2021 Performance Review (Part 1)

Posted by Mark on March 24, 2022 at 06:59 | Last modified: February 7, 2022 10:20Today I begin a mini-series to update my trading performance through 2021.

I haven’t done a performance update in a while, but I should do this every year. My first such review began with this post. Four years later I did this one. Later that year I also did this post with some nice graphs and data. The following year I did this one. Finally, I did this one to finish up a draft I had begun months earlier. This post includes some performance notes.

2021 was my best trading year ever. One could say I was lucky. Then again, as traders we are always lucky whenever a different market environment would have resulted in a much worse outcome. This is especially the case when the superior performance is realized in the face of an improbable (subjectively defined) market environment.

I tend to be reluctant to take credit for things I do not control. I do not control the market, but I am the one doing the trading and for that I deserve credit. Certainly if my account tanks, I will always get the blame by my own worst critic (for starters).

Some of this is about humility, which is a topic I have written about or alluded to in the last paragraph here, this post, this mini-series, this mini-series, this post, and this mini-series where I gave a very honest and open evaluation of myself.

Aside from reviewing my 2021 trading performance, in what follows I will go back to 2001 and recalculate the numbers relative to different indices factoring in dividend yield and tax differential for active trading. I incur a 60/40 blended tax rate compared to the benchmarks, which for purposes here will be considered LTCG. I don’t have a CIPM®, but I think any accurate performance comparison should address this point.*

Because my original plan was to crunch numbers in Python, this has become more of an ordeal than anticipated. My spreadsheet breaks down monthly periods by the last Friday of each month being the starting point for one period and the ending point for another. Not every Friday is a trading day (holidays), though, which means I sometimes use Thursday values. I’m fine giving a Friday date even when there is no trading on that day because it’s still a true statement. In some extreme cases, we may have had no trading on a Thursday and a Friday. Programming all this can get rather involved.

I will continue next time.

* — If you start reading performance reports, I think you will come to the realization that most do not.

Getting Back to Basics

Posted by Mark on September 2, 2021 at 07:11 | Last modified: June 1, 2021 08:27Today’s post is about getting back to basics, which is something I periodically find myself forgetting to do.

I have no complaints about my trading this year. I’m sticking with the plan, which is my primary goal.

For a few different reasons, though, I want more. First, I may need a different plan when the market environment sours (a constant threat as seen in the tables here). Second, I can accommodate a few more small-sized trades in the portfolio. Third, I always want to be on the road to self-improvement. I don’t always accomplish this, but I certainly want to be trying.

