Covered Calls and Cash Secured Puts (Part 22)

Posted by Mark on January 21, 2014 at 06:06 | Last modified: January 29, 2014 07:42I have already discussed the CC/CSP management techniques of rolling out and rolling down. On the heels of a detour to cover certain aspects of Rich MacDuff’s SysCW investment philosophy, today I will introduce the management technique of “rolling out and up.”

Rolling out and up (RO & Up) is a CC strategy very similar to rolling out. The goal is to delay assignment and to generate more income. This can augment an already-profitable position or avoid realization of a loss on a position that is not profitable.

The two guidelines for implementing this management technique are:

–Strike price of the replacement call must be higher than the existing option.

–Cash received from selling the replacement call must be greater than that required to buy back the existing option.

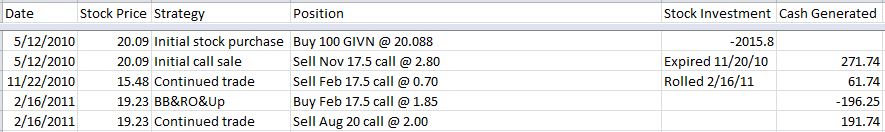

Here is an example from the MacDuff archives:

Look very closely. Do you see a problem here?

[Jeopardy theme song plays for 30 seconds]

Okay… what did you come up with?

One thing that may be strange is why the stock was purchased for $20.088/share and the total cost of 100 shares was $2,015.80. MacDuff does include supposed commissions and other transaction fees in his trade reporting. This also explains why the initial call sold for $2.80 only brings in $271.74 (this brokerage probably charges a ticket fee and a per-contract fee; $7.50/trade and $0.76/contract respectively, for example, would make these numbers work).

That’s not what I was thinking of, though.

Although the original call sold for $2.80, only $0.21 of that is extrinsic value. The annualized return on that would be:

(21 / 2015.80) * 100% * (365 days / 1 year) / (191 days) = 1.99% / year

This does not meet the criteria of MacDuff’s Math Exercise, which seeks at least 15% annualized. Were the stock trading above $17.50 at Nov expiration, up to $2.59 of the $2.80 would be subject to “give back” (MacDuff’s term). While intrinsic value may be sold, realizing that profit is conditional on the stock staying lower. The Math Exercise focuses on what can be expected if nothing changes since Nobody Knows in what direction the markets will move.

A bit more scrutiny–next… when we return.

Categories: Option Trading | Comments (2) | Permalink