to leave x fixed at 5 days and, as mentioned in the last blog post, vary y from 5-25 in increments of five [e.g. 5 (percent), 10, 15, 20, or 25] along with z from 6-15 in increments of one. Other backtesting assumptions were discussed in “Trading System #1–Backtesting Assumptions” from 9/14/12. The only change here is that I will take long and short SPY trades when VIX is “overbought” and “oversold,” respectively.

Table 2A

Table 2B

I abbreviated headings to make the Table font larger:

CAR = Compound Annualized Return (%)

RAR = Risk Adjusted Return (%) = CAR / Exposure %

Max. Trade % DD = Largest intratrade drawdown (%) (denominator is position size)

Max. Sys % DD = Largest portfolio drawdown (%) (denominator is current account value)

RF = Recovery Factor = Net profit / Max. System DD (higher is better)

PF = Profit Factor

Payoff Ratio = Average win / Average loss (second term of PF calculation)

SR = Sharpe Ratio

Avg % P / L = Average % gain or loss per trade

Avg % P = Average % profit on winning trades

Avg % L = Average % loss on losing trades

Several trends are evident from studying these results. The numbers in bold and larger font are unexpected values with regard to these trends. Feel free to take some time to peruse the Tables.

In my next post, I will begin the data dissection.

Categories: Backtesting | Comments (2) | Permalink