Musings on Naked Puts in Retirement Accounts (Part 3)

Posted by Mark on July 24, 2017 at 06:27 | Last modified: April 5, 2017 13:53Today I resume discussion of vertical spreads instead of naked puts (NP) in retirement accounts. I mentioned previously that [OTM] vertical spreads don’t usually affect standard deviation (SD) of returns or maximum drawdown (DD). In case of a significant market downturn, however, they certainly can.

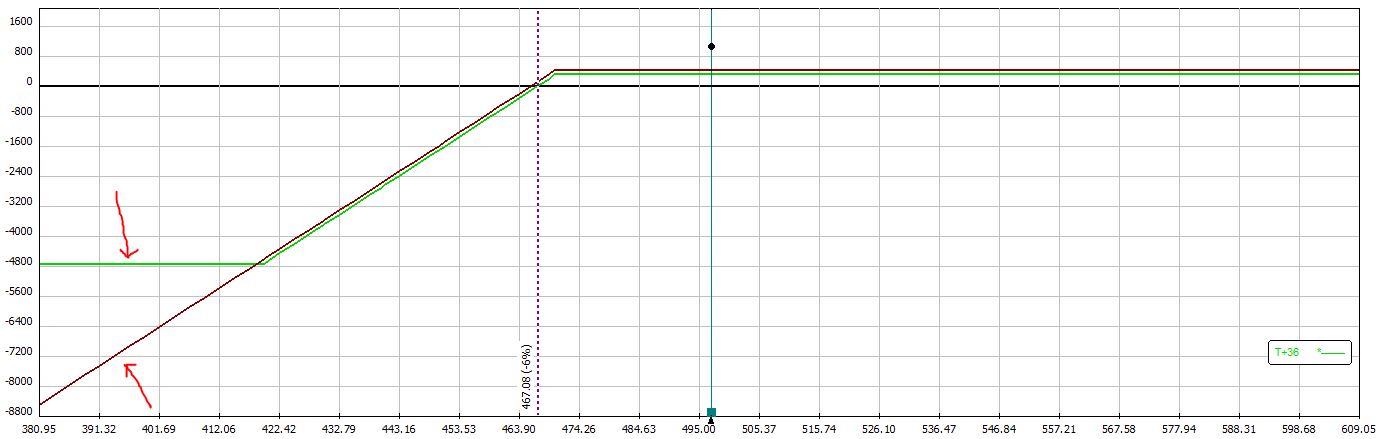

Let’s begin with the risk graph comparison posted earlier:

Notice how the green line (vertical spread at expiration) goes horizontal once the market drops ~16% to 419. That is where max loss is hit. The farther the market drops beyond that point, the more the NP (purple line) loses relative to the vertical spread. This represents a lower SD of returns and a lower max DD for the outperforming vertical spread.

This analysis assumes equal position size and offers an important distinction between ROI and gross PnL. In percentage terms, the vertical spread loses more than the NP if market falls the 16%: 100% for the vertical spread versus [under] 16% [buffered by initial premium collected] for the NP. In terms of gross dollars, the NP and vertical spread lose similar amounts until the vertical spread has lost 100% at which point the NP continues to lose more. 16% is the loss threshold beyond which the vertical spread delivers a lower SD of returns and a lower max DD than the NP.

Now let’s reconsider the naked 1000 put example I presented here. If I sell a 1000 put for $3.00 then [gross] risk is $100,000. If I buy the 900 put for $1.00 then I cut risk by 90%. I could, therefore, trade five times as many verticals while still halving the NP risk. Potential ROI on the vertical spread would be 6.7-fold greater.

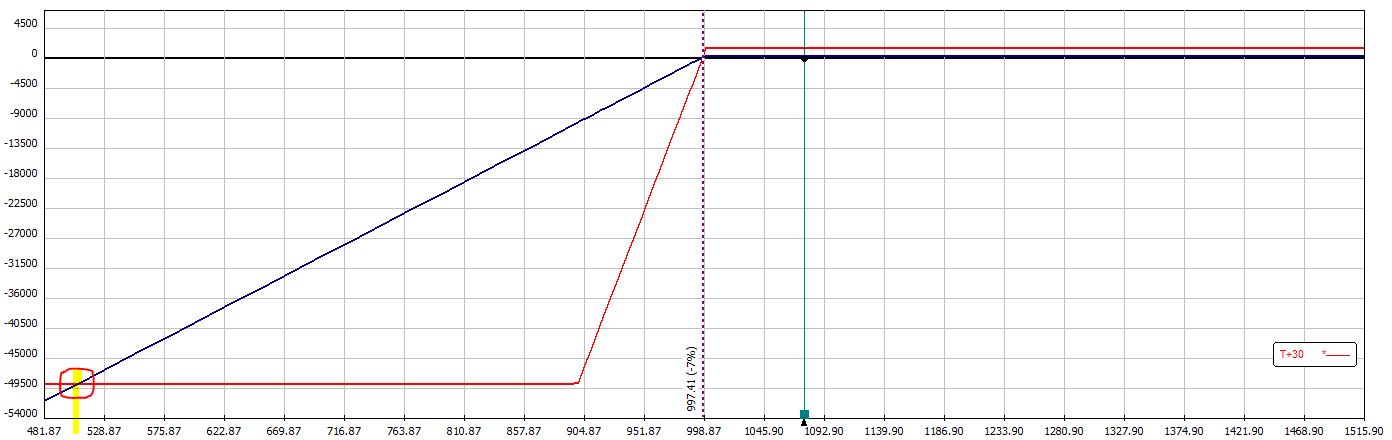

Here are the risk graphs of the vertical spread (red line) and NP (blue line):

The problem with the vertical spread is the possibility of losing the entire $50K should the market fall from 1000 to 900 (10%). For the NP to lose $50K the market would have to fall to 500 (50%), which is circled in red. In this case, the vertical spread outperforms if the market rises or if the market falls less than 7%. If the market falls between 7% and 50% then the NP outperforms. If the market falls more than 50% then the vertical spread outperforms.

Because a fall over 50% is so unlikely, this particular vertical spread position would probably post a larger SD of returns and a larger max DD than the NP were the market to enter a meaningful correction.

In the next post I will compare a different vertical spread position to see how it measures up.

Categories: Financial Literacy | Comments (1) | Permalink