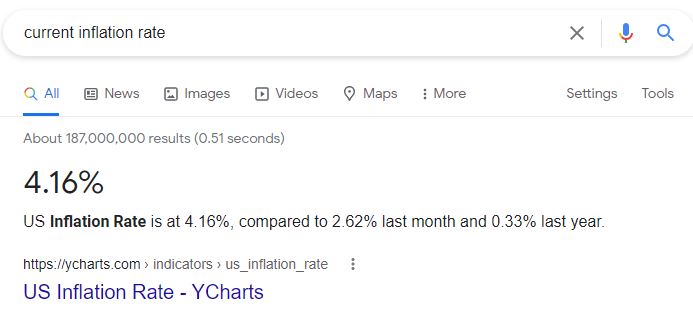

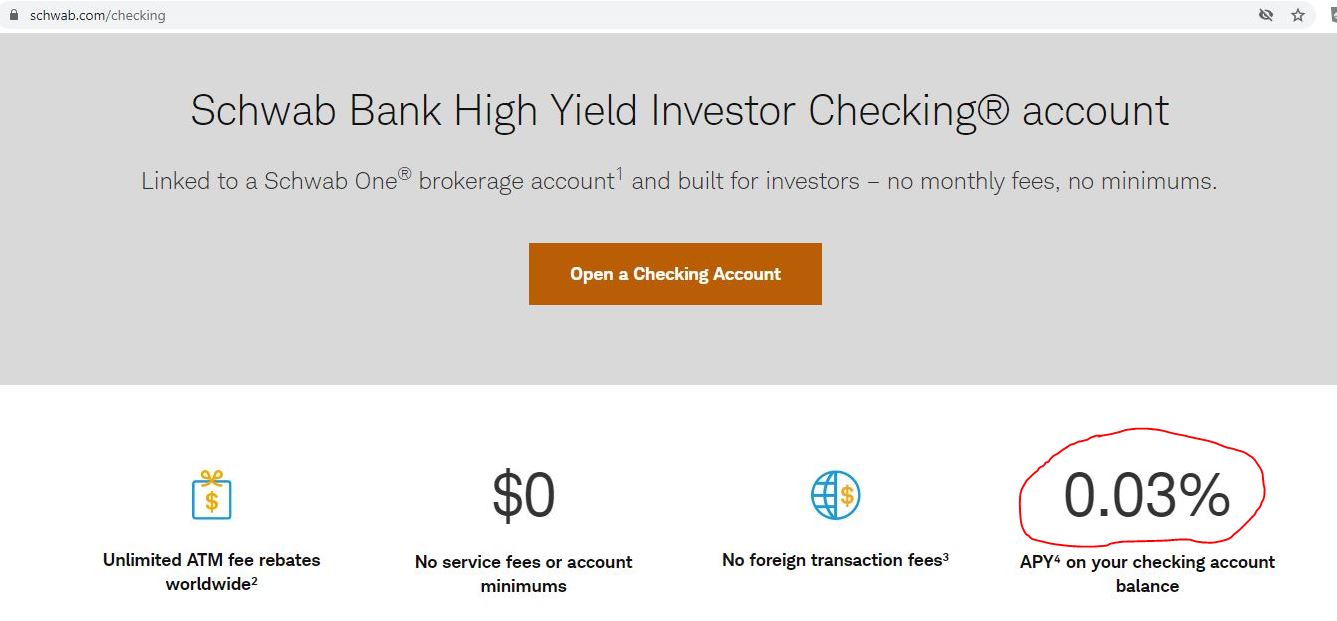

One further reason to want more: interest rates. I feel the need to make up for this deficit:

For all these reasons I want more, but I also have a lot on my plate right now:

- I’m trying to network with traders to establish new connections. This is a big ask (see third-to-last paragraph here, fifth paragraph here, and fourth-to-last paragraph here): probably itself equivalent to a part-time job.

- I’m mulling over potential job interviews (see here).

- I’m on the hunt for an automated backtester (see here).

- I’m doing some manual backtesting (see here).

- I’m studying one particular trading philosophy that is a paradigm shift away from what I currently implement. It takes a lot to wrap my head around this and to understand all the moving parts.

I occasionally hear about a relatively simple trading strategy that makes me think “I should have been doing this all along.” While I now recognize the periodic pattern, I never cease to be amazed when it repeats.

Maybe now is the time to do something to make sure the pattern repeats less. How can I make this happen?

- Write down the trading strategy in a straightforward, objective manner.

- Backtest the strategy enough to become comfortable with how the position moves and what I can expect with regard to relevant items like greeks, PnL, etc.

- Start trading live with the smallest position size available (one contract will suffice for many).

- As I feel comfortable, increase size slowly after trading through enough drawdowns and losses.

- Rinse and repeat (may also be done in parallel with multiple strategies).

I may get stopped out from #2 due to performance concerns. If the strategy is not viable in backtesting, then I need to junk it and make a note that development was unsuccessful. I am likely to stumble upon this strategy at some future date and I can save myself a lot of time and effort if I remember that I’ve “been there, done that.”

My discipline, to which the 900+ posts in this blog can attest, is beyond reproach.

My challenge is now to take that discipline and apply it to something new—something that, in this case, can potentially lead to multiple streams of income.

I have always liked the [quite marketable] sound of that!

