Musings on Naked Puts in Retirement Accounts (Part 4)

Posted by Mark on July 27, 2017 at 07:05 | Last modified: October 14, 2017 07:21If a vertical spread lowers the standard deviation (SD) of returns and max drawdown (DD) compared to a naked put (NP) then its résumé is bolstered as an alternative candidate for retirement accounts. This was an unlikely result in the first example studied.

Rather than quintupling position size for the vertical spread, what if I double it? The potential return would be $4 (rather than $10), which is a 33% increase over the NP. The NP risk is now cut by 80% (rather than 50%) to $20K, which is the breakeven for both trades.

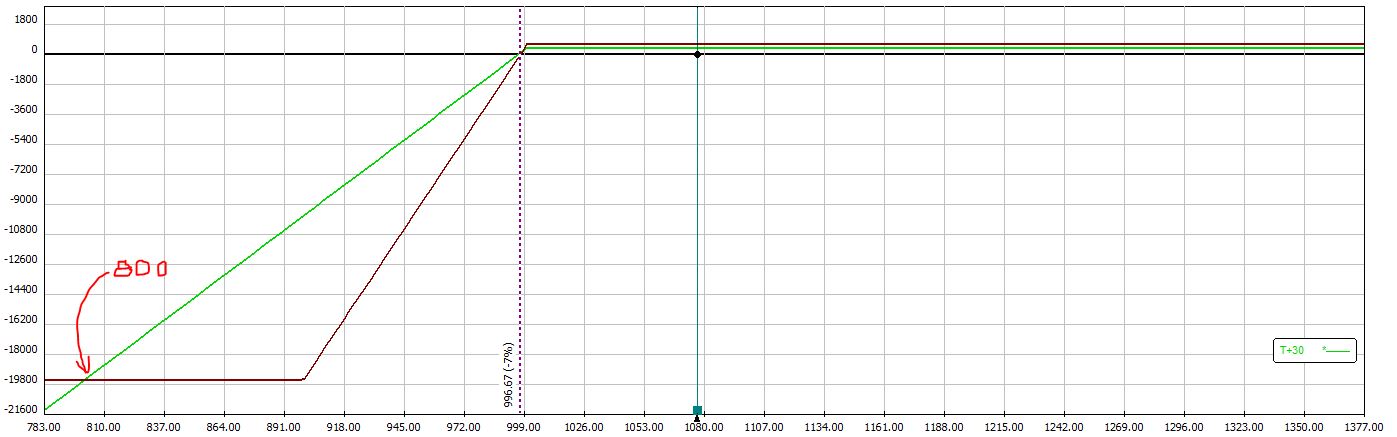

The risk graph now looks like this:

Like the previous example, the vertical spread outperforms if the market rises or if the market falls less than 7%. If the market falls between 7% and 20% then the naked put outperforms. If the market falls more than 20% then the vertical spread outperforms. A market correction over 20% is more likely than a market correction over 50% and this is where the risk metrics (SD of returns and max DD) would be improved by the vertical spread.

Of course, the vertical spread could be traded in equal position size to the NP. This would generate the first graph shown in Part 3. In that case, no gap of underperformance exists for the vertical spread and any market correction over 10% would generate better risk metrics for the vertical spread.

So going back to my statement in Part 1, does the vertical spread actually improve risk metrics?

The largest market crashes (e.g. fall 2008) will give rise to a lower SD of returns and a lower max DD for vertical spreads.

Unfortunately, these severe crashes occur so rarely that it’s hard to plan a trading strategy around them. The vertical spreads may or may not yield improved risk metrics depending on whether the market corrects, how often it corrects, and the exact magnitude of corrections during the time interval studied.

Compared to NP’s, vertical spreads may improve risk metrics. This is far from guaranteed.