Backtesting Frustration (Part 3)

Posted by Mark on July 3, 2017 at 06:14 | Last modified: March 1, 2017 10:36Today I will continue discussing backtesting frustration specific to the OptionVue (OV) software.

My third issue is difficulty obtaining accurate margin requirements (MR). The Status window is an excellent piece of functionality that shows, at a glance, desired statistics for all open trades. Only sometimes do I get an accurate MR here, though. Technical support has told me that margin in OV pertains to short options. Debit trades, like the butterfly, do not necessarily have an associated MR. That does not explain why it intermittently works for me, though.

Rather than carving out certain types of positions on which to calculate margin, my preference would be a renaming to something like “buying power reduction” (BPR). All trades reduce buying power and if BPR exceeds the value of my account then I get a margin call: plain and simple. Knowing the BPR will allow me to calculate ROI, which I sometimes like to do.

Another suggestion is a more continuous tracking of MR throughout the course of the trade. At any given time, OptionNET Explorer—another software package in the options analytics space—displays two MRs: current cost and the maximum margin ever recorded. This would be useful to know because while trades have varying levels of margin, holding the maximum margin ever required on the sidelines offers a better chance of maintaining every trade to completion. I believe ROI should be calculated on maximum margin for the same reason. ROI will be diluted since most trades will not reach maximum MR but in live trading, it would be reckless to position size without having full reserve capital available for a worst-case scenario that will happen given a long enough investing horizon.

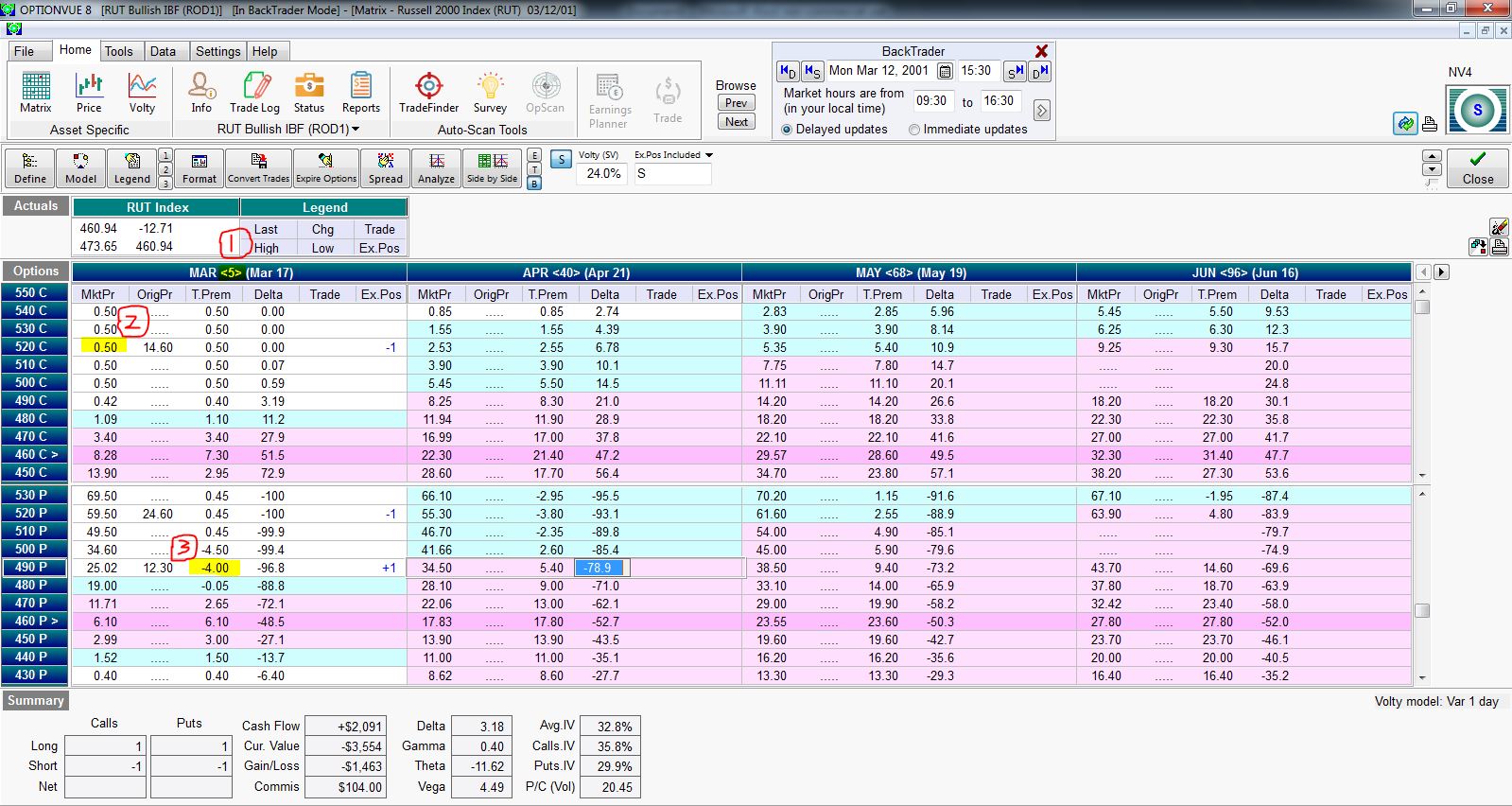

OV issue #4 is truly paralyzing for me at times: flawed and inconsistent price data. I have found the latter portion of the database to be pretty reliable. My concern is chiefly 2001 – 2004. Check out the following matrix screenshot:

I have highlighted three problems in this matrix:

(1) has to do with the DTE calculation (five days shown for this expiration Monday), which I discussed last time.

