Practice Trades Cal 1.2

Posted by Mark on February 10, 2022 at 07:30 | Last modified: December 21, 2021 09:33Building off this practice trade, let’s be random and backtest one year earlier.

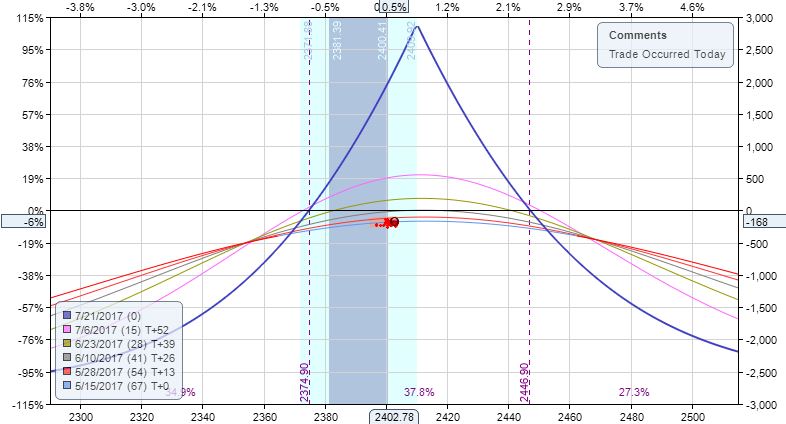

Cal 1.2 begins 5/15/17 (67 DTE) with SPX 2403 and 2410 puts -$168 (-6.4%). MR is $2,618 (two contracts), TD 2, IV 7.03, horizontal skew -1.01%, NPD 2.1, and NPV 157.2.

I’m not sure why TD is so low:

With the calendar less than 10 points above the money, positioning seems fine and I would expect TD to be higher. I’ll keep an eye on this as I look at more example trades.

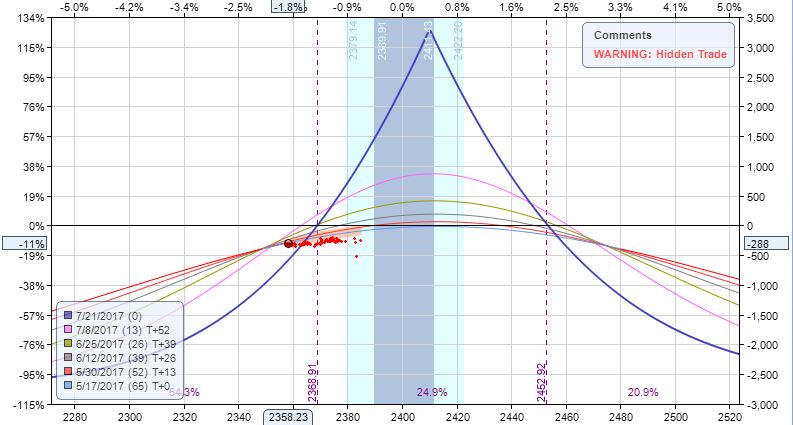

At 65 DTE, the market is down 3.94 SD to 2358 and trade -$288 (-11%) with TD near zero. Adjustment increases MR to $2,811 and puts trade down 13.2%. TD ~ 1.25 is not very encouraging. Horizontal skew is unchanged.

By 58 DTE, market has completely recovered to 2405 with trade -$442 (-15.7%) and TD = 1 again. Adjustment increases MR to $3,144 and puts trade down $526 (-16.7%). TD 8 is nice, but we’re getting close to ML. Also 4/5 T+x lines are underwater, which means the market will have to trade sideways for a while in order to see profits.

Under current guidelines, I should realize the loss right here.

If not, then I would exit trade by 50 DTE for a loss of $631 (-20.1%).

One thing I find encouraging about this strategy is the limited loss resulting from outsized moves lower. The long vega should hedge provided horizontal skew is unchanged (as it is here). At 65 DTE with the huge move lower, this trade is only -11% after being -5.3% the previous day:

A 4 SD downmove makes this anything but usual. I could exit for a loss immediately. Alternatively, I could just wait (SOH) and see if the market settles over the next couple of days.

SOH would outperform in this particular case. After the market recovers, an upside adjustment is needed at 49 DTE with trade down $422 (14.8%) and MR increasing to $2,846.

Trade -$542 (-19%) on 32 DTE with TD 2. From here, despite some bigger moves up and down, the trade does recover to +$5 at 8 DTE. I don’t have a time stop but I probably should—no later than 9 DTE to be safe? Alternatively, given what I’ve been through on this trade maybe I lower PT to zero and be happy with that.

The very next day, trade -$54 as TD = 1. This would be an adjustment point, but if guidelines dictate exit by 7 DTE anyway, I should close here and book the small loss (-1.9%).

Lots of discretionary ideas here fall under the “art of trading” umbrella. I certainly want to see how the existing guidelines perform over a large sample size of examples before implementing any of them.