Short Premium Research Dissection (Part 18)

Posted by Mark on April 23, 2019 at 06:42 | Last modified: December 16, 2018 07:29Continuing on with my research review, the author of this research report next gives us the following:

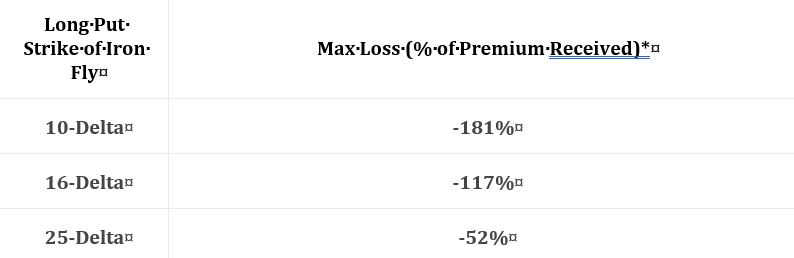

This represents the “median of all trades,” but she does not tell us the process. How many trades? When did these trades occur? Are they varied across volatility levels? She says they are “60 day” but does that mean exactly 60 or closest to 60? Are they taken every day, every week, every month, or otherwise? We need sample details and the complete methodology.

She writes:

> Either way, the delta of the long put helps us determine

> how to size trades. When buying 10-delta puts, a trader

> could implement a 100% stop-loss to use more leverage,

> or size the position to the maximum loss and use less

> leverage and give up profit potential.

I originally thought these were good comments, but reading them again I think they are hardly worthwhile. She is saying the trade-off is more leverage versus less leverage—more leverage versus profit potential. Either is quite obvious.

The critical, missing data would explain how well these approaches perform.

She goes on to say sizing per 100% stop-loss should be similar to sizing per max loss with the 16-delta puts (-117% median loss potential). I would still be interested to see the histogram described in the last paragraph of my previous post.

> When buying 25-delta puts, it may not make sense to use

> a stop-loss at all because the maximum loss potential

> has been so small.

I’d much rather see claims based on backtested data to see how the different setups performed than claims based on a proxy (maximum loss potential) of unknown relevance.

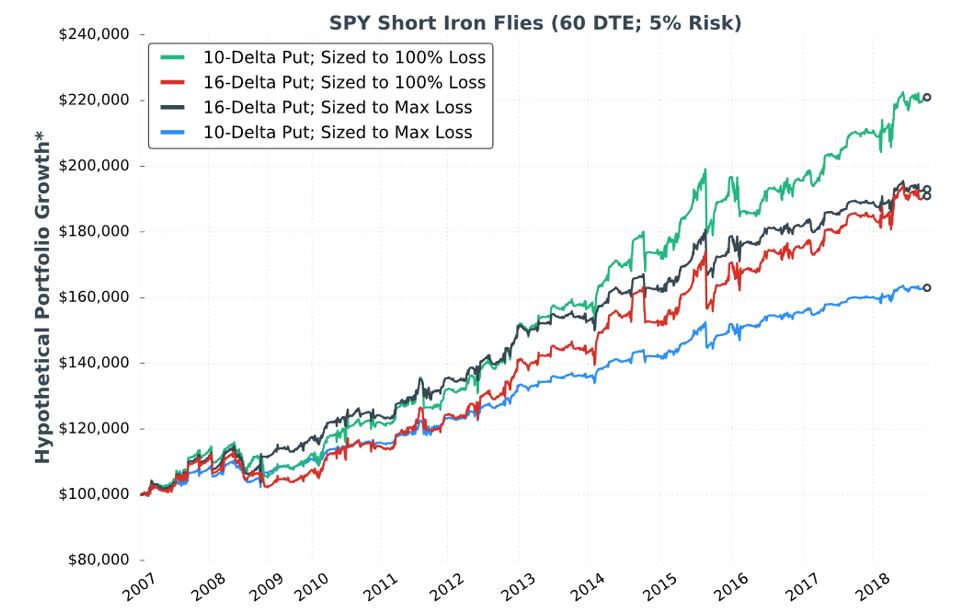

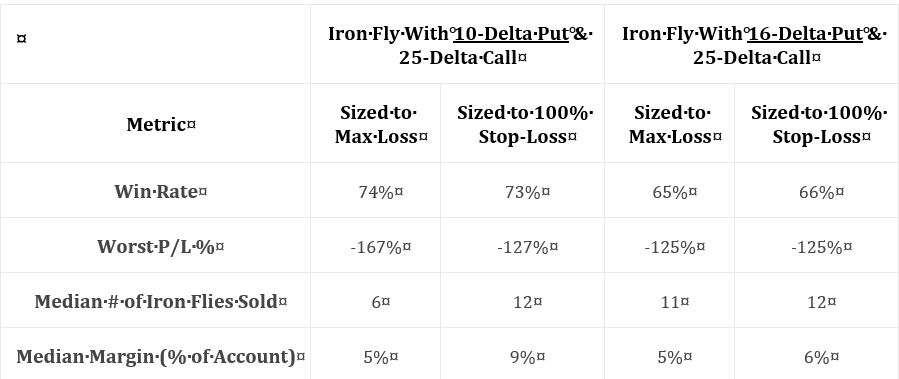

In the next section she gives us incomplete data on two different strategies and the two sizing approaches in the ninth “hypothetical portfolio growth” graph and accompanying table:

Kudos to our author for giving us “full study methodology” here. Trades are entered closest to 60 DTE only when VIX < 30. Trades are closed at 75% profit target, when down premium received (stop-loss condition), or at expiration (sizing approach #2): whichever comes first.

I would actually call this a fuller methodology because some important details are left out. She does not give us exact backtesting dates, number of trades, or a statistical analysis of differences. I will therefore watch very closely to see what conclusions are made.

As an entirely different strategy, I think all questions about trade parameters are reopened (see second paragraph of Part 13). She omits the entire analysis, however, and steals the best values from the unlimited-risk strategy for DTE, VIX, profit target, and stop-loss. She was guilty of curve-fitting before. Here, she leaves the door open to fluke in case these particular trade parameters perform well while adjacent ones do not. This is a problem.

Categories: System Development | Comments (0) | Permalink