(2) refers to the fact that the 500 – 540 calls are all priced at $0.50. This is bogus. Pouring salt on the wound is the fact that the 490 call is priced even lower. If this were ever true then the 490 would be bought and any/all of the 500 – 540 calls would be sold for a guaranteed profit until the price discrepancy went away.

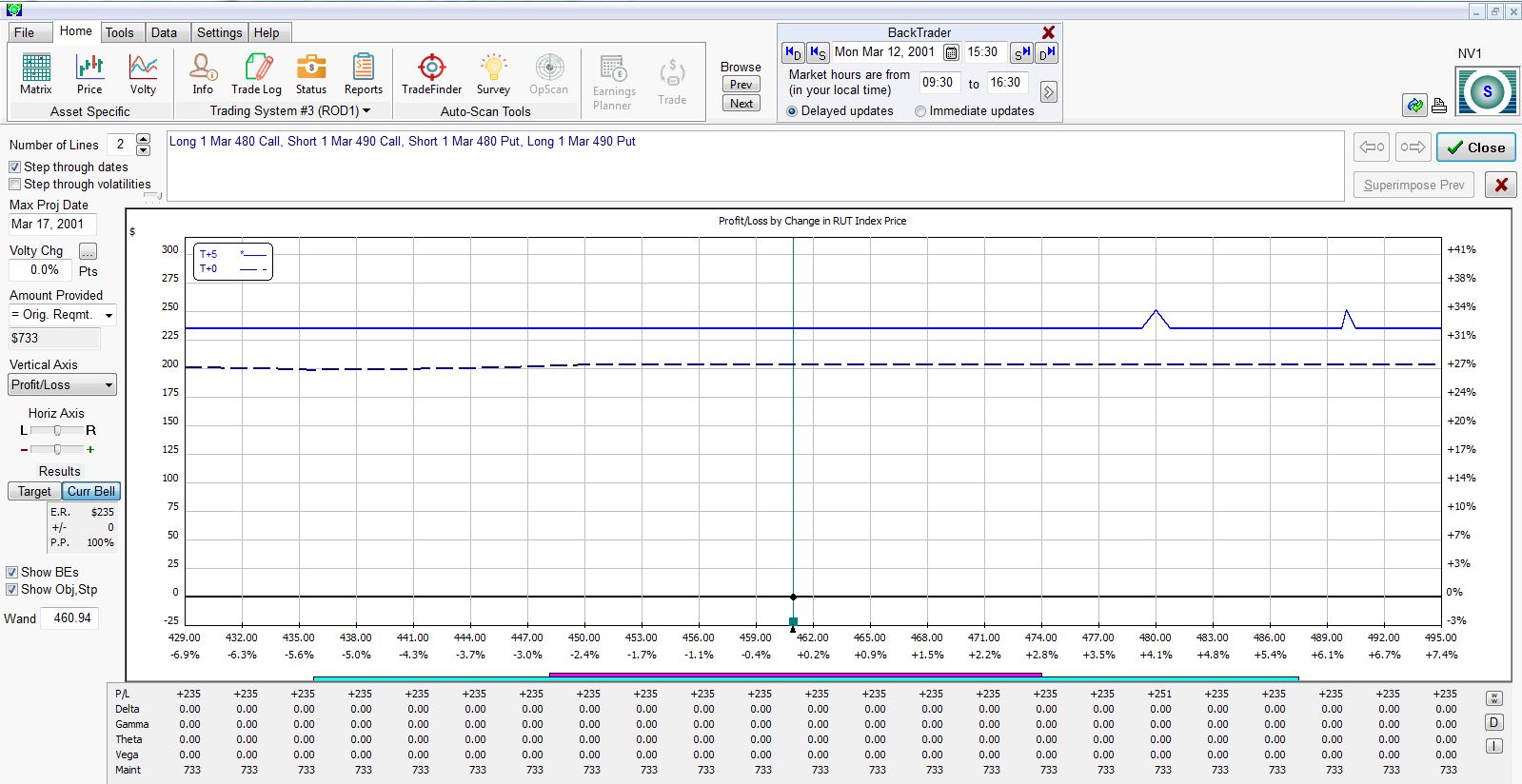

(3) shows the 490 put with -$4.00 of time premium. If that doesn’t make sense to you (it didn’t to me) then recognize the option is ~29 points in the money and priced ~$25. If this were ever true then I could trade a box spread (bull put and bear call vertical spreads at the same strikes) for a guaranteed profit:

As some guru used to say, if trading were that easy then it would be called winning.

I will continue next time.

Categories: Backtesting | Comments (0) | Permalink