Covered Calls and Cash Secured Puts (Part 19)

Posted by Mark on December 27, 2013 at 06:36 | Last modified: January 24, 2014 07:38Having talked about exercise and assignment, today I will discuss a trade management strategy for use in sideways/down markets called “rolling out.”

Rolling out is a common approach to adjusting an option position. When I roll, I buy to close a short option and sell to open an option at a later expiration date. I am thereby rolling the expiration farther out in time.

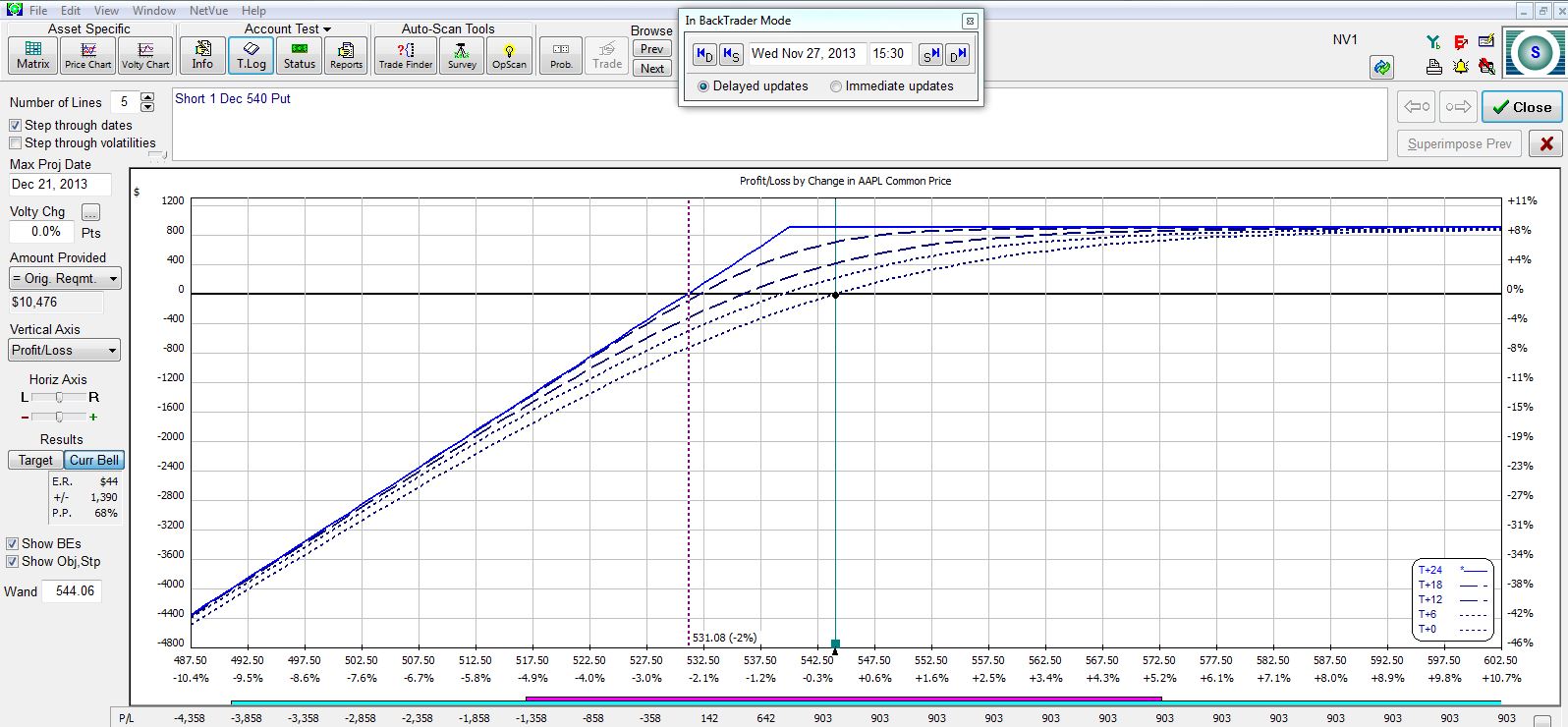

For an example, let’s go back to November 29, 2013, with AAPL trading at 556.08. Suppose I initiate a Dec(22) 540 CSP:

The legend in the bottom right identifies the different curves over time. At the bottom, I can see how the position gains (loses) money today (T+0) as AAPL stock moves up (down). The top, solid curve is the expiration line that shows PnL of the position at option expiration, 24 days into the future (T+24).

