Recycling of Market Participants (Part 2)

Posted by Mark on December 28, 2017 at 07:23 | Last modified: September 27, 2017 09:10Today I continue with a July 2015 thread about relative quiet in the forum.

On Jul 14, 2015, at 12:51 am (PDT) . Posted by CM:

I went back to the States for a couple of months for our annual fishing trip and to help my brother-in-law put up hay for his horses for the winter… When I return to a normal life in a few weeks I will be able to start posting again. My portfolio is currently flat, because of depressed stock prices, but the option trades are positive. Yes, trading plan is working…

I felt inspired to refresh the thread over two years later.

On Sep 26, 2017, at 4:08 am (PDT) . Posted by Mark:

I’m here with one follow-up post because I think many of you are missing the point. Please feel free to disagree; my words are hardly set in stone.

Over the years, I have found traders to be a very fickle lot. The oft-quoted statistic that 90% fail within five [1-2?] years supports this. I don’t know who [if?] did the original study but it is consistent with what I’ve seen of human nature from attending trading groups. Ego fulfillment means bragging when correct and/or making money. And Mr. Market lets us do that—sometimes with gradual profits over a long period of time. At some point he gets crabby and catastrophic losses await for many who have become smug and started to trade position sizes that are too large.

These washouts are when the fickle traders disappear. First they feel stress and lose sleep. Then they are forced out at big losses feeling lucky [hopefully] to have escaped with something. After a period of reflection, they finally walk away—head down and tail between their legs—possibly never to talk about or discuss this with anybody. After the grieving is complete they pull themselves up by the bootstraps and move onto the next big thing.

On multiple occasions I have seen people present impressive performance records punctuated by pauses during sudden market pullbacks/corrections. How lucky they were to have been vacationing at the worst times! I wouldn’t call any particular individual a blatant liar but they certainly are out there.

I think a good strategy meets profit goals within risk tolerance levels net losses—and there will always be losses! Anyone presenting a large sample size of trades without losses is a liar and someone to avoid because that is not reality.

The takeaway here is nothing new: THERE WILL ALWAYS BE LOSSES! As a trader I need to accept this before I begin the journey and strive to always size my positions accordingly. Failure to do this can potentially end my trading career, which on a larger scale, results in the recycling of market participants.

Recycling of Market Participants (Part 1)

Posted by Mark on December 26, 2017 at 06:59 | Last modified: September 26, 2017 07:35On the heels of this post, I recently stumbled upon the following July 2015 thread from a covered calls forum that I saved.

Sun Jul 12, 2015 12:22 pm (PDT) . Posted by AS:

Where is everyone???

Sun Jul 12, 2015 12:55 pm (PDT) . Posted by SP:

Probably vacationing.

Sun Jul 12, 2015 3:21 pm (PDT) . Posted by SB:

People like talking when they make money, remain silent when they lose it. How have covered calls in general done over the last few weeks?

Sun Jul 12, 2015 9:48 pm (PDT) . Posted by JW:

I am thinking SP has if correct, a lot of folks are away for the summer break. This is traditionally a very slow time of year. One member states on the bottom of his posts that “boring is better.” That is certainly the case with myself. There are periods when I feel like I am on a perpetual vacation here… My “job” truly is like watching paint dry. Most of this group will not want to read about each time I pull the trigger on my boring income trades.

Mon Jul 13, 2015 5:03 am (PDT) . Posted by Mark:

On this point I very much disagree with you. Yes, “boring is better” but people are usually losing money when these type of trades are not boring.

I think SB is right on: “people like talking when they make money, remain silent when they lose it.”

This is just my opinion because it’s not something we can ever know for certain.

On Jul 13, 2015, at 3:10 pm (PDT) . Posted by MM:

Or some people aren’t participating.

I’ve been in cash for some months with only a few selective trades which aren’t in options. It’s been a time to be very, very selective in my opinion.

On Jul 13, 2015, at 4:37 pm (PDT) . Posted by MA:

I, for one, have been very busy at work and haven’t had the time it takes to do this right, so I’ve been on the sidelines for the past few months, which appears to be a good place to be with all the turmoil going on with Greece and the market’s reaction.

On Jul 13, 2015, at 4:44 pm (PDT) . Posted by JW:

Many new traders think they are not trading when they are in cash. I think those who have been in the battle for a while know well that cash is a position you chose and there are times that it is the best position.

One thing I have grown very cautious about is posting our bragging rights trades. For example, we did a series of trades on JRJC… [and] nailed returns as high as 13% per monthly cycle selling put options…

I dislike posting these positions for two reasons. I have had a few folks call me a liar when they could not replicate the trade a few days later because the stock took off and they did not have the patience to wait for the right entry opportunity. The other reason is I do not like encouraging newbies to work with volatile issues like JRJC until they have experience and a good plan of how to handle the trade if the tide turns against them.