Categories: Accountability | Comments (0) | PermalinkKD or the Retail Trader? (Part 3)

Posted by Mark on July 5, 2021 at 06:02 | Last modified: May 25, 2021 08:19I left off with mention of NS. Time to wrap up his story.

After I asked where he got my name, he responded:

> Hi Mark,

>

> I found your contact information on the… [collaboration spreadsheet]

> from KD.

>

> I have decided to continue to trade stocks only for now. I think this

> adventure and undertaking is premature at this moment in my life, the

> time commitment and capital needed to succeed is not there. Will

> revisit this in the future. Thank you for your understanding.

>

> NS

In 24 hours, NS apparently went from enthusiastically seeking collaboration on futures trading strategies to not trading futures at all. He doesn’t have the time commitment: did he just learn what kind of commitment it would take? He doesn’t have the capital: did he just learn about capital requirements? Did he research these critical details before spending thousands of dollars on the course? He seems like a responsible adult: a family man and a CEO of a company with 20 employees. Sudden reversal and complete oversight are not what I would expect from a guy with his head on straight.

This escapade with NS strikes me as the epitome of fickle. You know, fickle: capricious, changeable, variable, volatile, vacillating, mercurial, irregular, inconstant, undependable, unsteady, etc.

This also reminds me of trader reluctance to discuss losers (see second paragraph here and bullet points 6 – 7 here).

Since NS and the 12 e-mail contacts I wrote about are all associated with KD, I wonder if this behavior is a reflection of a lousy approach. Paying for a failing system is an ego-challenging experience when we feel ripped off, taken advantage of, or violated. I wrote earlier about my failure. I gave 3+ months of full-time effort. I was disciplined. I documented. I exchanged 50 – 100 e-mails with KD asking questions, discussing details, and reviewing examples. My time committed is more than I would would expect from most. If it didn’t work for me, then I would not be surprised to learn it didn’t work for others either. KD warns it may require even greater effort, but it could be a complete farce. I have my suspicion.

On another hand, statistics about the high failure rates among traders as a whole circulate often. Maybe the same sort of commitment and patience required to succeed with KD is required to succeed with trading and most people just don’t have it. Trading itself could be a farce, but I have to admit that I have succeeded with my overall efforts until now. This makes me less likely to reject the entire trading enterprise.

Categories: Accountability | Comments (0) | PermalinkKD or the Retail Trader? (Part 2)

Posted by Mark on July 2, 2021 at 07:29 | Last modified: May 24, 2021 15:29Is the takeaway from this blog mini-series more a reflection of KD or of retail traders in general?

I left off discussing my outreach to 12 people from the Y collaboration worksheet. Here are the results:

- One said he had moved on from KD’s approach and was now trying something else.

- One said he had not yet started to apply KD’s approach and would not be any help (despite the fact that he added himself to the spreadsheet months earlier).

- One said he hadn’t gotten anywhere with KD’s approach because he was struggling with the programming.

- Two responded enthusiastically about working together but did not respond to a subsequent e-mail.

- Seven did not respond at all.

I am shocked by the overall response. I stated in the third paragraph here that I could not recommend KD because I had yet to find any success. This is supported by the total reception to my e-mails. Most people having success would be happy to share stories, meet others who are like-minded, hear other potentially helpful suggestions, etc. Over half my e-mails went without any response, two gave no substantive response, and the rest expressed failure and/or remarkably weak excuses.

I cannot exclude the spam filter as reason for why so many e-mails went unacknowledged. Two of the nine were second e-mails following an initial response, which makes the spam filter doubtful. I don’t know about the other seven. Keep in mind, though, that all messages went to people who voluntarily put themselves on a list to be contacted. I am somewhat computer literate and know to check my spam folder periodically for non-spam messages. I would like to think that intelligent people spending thousands of dollars for strategy development education would also know, but I can’t be sure.

Six months later, a newbie contacted me. He wrote:

> Hello,

>

> How are you? I just took KD’s Y workshop and saw that you are

> open to collaboration.