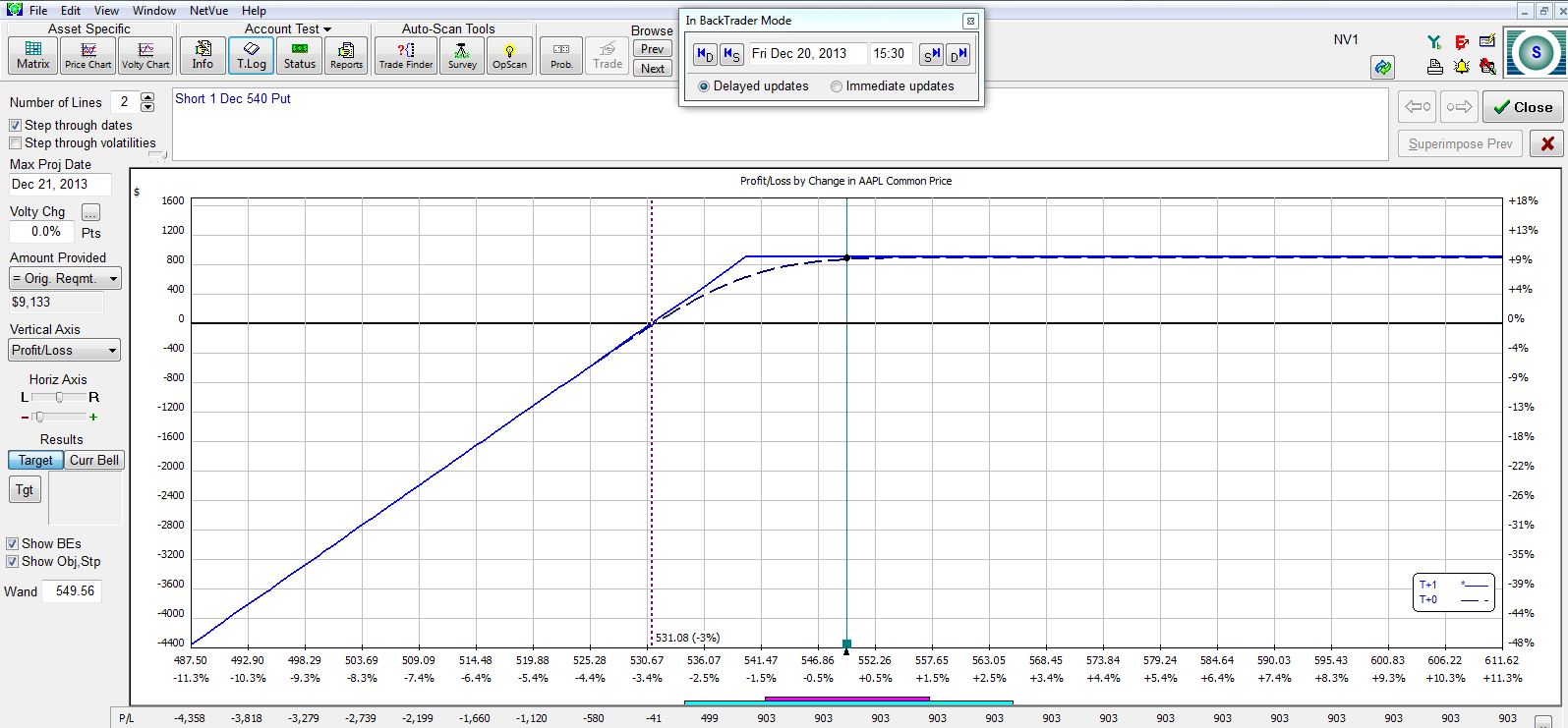

Let’s fast forward to the last trading day before expiration. AAPL is now trading at 549.56, which is down just over 1% from where I initiated the trade. Trading has been roughly sideways and the position has made $891:

The CSP is about to expire worthless, which will enable me to keep the $903 I originally sold it for. If I wish to continue the trade then I can roll out the CSP:

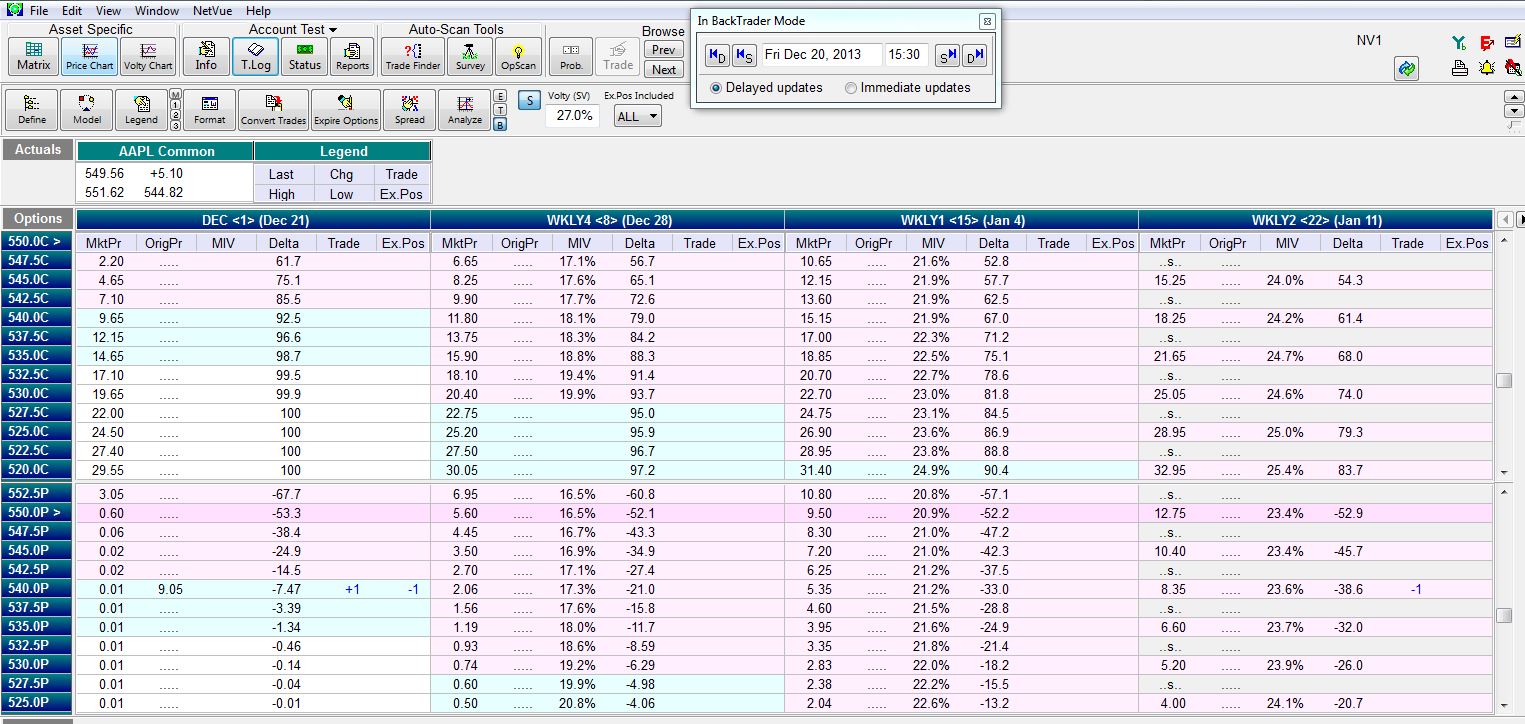

In the “Trade” column, you can see I am buying to close the existing short put (+1) and selling to open a new put (-1) at the same strike price three weeks later. The new risk graph is shown below:

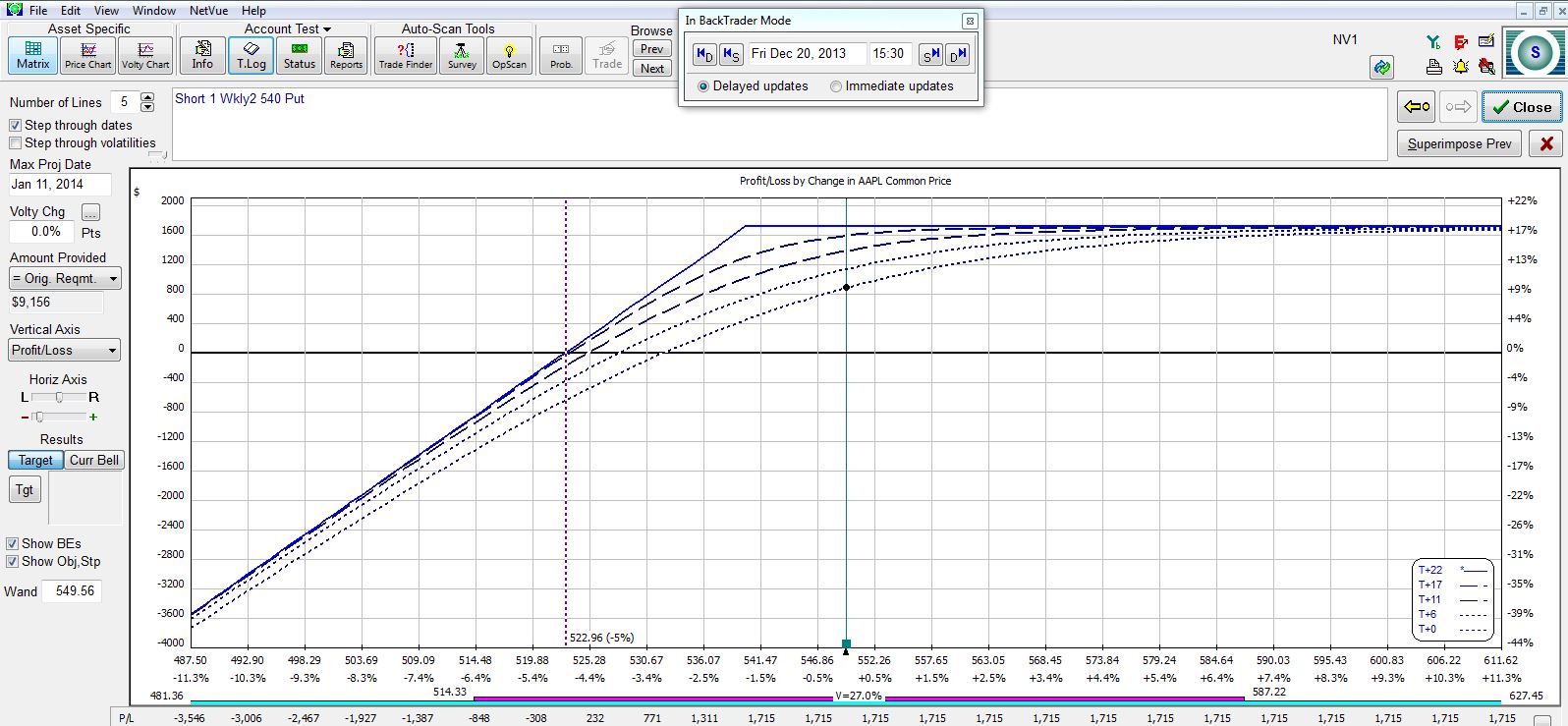

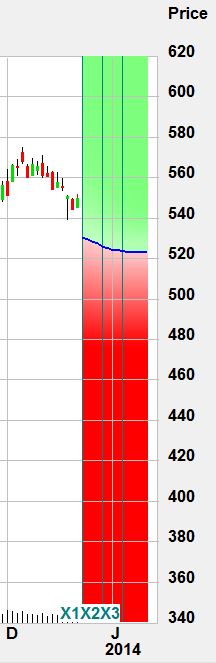

If the stock continues to trade sideways or move higher then this position will make an additional $824 for a total potential profit of $1,715. The price chart shows where the stock needs to trade for the position to make or lose money:

While this roll is an adjustment, I could easily just let the trade expire and begin a new CSP trade at the same strike and later expiration date. The difference is mostly semantic.

I will talk more about rolling out in my next post.

Comments (2)

[…] Part 19 example showed how rolling out may be used to continue a successful CC/CSP trade in a sideways […]

[…] have already discussed the CC/CSP management techniques of rolling out and rolling down. On the heels of a detour to cover certain aspects of Rich MacDuff’s SysCW […]