To be continued next time.

Back to the Future

Posted by Mark on December 22, 2017 at 06:02 | Last modified: September 25, 2017 18:42Over the last few years, the ambitious side of me as been asking “what next?”

I have done a solid job managing my decent-sized portfolio since leaving pharmacy in 2007. I have learned enough to become an option trading “expert.” I have developed a trading business that I continue to operate daily. I have posted annual returns approaching 15%. I have begun to take on “friends and family” accounts.

My next step could involve finding other full-time retail traders with whom to collaborate and develop new strategies. In doing so, I would grow as a trader and develop additional streams of income. Unfortunately, collaboration is hard to find as I have found few other “equals” interested in my work.

Another possibility could involve taking definitive steps to enter the wealth management business. I hesitate to launch an investment advisory because I don’t see a clear path to the assets deemed necessary to make this pursuit worthwhile. My ideal situation would be a [handful of] qualified investors[s] each willing to invest seven figures with me. A small number of clients would allow me sufficient time to trade daily in separately managed accounts. Tens to hundreds of [smaller net-worth] clients would require me to take custody in order to trade all assets at once in a hedge fund. This would require a higher level of trust for someone with no industry experience.

Finding high net-worth clients is probably a necessary hurdle to clear because hedge funds with non-accredited investors face additional challenges (blog topic for another day).

Getting institutional money would be perfect but I suspect this would require an officially audited track record that I do not have. My accountant can testify to my performance but he doesn’t get paid to audit.

To this end, I have considered starting an incubator fund but this would leave me with nothing to offer at the time of presentation. The incubator could be officially audited but no outside investors are permitted.

On the way to a career in wealth management, I suspect the journey must involve putting my performance on display for others. In general and clear terms, I need to something to pitch what I do and how well I do it. I then just need someone to give me a chance—maybe someone willing to start off with a relatively small sum of money that we can [hopefully] watch grow together!

Categories: About Me | Comments (1) | PermalinkMoney for Nothing?

Posted by Mark on December 19, 2017 at 06:41 | Last modified: September 20, 2017 15:21Dire Straits! While I love the song, no longer do I think it characterizes premium trading groups that charge for attendance.

In June 2015, I was irked to see a new trading group for $15/meeting. I e-mailed the organizer to verify: “as in $780/year?”

“It costs $100 for a day of golf,” he replied. “This is a good value.”

Although I enjoy watching on TV, I have never been a golfer.

Charging for a group like this was something I truly despised about the financial industry. I viewed the category of self-directed traders as bifurcated between the traders themselves and the set of companies looking to profit off them. The latter sells mentoring, trader education, market software, coaching, etc.

I could accept raising funds to cover group expenses but I could not accept raising funds simply to pad pockets. I considered myself to be in the business of trading—not a business of the just mentioned that would involve marketing, sales, or advertising. As a group of equals, I figured what a trading group had to offer me was what it had to offer every member: new ideas to bolster trading income. Why should the organizer alone, then, profit from its formation and attendance?

One reason I have since had a change of heart is because this is not a group of equals. I have unsuccessfully searched for others with a full-time trading business (see here, here, and here). I have found many who say they want to learn. I have found some who describe themselves as [inconsistent and] “part-time.” I have found more stock traders who know nothing about options. If the group I form will not be a group of equals and they have more to gain from an informational exchange than I do, a per-session charge is justified as an investment for their future.

My second objection to free trading groups involves accountability. I blogged about this here but the seeds for this belief were planted much earlier. On July 19, 2015, I wrote:

> I’ve said this recently but I strongly believe it takes a

> lot of time and effort to make substantial money trading.

> It takes constant, continuous commitment. I almost believe

> one must approach trading as a business whether it actually

> is or not. I think the time dedicated to learning and

> practicing will ebb and flow and without a maximal

> level of devotion, when that time ebbs much of what

> was gained during the flow will be lost.

We hope that with experience comes wisdom. I have changed my tune with regard to investment advisers. I have changed my [Dire Straits’] tune with regard to premium trading groups as well.