>

> I’ve been recently liberated from a high-tech job as a product

> manager/business development in Silicon Valley. I’m trying to build

> a steady income stream by trading futures. I’ve submitted one

> strategy to the club so far and I’m trying to build up a diversified

> portfolio.

>

> Let me know if you are open to corresponding through email.

>

> Thanks,

>

> DO

I think the message I sent to others was a proper introduction and done with enough awareness to avoid alarm. DO’s message to me most assuredly accomplished the same. NS’s initial contact that I included in the last post: not so much.

Speaking of NS, I will get back to his surprising ending next time.

Categories: Accountability | Comments (0) | PermalinkKD or the Retail Trader? (Part 1)

Posted by Mark on June 29, 2021 at 06:13 | Last modified: May 25, 2021 07:49Motivation for this post is an e-mail I received from “NS” expressing interest in working together to develop trading strategies. You be the judge as to whether the ultimate takeaway is particular to KD or a statement about retail traders in general.

I introduced KD in the second-to-last paragraph here. As part of his offerings, he created a “strategy collaboration spreadsheet.” This is a networking tool for anyone interested in working with others to develop trading strategies.

Collaboration has been discussed many times in this blog (i.e. here, here, here, and here).

The e-mail I received from NS reads:

> Hi Mark,

>

> I am a father of 3, Husband, CEO, Systematic trading enthusiast. Traded

> stocks discretionary for 12 years, have been trading stocks systematically

> for 1yr Looking for a partner to join forces for accountability and

> collaboration to complete new strategies. What is your availability for

> an introduction meeting?

>

> [corporate signature]

While I continue to search for collaboration, I got an ominous feeling from this e-mail. Kudos to NS for introducing himself and providing some personal background. I just didn’t know how he found me. I have been away from the KD world for over a year. Did he read my blog and message me through the website? Was he someone I contacted in the distant past? Did he get my name from a third party? NS’s e-mail felt totally out of the blue.

After some deliberation, I responded:

> Hi NS,

>

> How did you get referred to me?

>

> Thanks,

> Mark

This ends in a very interesting way, which I will get back to later.

When I purchased KD’s “Y” (a brand name that will remain masked), I added my name to the collaboration spreadsheet and started e-mailing people. Over the course of 4+ months, I reached out to 12 people from the spreadsheet. For those who did not respond at first, I sent a follow-up two weeks later “in case they missed” the original. This was my message:

> Hi X,

>

> I am contacting you from the Y collaboration spreadsheet. I’m

> looking for someone with whom to exchange ideas, feedback,

> impressions, test strategies, etc.

>

> I hope you’re making it through this COVID-19 crisis okay!

>

> Thanks,

> Mark

The difference between my e-mail and the one I received from NS is mention of Y. Y should be easily recognizable because everyone paid a lot of money to get it. This makes us a shared community. Y should provide for a warm lead—at least warm enough to warrant a short response from those not interested and/or an explanation of why (since they did voluntarily add their name to the spreadsheet in the first place). Nobody owes that to me, of course, but for some I tend to think “common courtesy” would include it.

How exactly did I fare with my outreach attempts?

I will continue next time.

Categories: Accountability | Comments (0) | Permalink2018 Incident Report (Part 6)

Posted by Mark on June 5, 2020 at 07:51 | Last modified: May 13, 2020 13:17I’ve been getting more organized this year by converting incomplete drafts into finished blog posts. Today I conclude a July 2019 draft reviewing my 2018 trading performance.

—————————

When I’m not making money it feels terrible: no doubt about that. I feel like a failure, like I should go back to work pharmacy, etc. I want a better way although I should not look to throw the baby out with the bathwater. If the worst I ever do in a year is lose 5 – 10% then on the whole I’m going to be a star and I have to remember that.

Perhaps never do I feel more on-edge than when I am out of the market with uncertainty over when to get back in. The volatility train does not arrive often and when it does it usually makes for a short stay. I hate to be on the sidelines when the train leaves the station, which is why I am so quick to jump back in after making a large exit.

