Covered Calls and Cash Secured Puts (Part 13)

Posted by Mark on December 6, 2013 at 07:17 | Last modified: January 21, 2014 09:19The current blog series has been detailing different aspects of the covered call (CC) and cash secured put (CSP) trade. Today I will continue by addressing moneyness of the short option.

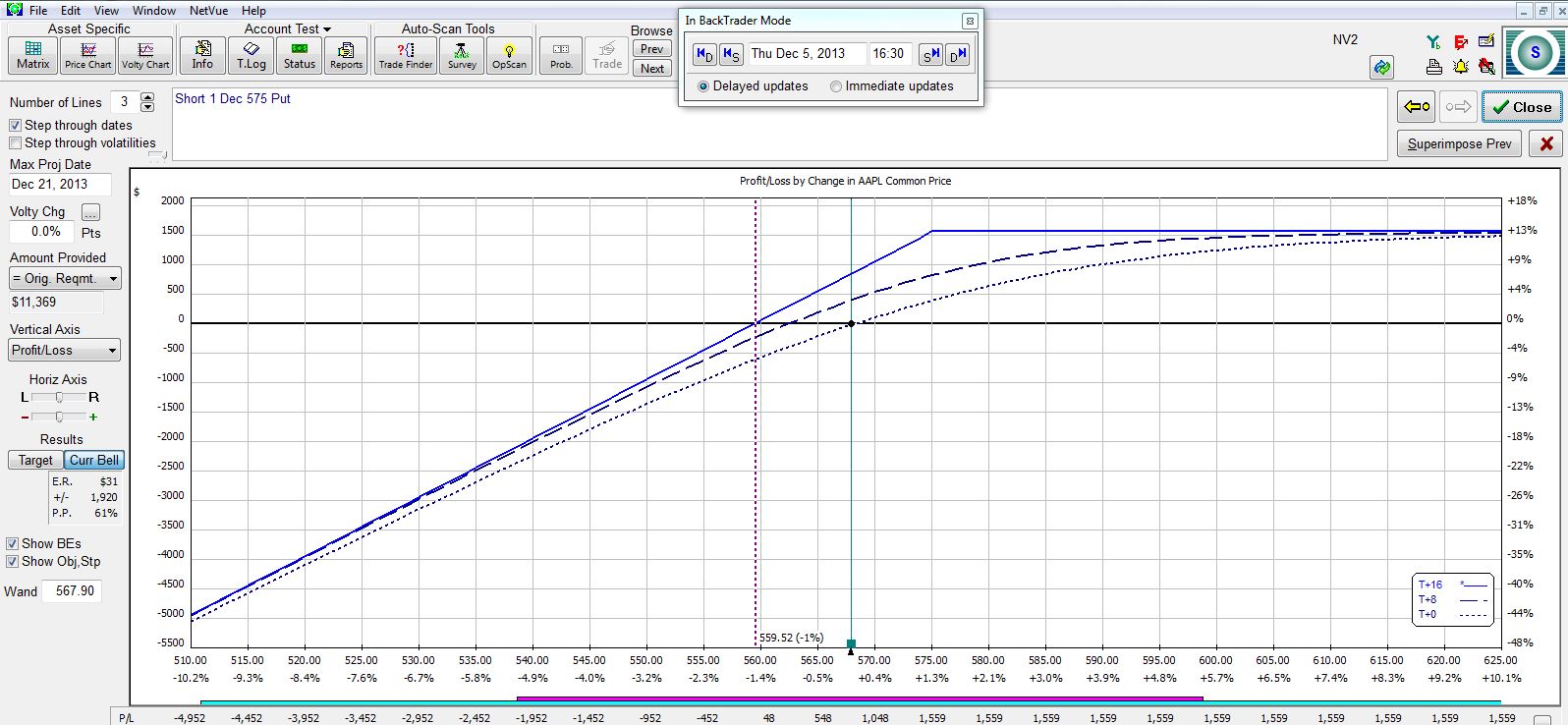

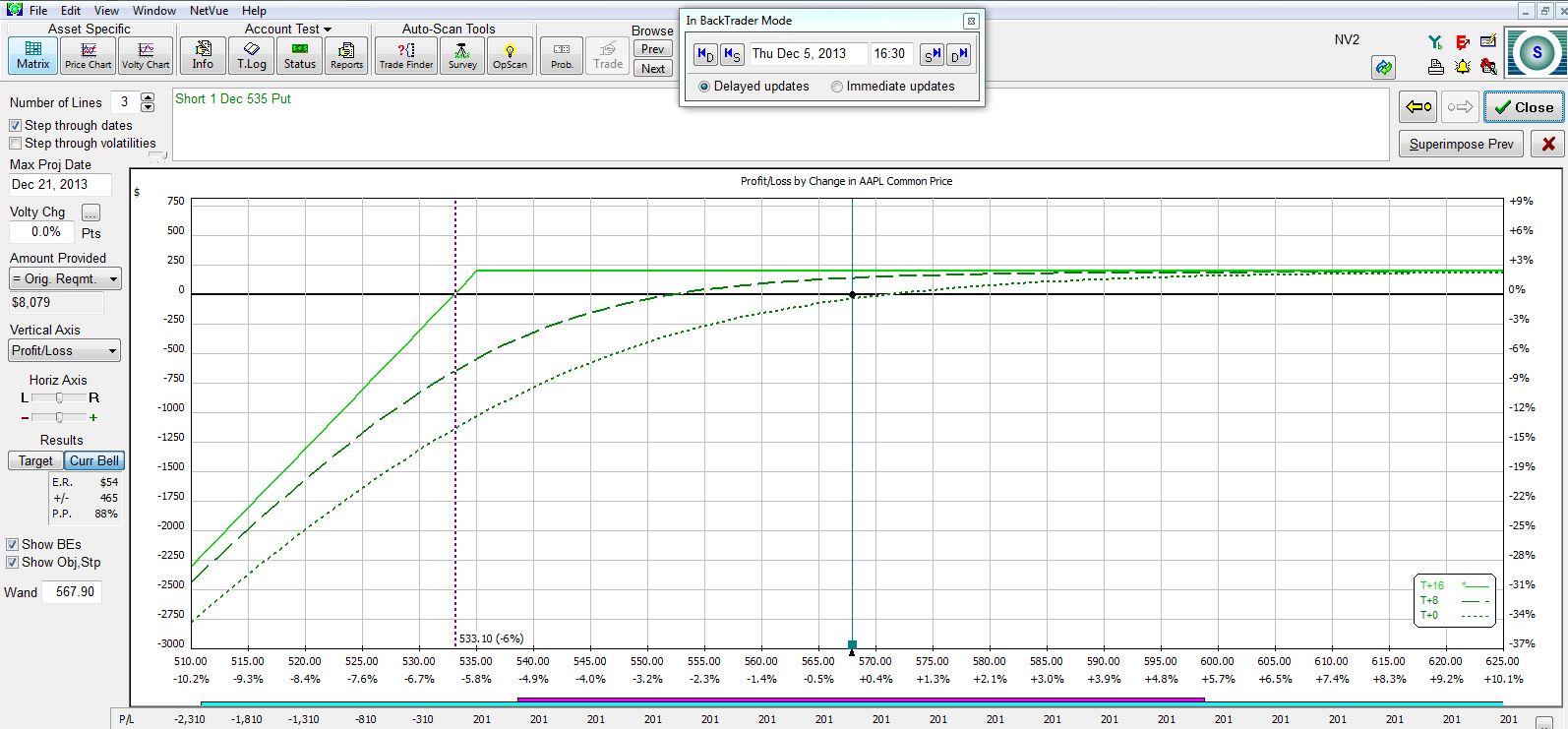

Moneyness is the relative position of the current price of a stock with respect to the strike price of the option. Consider AAPL stock, which closed yesterday at $567.90. If I wanted to trade a CSP then I might sell an in-the-money put at the $575 strike:

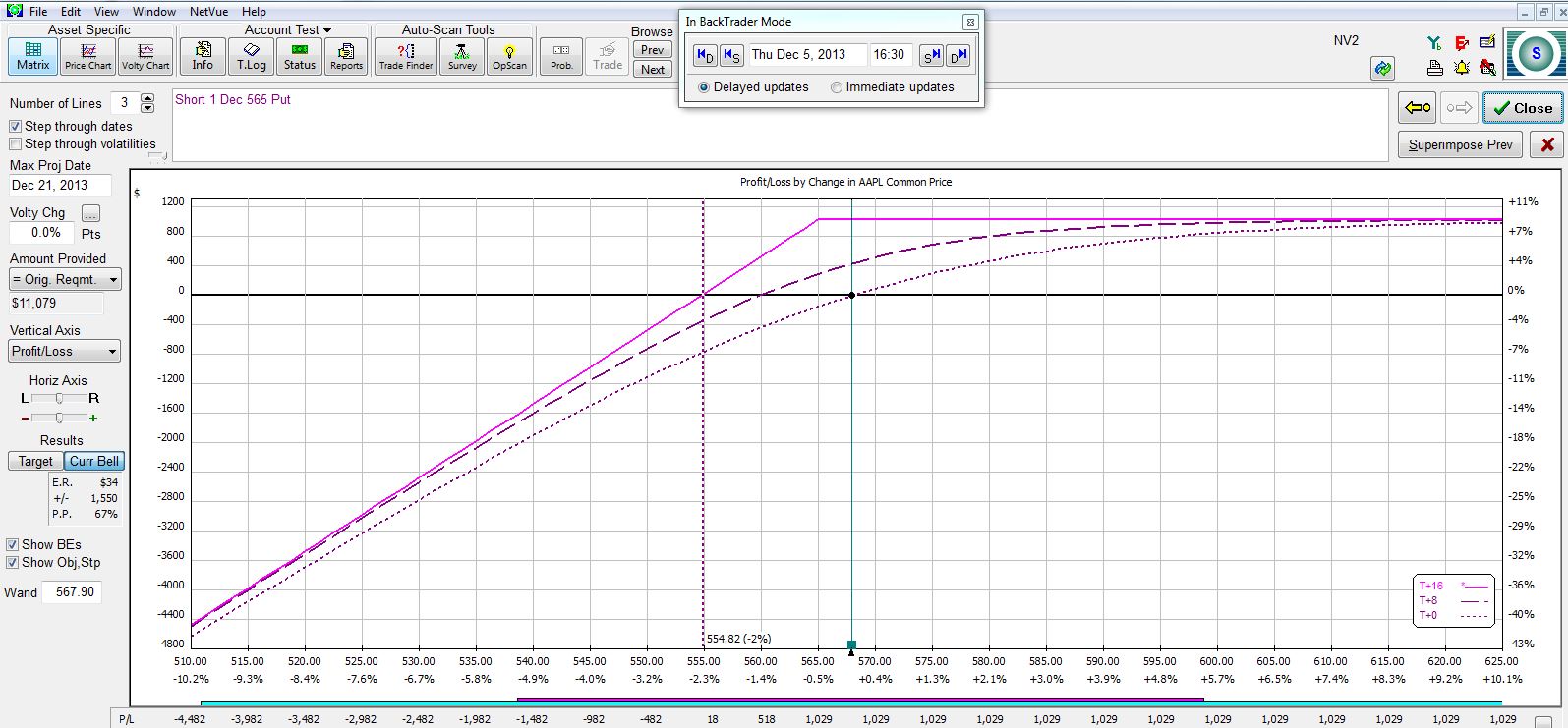

Here is a near-the-money option at the $565 strike:

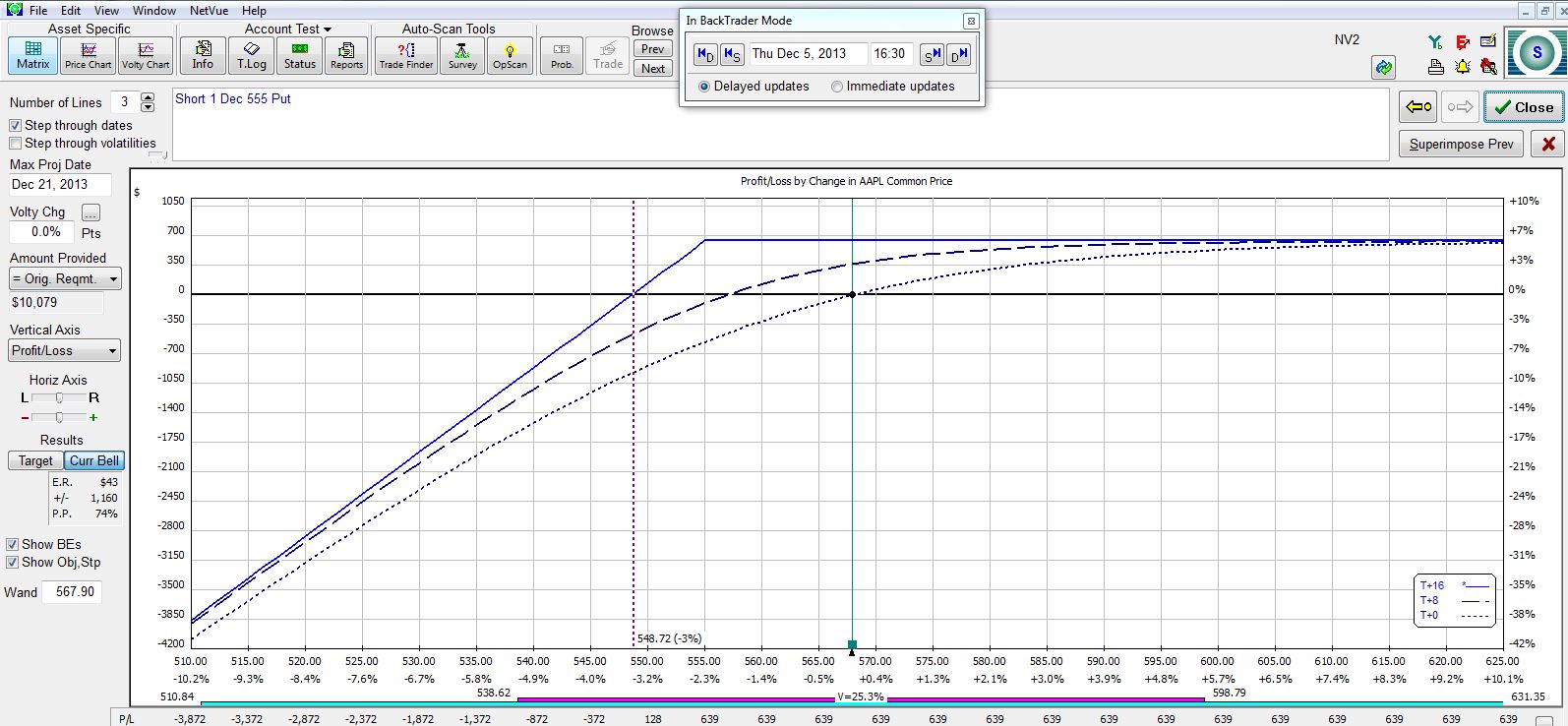

Here is an out-of-the-money (OTM) option at the $555 strike:

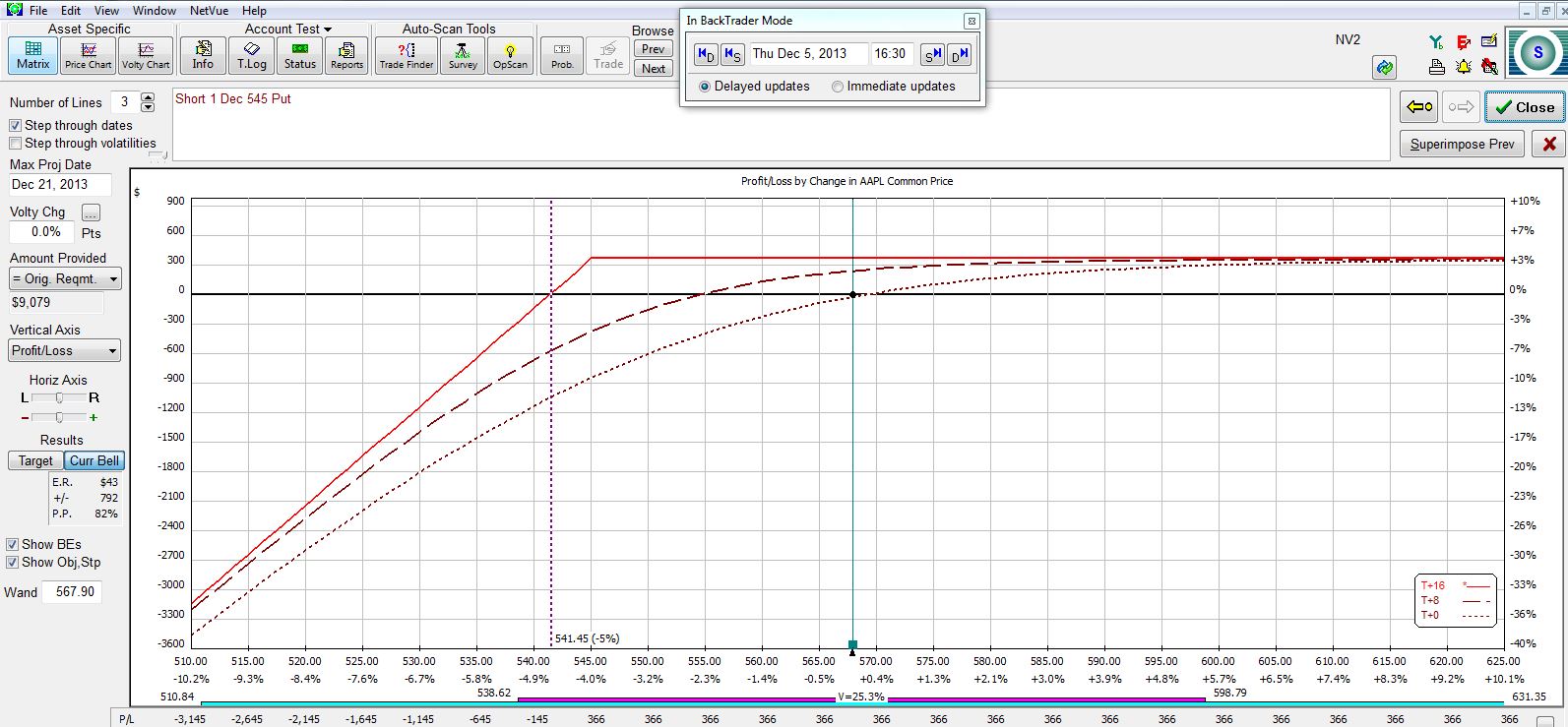

Here are farther OTM options at the $545 and $535 strikes:

Which is best? There is no right answer.

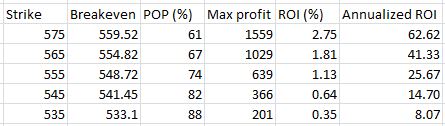

What I need to understand if I’m going to do this trade are the relevant tradeoffs. The farther OTM I go, the greater my probability of profit (POP) and the less profit I can expect to make. Here is a summary of the four trades:

The farther OTM I go, the larger my POP and the smaller my potential profit.

The larger my POP, the greater my downside protection. At the breakeven stock price (second column in the table), my profit on the trade will be zero at expiration.

If I think the stock might fall then I may seek a higher POP, lower breakeven, and lower potential profit.

If I think the stock might rally then I may accept a lower POP and less downside protection in exchange for a higher potential profit.

These are some of the considerations to be made when designing a CC/CSP trading plan.

Categories: Option Trading | Comments (3) | Permalink