Categories: Networking | Comments (0) | PermalinkStandard Deviation of Returns (Part 2)

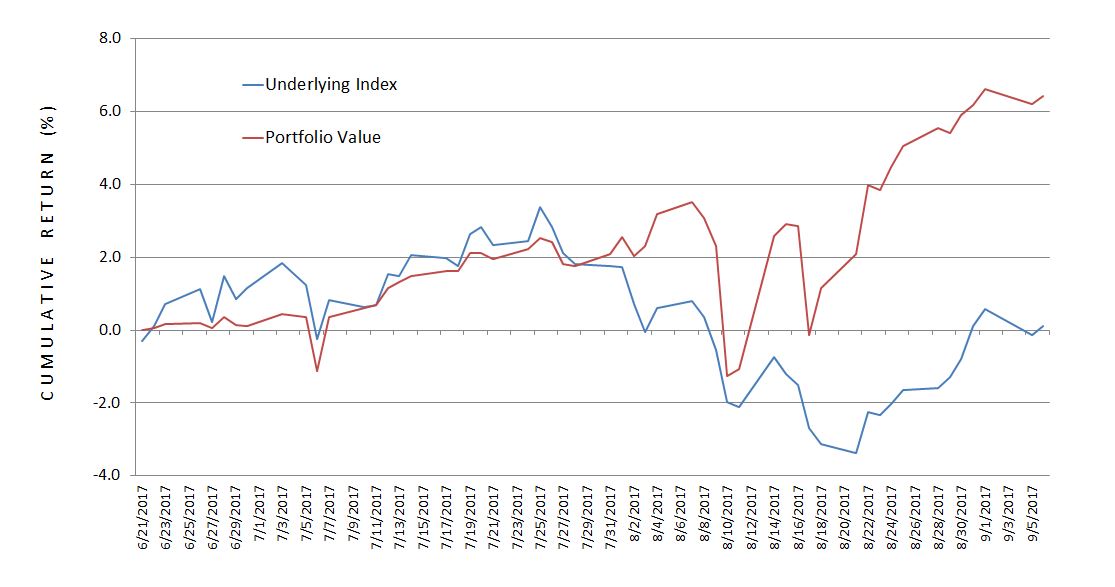

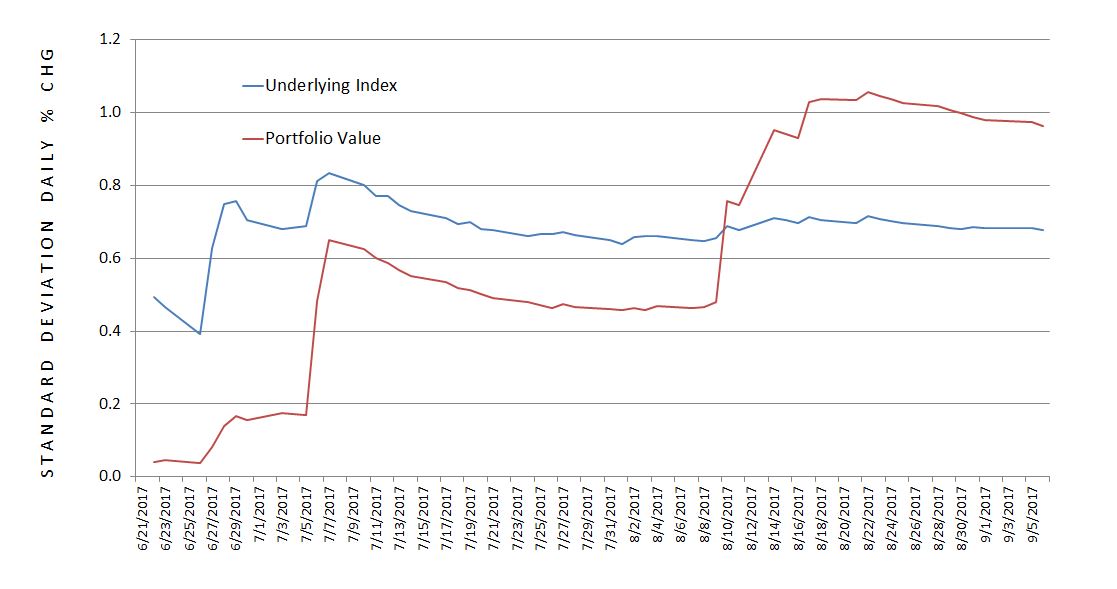

Posted by Mark on December 14, 2017 at 06:38 | Last modified: October 12, 2017 12:37I left off by illustrating how standard deviation (SD) of returns is greater for my new friends-and-family account than for the underlying index.

I think of naked puts (NP) as having a significantly lower SD of returns so this was puzzling. Is it a bona fide finding?

Applying the rolling-returns rationale, we can observe SD to be lower for NPs (red line) most of the time. When the market pulled back, SD moved higher for the NPs and has remained higher to date.

