2021 Performance Review (Part 11)

Posted by Mark on April 29, 2022 at 06:46 | Last modified: February 16, 2022 13:36To conclude this mini-series, I offer the annual time frame along with some additional miscellany still germane to my pursuit.

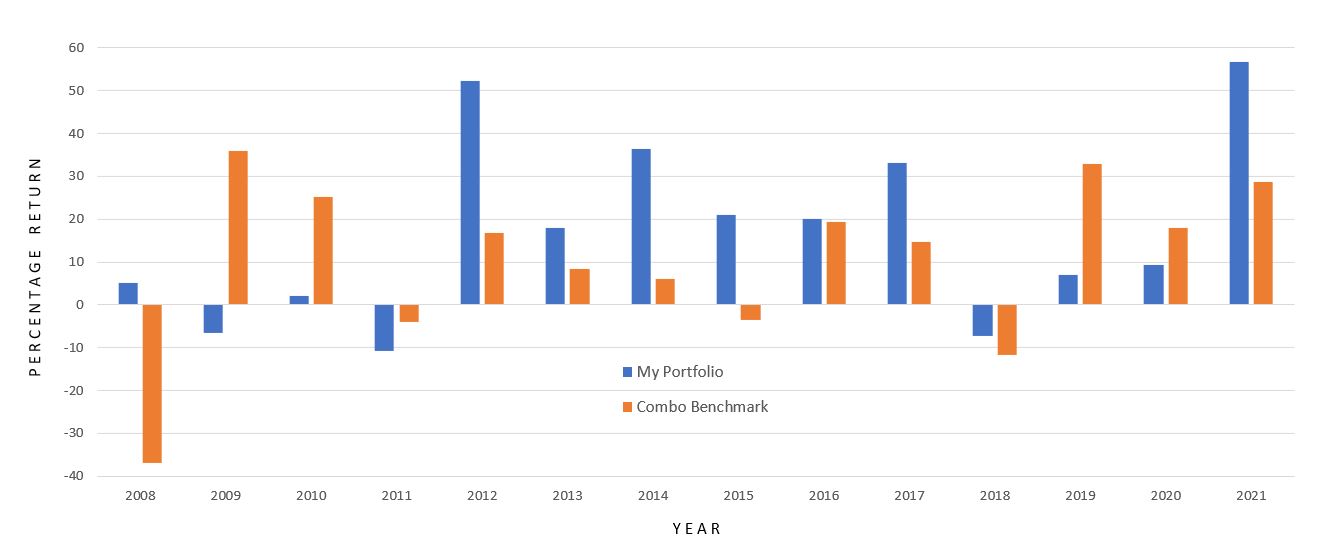

Here is my performance by year versus the combo benchmark:

As mentioned in the second-to-last paragraph of Part 10, calendar years conceal my maximum drawdown. That is not the intent and the data must be sliced differently to show everything, which I have done.

My trading has taken several different forms over the years.

I assumed management of my personal brokerage account in 2001 and implemented stock-screening strategies I researched and developed. I had a decent first month but was hit by the 2001 correction thereafter. My stock investments were mostly short-term although I had a couple that went on to become spectacular long-term winners. Those played a large part in allowing me to leave my full-time job at the end of 2007.

In 2008, I began to trade options full-time. Making money in 2008 is one of my finest accomplishments. I changed strategy a few times over the first five years and suffered a couple catastrophic losses from which I was able to rebound, but the pain was certainly real (see this blog mini-series). The Big Question going forward was how I would navigate the periodic pain?

This review has updated my performance to include the last five years of trading. During that time, I phased out one brokerage account and started with another. For a couple years I was trading different strategies in the two accounts. 2018 included two 10% corrections in the same year and explosive volatility. I did some soul-searching because of the unlimited-risk nature of my approach, and I spent most of 2019 in cash backtesting and refining to address liquidity concerns along with absolute risk. Soon after jumping back into the market, I got an exit signal in Feb 2020. The hit I took was mitigated (see last sentence of this second paragraph) as the market proceeded to sell off an additional 27%.

The bar graph above reveals how much I missed in 2019 being mostly out of the market. 2019 could have conceivably been another 2021, which ended up as my best year ever. Sometimes it hurts to be on the sidelines.

Despite the pain, this blog mini-series provides an answer to the Big Question: quite well with benchmark outperformance in excess of 6% p.a. since 2008. I hope to continue outperforming going forward, but there are no guarantees. Making this happen will take some luck, some discipline, and lots of effort.

Thus concludes my 2021 performance review showing my live-trading experience with all its bumps, bruises, and scars: 100% out-of-sample data, to be sure. None of the backtesting I have done over the years has been included here.