Put Credit Spread Study 1 (Part 3)

Posted by Mark on September 29, 2017 at 06:34 | Last modified: August 1, 2017 09:05Last time I presented initial results for the put credit spread (PCS) backtest. Rarely does a trade actually average TF of $0.26/contract, though, so today I will look at smaller values.

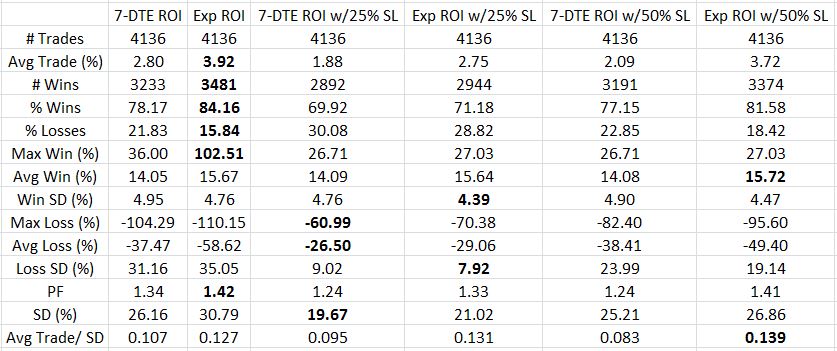

Calculated on net MR, here are the results for TF of $0.16/contract:

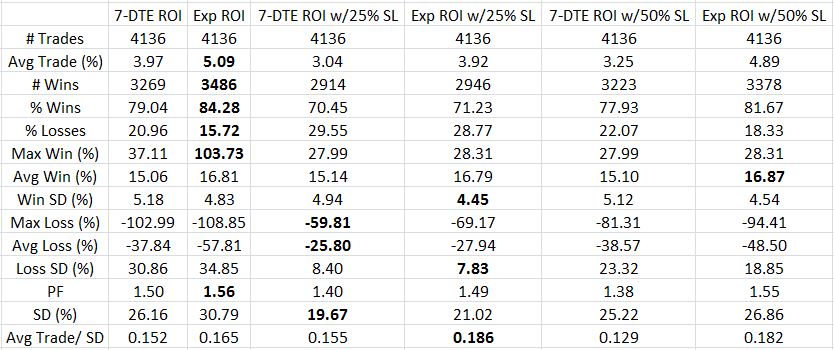

Following are the results for $0.06/contract TF based on net MR:

I generally find these numbers more encouraging than the bullish iron butterfly because the latter is not profitable with TF greater than $0.06/contract. The PCS is marginally profitable even with TF $0.26/contract. Reducing TF to $0.06 increases the average PCS trade to 3-5% profit, which is 24-40% annualized.

Unlike a butterfly, the PCS has risk in one direction only. This dramatically increases the probability of profit.

Like a butterfly, magnitude of losses are a problem with the average PCS loss being 2-4x the average win. I thought the 7-DTE exit would cut out the worst losses but it reduces profit as well. The best performing trade seems to be holding to expiration with a 50% SL although I would also seriously consider the 25% SL for risk-adjusted reasons.

Categories: Backtesting | Comments (0) | Permalink