Max drawdown (MDD), also discussed in the previous post, would produce a similar result. MDD was roughly 4.8% and 6.6% for the NPs and underlying index, respectively. Despite the small sample size, this is a significant difference in favor of NPs.

I calculated risk-adjusted return (RAR) by dividing total return by SD of returns. This improved NP return from 6.41% to 6.66% and benchmark return from 0.12% to 0.17%. On a percentage basis this represents a much greater improvement for the benchmark but the magnitude of numbers is so disparate that the NP return is still far greater.

Weighing all the evidence, even if the finding is real it certainly may not be relevant.

But then I stumbled upon a solution.

The finding is real and a function of the leverage ratio. Leverage ratio is notional risk of the account divided by net liquidation value. It makes sense to say the more NP positions I hold, the wider account value swings I will see. The underlying index has no position size so its SD will remain constant. Studying SD of the daily account value changes is probably not very meaningful for this reason.

If I wanted to compare SD between NPs and the underlying index then looking at a large sample size of matched trades would probably be best. As one example, suppose I shorted a 700 put. The notional risk is 700 * $100/contract = $70,000. I would therefore use $70,000 as the initial account value and calculate the SD of daily % changes in account value until position close. For the underlying index, I would start out by purchasing a number of shares equal to $70,000 / index price. Daily index account value then equals number of shares multiplied by the index value on each day. From that I could calculate SD of the daily % changes. These two SDs could be compared.

So there you have it: leverage ratio is the culprit making my SD of returns larger than the benchmark! As long as the total returns are significantly better, though, I don’t expect much client pushback.

Categories: Money Management | Comments (0) | PermalinkStandard Deviation of Returns (Part 1)

Posted by Mark on December 11, 2017 at 07:12 | Last modified: September 10, 2017 15:03I have recently begun to trade a small friends-and-family account. In running the early numbers, I was surprised to see standard deviation (SD) of returns tracking higher for the portfolio than for the benchmark.

Based on my trading/research experience, naked puts (NP) generate comparable returns to the benchmark with a significantly lower SD of returns.

The best analysis I have between long shares and NPs may be the second graph shown here. In that analysis I did not calculate the total but using my naked eye and this online calculator, the NP portfolio returns 8.69% per year vs. 11.17% per year for the benchmark. That is not “comparable” returns—it’s a smackdown by the benchmark.

The graph does show this return comparison to be date sensitive. Just three months earlier (1.65% of the entire backtesting horizon), the NPs had a higher ROI than long shares. Across the whole graph, the NP line (red) beats long shares (blue) ~2/3 of the time. Statistically speaking, I worry about this inconsistency. Perhaps a rolling analysis should be done to get a larger sample size than just a single-point comparison, which may not be representative.

In the previous study I used maximum drawdown (MDD)—not SD of returns—as a measure of risk. When I looked at risk-adjusted return (RAR), the NP portfolio significantly outperformed despite the smackdown mentioned above.

Now let’s move forward and study the NP portfolio I have been trading for 1/6 year. I track the cumulative return for the portfolio and for the underlying index:

This is consistent with what I have come to expect from NPs. The equity curves are similarly shaped. The underlying index or NPs can outperform when the market is higher or lower, respectively.

I calculate daily % returns so I can monitor the SD of both:

The NP portfolio shows a larger SD of returns than the benchmark! How can that be?

Categories: Money Management | Comments (1) | PermalinkOne Brief Paragraph

Posted by Mark on December 8, 2017 at 07:23 | Last modified: September 7, 2017 11:51On September 6, 2017, I met with a professor (now Dean) from my pharmacy school days for a career discussion. Today’s post is the fulfillment of two assignments.

First, he asked me to write one brief paragraph detailing what I seek from the business school and why.

I wish to speak with someone at Michigan Ross about the possibility of developing an affiliation with the school. Having worked as a trader in securities managing my personal account since 2008, such a relationship could enable me to:

- Give presentations about what I have learned during my non-traditional, hands-on journey

- Mentor students with an interest in the markets by working on specific data research and backtesting projects

- Facilitate networking with experienced trading professionals and/or fund managers nationwide

- Explore the possibility of transitioning my personal trading business into a wealth management firm for others

- Fulfill a New Years’ resolution to become more involved [with others]

Second, he asked me to write one brief paragraph detailing what I seek from the college of pharmacy and why.

I wish to give an investing presentation to Pharm.D. students and faculty. This could help to achieve several goals:

- Improve investment literacy: a subset of financial literacy especially relevant to professionals in higher-paying jobs

- Honor my pharmacy education, which included valuable critical-thinking lessons I consider to be largely responsible for my 10-year trading success

- “Give back” as an expression of gratitude for the business opportunity I feel lucky to have discovered during my sinuous academic and professional journey

- Gain valuable public-speaking experience

- Network with others who might have a desire to delve deeper into investment/financial education

Two detailed paragraphs in a shorter-than-average blog post… I hope this counts as being brief!