I need a better way. I need to backtest something with a sufficiently large sample size in which I can believe. Otherwise, I will feel like this is mere gambling.

A couple other thoughts for exit strategy include:

- Close partial positions when I am down one month’s usual income

- Start selling the call side when down one month’s usual income to better hedge against downturns (but how will that fare in rising markets?).

- Switch to a symmetric, BWB, or verticals instead of NPs. On this point, I could go back to the idea of selling $0.30 on a $5 spread to make 6% per month or 72% per year. If I allocate only 20% of the portfolio then that is 14.4% per year with no possibility of losing more than 20% in a month. That’s still not a great deal risk/reward ratio, though.

Here’s one more batch of random thoughts:

> Part of my problem this year had to do with anchoring and greed.

> I started the year making good money in Jan. I then lost much

> more (quickly) in Feb. From the time that I got back in

> (slowly), I worked several months to catch up through Oct when

> I was up ~10%. I knew it wouldn’t be my usual good year (or

> maybe I was just comparing to +36% last year) so I was

> patient… and then probably dead-set on holding longer and

> hoping the market would stay up—until it didn’t. I had a

> decent idea to get out if my YTD gains evaporated (first chance

> to get out when market went into backwardation was Oct

> when I was still up 4 – 5%). I was then too eager to start

> getting back in at first glance of normalcy. After a couple

> days of contango, I re-entered and then lost more. Sporadic

> trades thereafter lost as well. By the time I truly called

> it a year on Dec 20, I was down close to 10% (of my initial

> 2018 equity value; this would be more than 10% of my initial

> 2017 equity value on which the +36% is calculated).

>

> Going forward, I must work on developing rules and sticking

> with them no matter what. Sticking to the plan must be

> everything. One way or another, I’m going to be

> frustrated when the market goes against me. I might as well

> be frustrated knowing that I at least followed my rules

> because the alternative to following rules is to hope.

> If all I have is hope and I lose more because of it—which

> has happened with every major loss I have suffered to

> date—then I’m going to feel even worse and kicking myself

> back to the drawing board like I am right now.

2018 Incident Report (Part 5)

Posted by Mark on June 2, 2020 at 07:58 | Last modified: May 13, 2020 11:19Once again, today I continue with an unfinished July 2019 draft evaluating my 2018 trading performance.

—————————

With regard to getting out, I wrote to colleague FM:

> As I said, I want to be out when the market gets volatile because

> all of the largest market crashes have been preceded by some sort

> of craziness. The trick is getting out too soon or too late and

> there is no magic bullet that will work for all occurrences. In

> general, though, “craziness” involves wide market swings, regular

> 1+ SD moves, longer-term moving averages being pierced to the

> downside, VIX levels breaking through resistance, etc.

>

> I had a mental stop at YTD profits for my account. Once those

> evaporated I got out—and in retrospect, I’m glad I did because had

> I not then I certainly would have the very next day with much

> bigger losses.

>

> …I know you got frustrated previously seeing $307K go down to

> $251K so I closed [those] positions… to preserve some gains.

>

> With a sliver of [the] portfolio invested in NPs, one could make the

> case for me to keep trading [the] account per usual. The benefit of

> getting out would be to prevent even [that] sliver from incurring the

> biggest losses because at some point, there will probably be a major

> market crash on the order of 20%, 30%, or more. Trading this way,

> I can probably avoid those excess losses. The right answer is

> only knowable in retrospect.

Colleague FM responded:

> Your response is consistent with prior concerns about managing

> volatility. The backtest through 2008 seemed to produce very good

> results and I am not sure why volatility this year would be especially

> concerning.

>

> Regardless, much of your trading is based on how you feel about the

> market; which is not atypical of traders. However, if you are trying

> to sell a methodical, long term process, you will have a hard time

> as there is not a definable structure.

I’m actually trading larger and with more variable capital than done in the backtest. This may be part of the problem.