Meeting with XC (Part 3)

Posted by Mark on December 4, 2017 at 07:02 | Last modified: September 19, 2017 11:04Today I conclude with summarized notes from my meeting with financial adviser XC on August 22, 2017.

If I want to find people with a disproportionate equity concentration then XC suggested looking at Domino’s Pizza, headquartered locally, which has gone from $8 to $160 in recent years. Ford is another possibility (think of all the commuters going to Dearborn every day) along with DTE Energy and Consumers Energy.

XC is a believer in credentials: the more the better. Series 65 is the minimum requirement to manage money in Michigan but it’s given by FINRA, which is focused more on brokerages. He suggested looking into options/derivatives licenses as well.*

Hypothetically speaking, if he advised for one of my trading clients then I would be my own solo practitioner. He would not officially recommend me—doing so would put his company’s reputation at risk—but he would be interested in my performance. He would also be mindful of my fees. If I were generating a lot of short-term capital gains for a client with an annual capital gains budget then it might affect how he would manage their trading portion. The more fees I charge, the less the overall AUM, which would lower his compensation. This could be a potential conflict of interest.

If I were to pitch my trading strategy then XC said they would have to play devil’s advocate by addressing risk and liability exposure. I was not sure whether or not this was intended to be a hint.

XC recommends Schwab Advisor Services at >$5M AUM because of the useful tools they offer. At $25M AUM they pair you with a corporate relationship expert.

XC seemed like a sincerely nice person with a solid knowledge base. He was also generous with 100 minutes of his weekday time. If I start an IA then he said he would be interested to hear how I progress. If I need anything further then he invited me to call. He expressed interest in reading my blog and suggested again that I check out their website and available tools.

I took a few useful suggestions away from our meeting. I will make a LinkedIn profile. I will think more about putting together a presentation of my story and/or what I do. I will also look into whether any [insurance] companies might be looking for IAs to manage their cash position.

*–Series 3 is the National Commodities Future Examination and Series 4 is the Registered Options Principal Examination. I question the relevance of the former to trading options and I’m doubtful about the latter, which deals with supervising option traders and trading activity.

Categories: Networking | Comments (0) | PermalinkMeeting with XC (Part 2)

Posted by Mark on December 1, 2017 at 07:41 | Last modified: September 19, 2017 09:49I continue today with summarized notes from my meeting with financial adviser XC on August 22, 2017.

XC managed assets for an insurance company that grew to over $200M AUM through some fortuitous M/A activity. His first personal clients were co-workers who liked what he did with corporate funds and asked him to manage their money. This was $25M in a single-shot that he credits more to luck than he does to investing skill.

XC introduced me to E/O (errors and omissions) insurance. One example of an E/O situation is where the IA goes to buy 25,000 stock shares of stock for a client and accidentally enters the wrong ticker symbol. The IA would be liable for any losses and E/O insurance would protect the firm. I did not get the chance to ask about cost.

He talked a lot about some of the free tools located on his company’s website, which allow clients to make future growth projections and to see how their overall financial situation is progressing. He suggested I check out these tools and encouraged entry of some personal information to see what it says about me.

After discussing these tools for a few minutes I pointed out that trading, not financial planning, is what I want to do. Even so, he argued, I should not aim to be a trader who has no personal relationship with clients. Talking about their total financial plan and where I fit in is a way to avoid such anonymity that could otherwise leave clients’ future satisfaction solely dependent on my trading performance [“everyone knows” no strategy works well in all markets]. XC said client turnover is very costly in this industry because expenses to the firm are front-loaded.

Getting back to the website, XC said they post a blog every 2-3 weeks of 1,000 words or less. They rarely post market commentary because he doesn’t want content to be time-limited. He said the blog is a really good way to get an idea of how/what someone thinks. The posting date (although it may be changed or the post deleted) adds context about current events surrounding a stated viewpoint.

He attributes a lot of his success to networking. Some of his jobs arose because of people he knew as far back as college.

XC talked about a gynecologist he knew who later went into finance. He was interested in trading but didn’t want to be the one doing the trading. Instead he did extensive research on a broad spectrum of wealth managers and became an encyclopedia of available offerings in the industry. Combining this with his knowledge of physicians’ backgrounds and needs, he was able to talk to clients and make (give) relevant recommendations (advice).

I will conclude next time.

Categories: Networking | Comments (1) | Permalink