If I were just trading OPM then I would commit to trading consistently and regularly. I might have to stop trading my own money, though. I might also have to somehow separate myself from the client. Talking about this in times of market turmoil puts me even more on-edge since I always want to be cautious, qualify what I say, and not be too arrogant so as to be subsequently bitten in the behind due to excessive hubris.

I will conclude with my next post.

Categories: Accountability | Comments (0) | Permalink2018 Incident Report (Part 4)

Posted by Mark on May 28, 2020 at 06:32 | Last modified: May 13, 2020 10:33Today I continue with an unfinished July 2019 draft evaluating my 2018 trading performance.

—————————

Other considerations regarding the problematic strategy include:

- When to get the calls involved?

- Make some sort of checklist and record data daily. Take preventative action no matter what. Consider limiting position size so I always have some powder dry (have I been trading too large? Or keep trading this size but don’t change for a while). Checklist should have a number of items and the decision whether to take corrective action should depend on total checklist score (this will be too subjective for backtesting especially given limited number of occurrences of significant corrections per third paragraph here).

- When I roll, I’m starting at a much greater price (e.g. $12 – $14), which has a much higher delta. If the market continues to trend from that point, then those options quickly become $20 – $30. This makes me horribly uncomfortable. Until I find something better, exiting at first instance is a better choice than rolling.

- I want to test taking significant action on the biggest losses in X days. Looking over the whole set and making this decision is committing a future leak. However, plotting the difference across a range of X (e.g. 5 – 100 by increments of 5) or maybe a WF approach using largest in the last two months seems interesting [are both approaches the same? Even with a WF approach I have to figure a way to determine X].

With regard to my trading on Oct 24-25, 2018:

- I’d like to talk a bit about my trading mistake from Wednesday where I said to myself, “I’ll just go ahead and sell [harmlessly] an $8 call to recoup some of my losses.” When the market retraced half its huge Wednesday decline on Thursday, I felt horrible looking at a $20 call. I got little help from volatility despite VIX being down two points. A better way to approach this might be to look at the projected option price with the market retracing at least to the opening (high) price from Wednesday and to assess my risk tolerance. Another possibility is taking a 15-60-minute break from monitoring positions. While I risk seeing a horrifying DD when I return, I seem to pick the extreme in too many cases (e.g. closing the call on Thursday around 3 PM only to see SPX give back 10 of its 60 positive points into the close).

- I am not convinced TA is any better than 50/50. What it can do, though, is put some definition around what I’m doing such that my trades are consistent. Maybe I only go long (short) into an overbought RSI. Maybe I only go long (short) when I see a confirmed close above a previous candle’s high (low). At least this avoids me looking at the market, freaking out, and chasing only to watch (a short time later) my decision be proven horribly wrong after a reversal. This aligns with Goal #3 that I have discussed previously.

- It’s sloppy trading when I am forced to trade in fast-moving, wide markets and cave in huge amounts of money to get filled (especially when, two minutes later, I see the fill could have been had for a much better price).

I will continue next time.

2018 Incident Report (Part 3)

Posted by Mark on May 26, 2020 at 07:32 | Last modified: May 13, 2020 09:23Today I continue with an unfinished July 2019 draft evaluating my 2018 trading performance.

—————————

These possibilities aside, one thing I can do is have a system for when I get into trades and when I stay out. Maybe I use something like the STFS and never enter when the trend is going against me. Maybe I use a simple pivot system and only enter long (short) at a buy (sell) signal. Maybe I watch the price for a time period and enter a limit order that seems reasonable based on recent trading activity. While none of these ideas will guarantee I get better fills, they would all provide some objective framework to follow. If nothing else, at the end of a trading session I could say “I followed my plan.” Ultimately, that may be the most important thing anyway.

Related to Goal #3 is a thought I’ve had about day trading futures. This would give me extended face time with the market and help me to become more comfortable watching. Trading futures can also hedge my option portfolio if I am trading the trend while having theta positive option positions in place.

Trading futures may also help me find some “co-workers.” I’ve had one heck of a time finding serious option traders around. I might fare better finding futures day traders since “day trading” seems to be a stronger buzzword than “options.”

In addition to having a defined approach, all of the above would require me to spend more time looking at the market. This brings me back to Goals #1 and #2 described previously.

With regard to the worst sales pitch ever, here are some ideas I have for potential trade indicators:

- IV % increase (consider closing if IV has increased 30-50% when the position is losing money)

- Option price (regardless of M/S, I’ve found level of comfort and strength of discipline to be inversely proportional to option price. Delta may be a confounding variable as higher-priced options move faster in terms of gross amount)

- Distance OTM (some efficient frontier exists between moneyness and days to expiration. This may be hard to define but I know it exists)

- Number of contracts (I dare not call this “position size” since other things play into the latter like notional risk, PMR, etc. I may look to change my trading to a fixed number of contracts per month rather than a dynamic approach where I trade every day despite the DD improvements enjoyed by the latter from time diversification. PMR is proportional to number of contracts)

- ATM IV:10-delta IV (the idea here is to take note of vertical skew. A steeper skew may or may not be the time for me to be in the market: need further testing. Another approach could be to monitor delta X% OTM. This would change with DTE. I may have 12 data points per year, however, and it might [not] be useful to determine a percentile rank for where the current ordered pair fits into the whole distribution)

- Technical analysis. While I won’t believe in untested strategies, I may be able to specify criteria for entry, to stay out, to add new positions, or to sit on my hands. Things to watch could include trend direction (e.g. 8/34 crossover, price closing above/below 5/20/200-SMA, slope of 50-SMA), $TICK strong or weak (tags of +/- 1000), etc.

I will continue next time.

2018 Incident Report (Part 2)

Posted by Mark on May 22, 2020 at 06:28 | Last modified: May 13, 2020 07:31I left off reviewing my 2018 trading performance (originally written June 2019). This is part of my year-long quest to get more organized by converting incomplete drafts into finished blog posts.

—————————

Part 1 concluded with three goals for the coming year.

#1 addresses the observation that I really don’t like looking at the market. My style of trading has generally been “no news is good news” even though news has so little to do with any of it (see paragraph below excerpt here). When I get around to checking the market (and subsequently trading), I sometimes notice holding my breath before the visuals display on the screen with a subsequent sigh of relief when I realize things are under control.

Filled with trepidation is not exactly the way I want to approach my job on an everyday basis. I think the worst sales pitch ever has something to do with that concern. I would much rather look at the market with anticipation, calm assurance, collectedness and confidence, peace, security, contentment, and serenity: choose a synonym.

Goal #2 addresses the fact that I typically check the market once daily. I should look more often especially if I get into more frequent trading like Weeklys (I have seen both positive and negative reviews).

Goal #3 pertains to a feeling that I usually end up getting bad fills. A bad fill is when I pay $3.00 for something only to see it cost $2.60 a few seconds later. Reasons exist for this sort of thing to happen (e.g. displayed bid/ask shrinking when someone actually places an order, market makers wanting to transact toward their side of the natural to realize bigger margins, etc.). The only way I can ensure this does not happen is to place an order for an advantageous price and then wait for a fill.

Goal #3 is related to #2 because I can’t always accomplish this by popping in and out once to check the market. I may have to sit with the market, watch the chart, perhaps work the trade, etc.

I have a couple ideas as to how to achieve #3. One possibility is to create trading strategies that give me leeway to pick up my bat and ball and come back another day when conditions are more advantageous. Another possibility is to only enter trades that would be down money right now if placed on a previous day (or bar). If the backtest as a whole looks good, then I would think being more selective and getting more advantageous entries should be added benefit. The drawback would be a [small?] percentage of trades that would have posted zero MAE. Missing out on these trades may lower my overall average profit.

I will continue next time.

Categories: Accountability | Comments (0) | Permalink