Covered Calls and Cash Secured Puts (Part 15)

Posted by Mark on December 12, 2013 at 01:39 | Last modified: January 22, 2014 02:27In a recent post, I discussed moneyness as a variable to CC/CSP trading that must be considered with regard to tradeoffs. Another such variable is time to expiration of the short option.

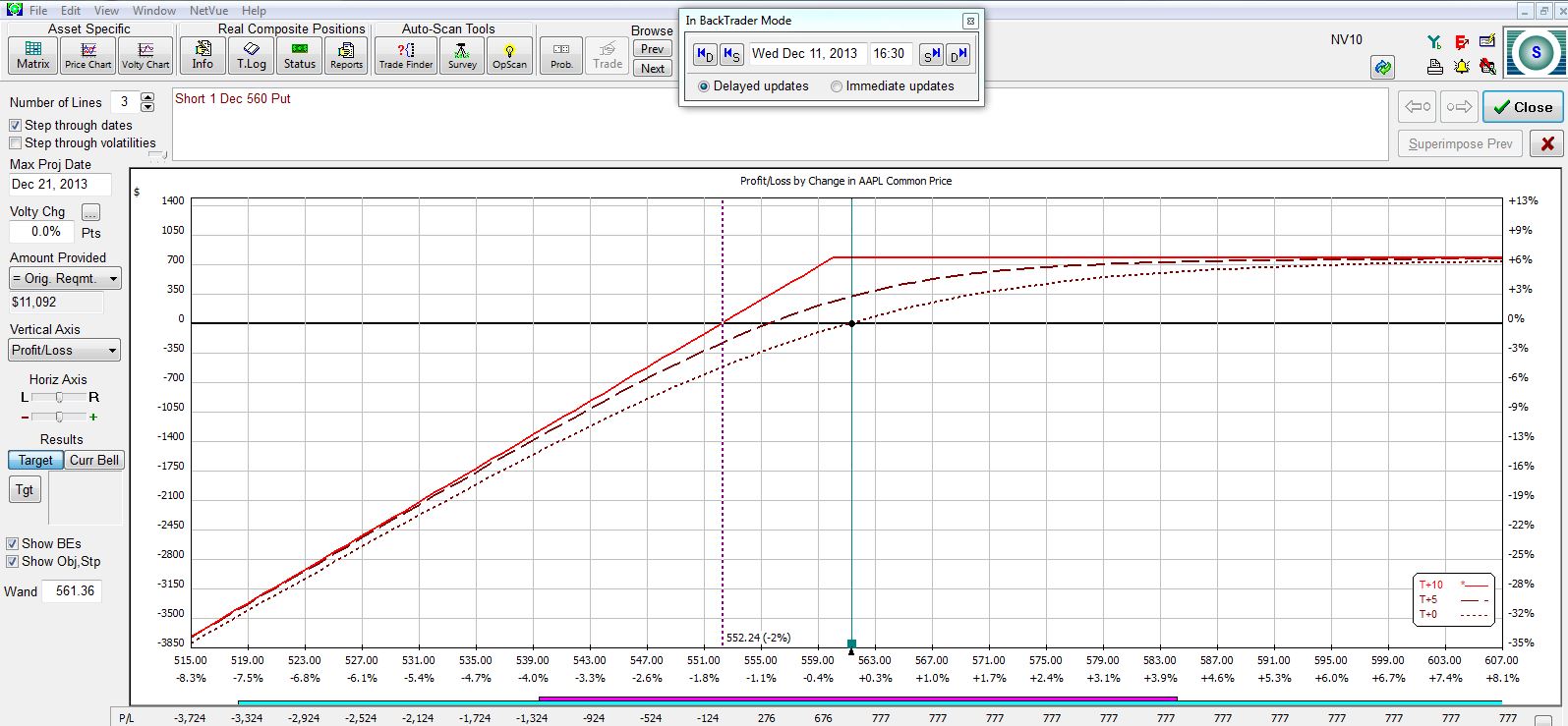

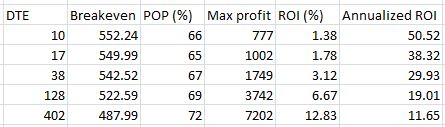

Days to expiration (DTE) of the short option is the number of days between now and option expiration. Consider AAPL stock, which closed yesterday at $561.36. If I wanted to trade a CSP at the $560 strike then I might sell one with 10 DTE:

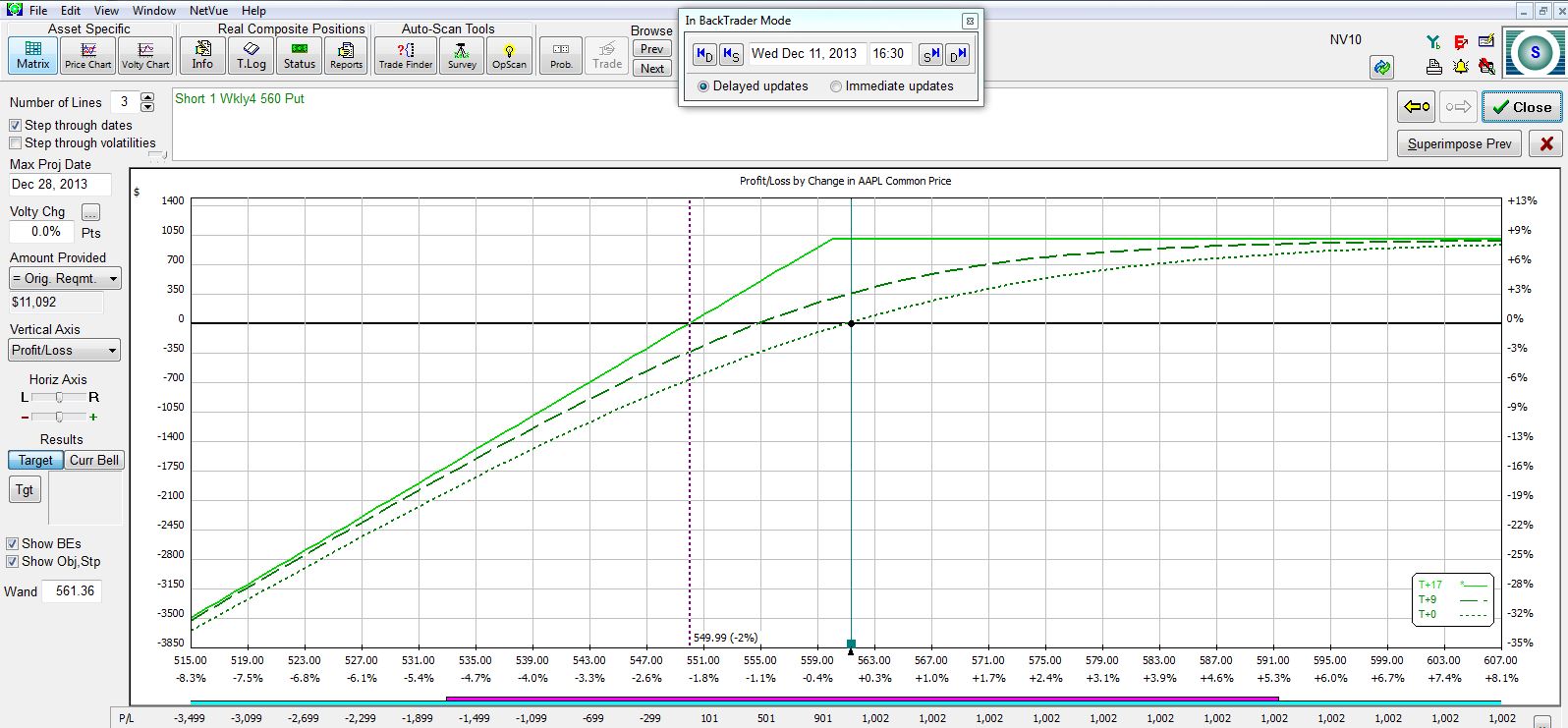

I might go out to the next weekly option with 17 DTE:

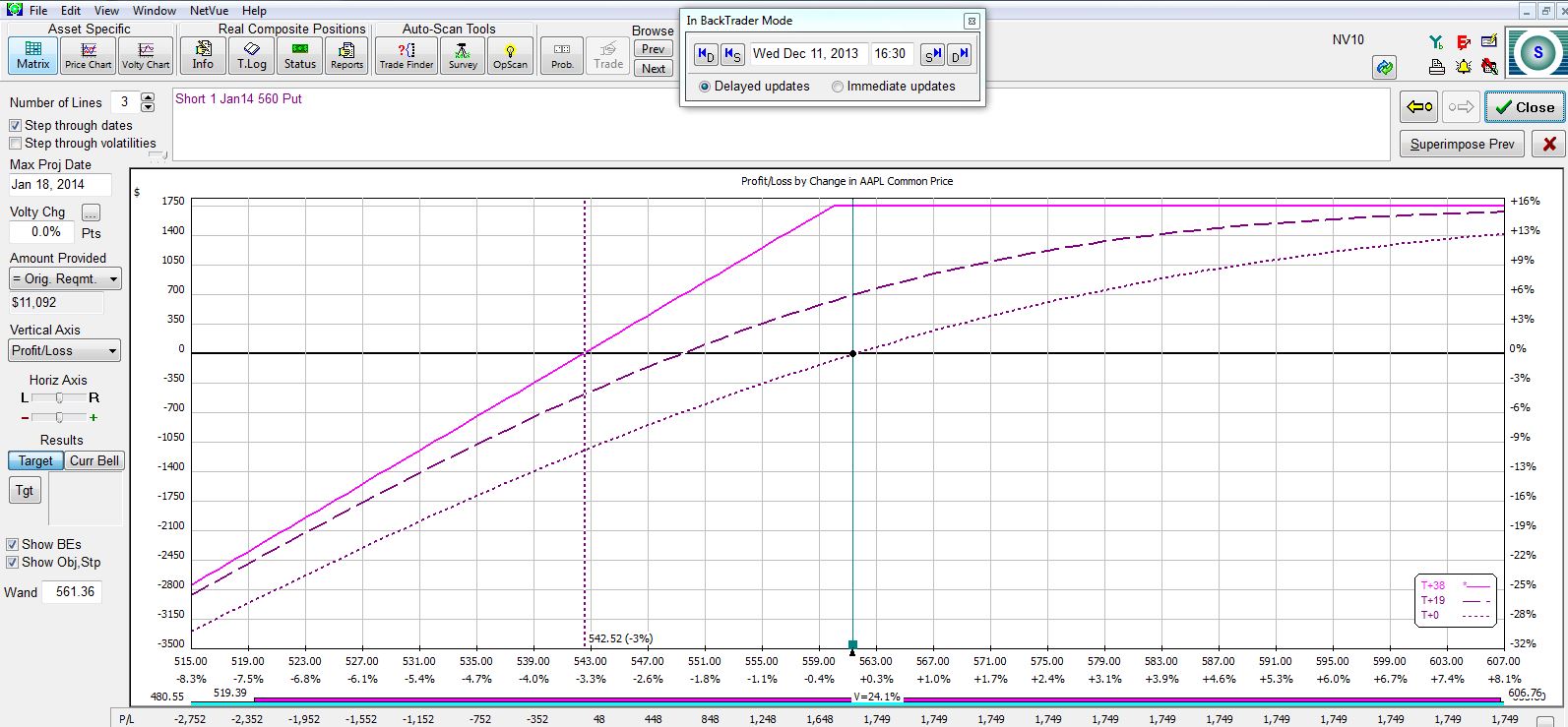

The January monthly CSP at 38 DTE looks like this:

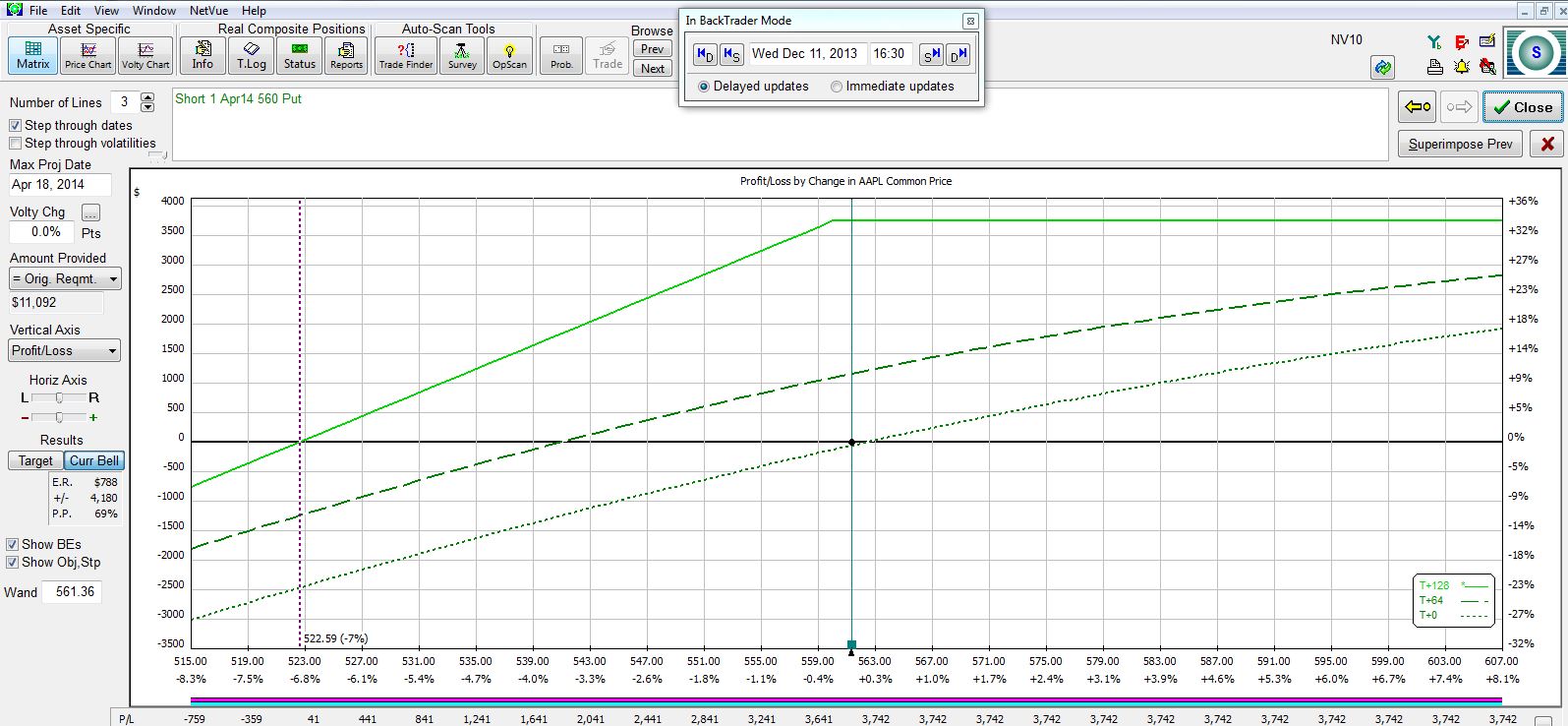

The March monthly CSP at 128 DTE looks like this:

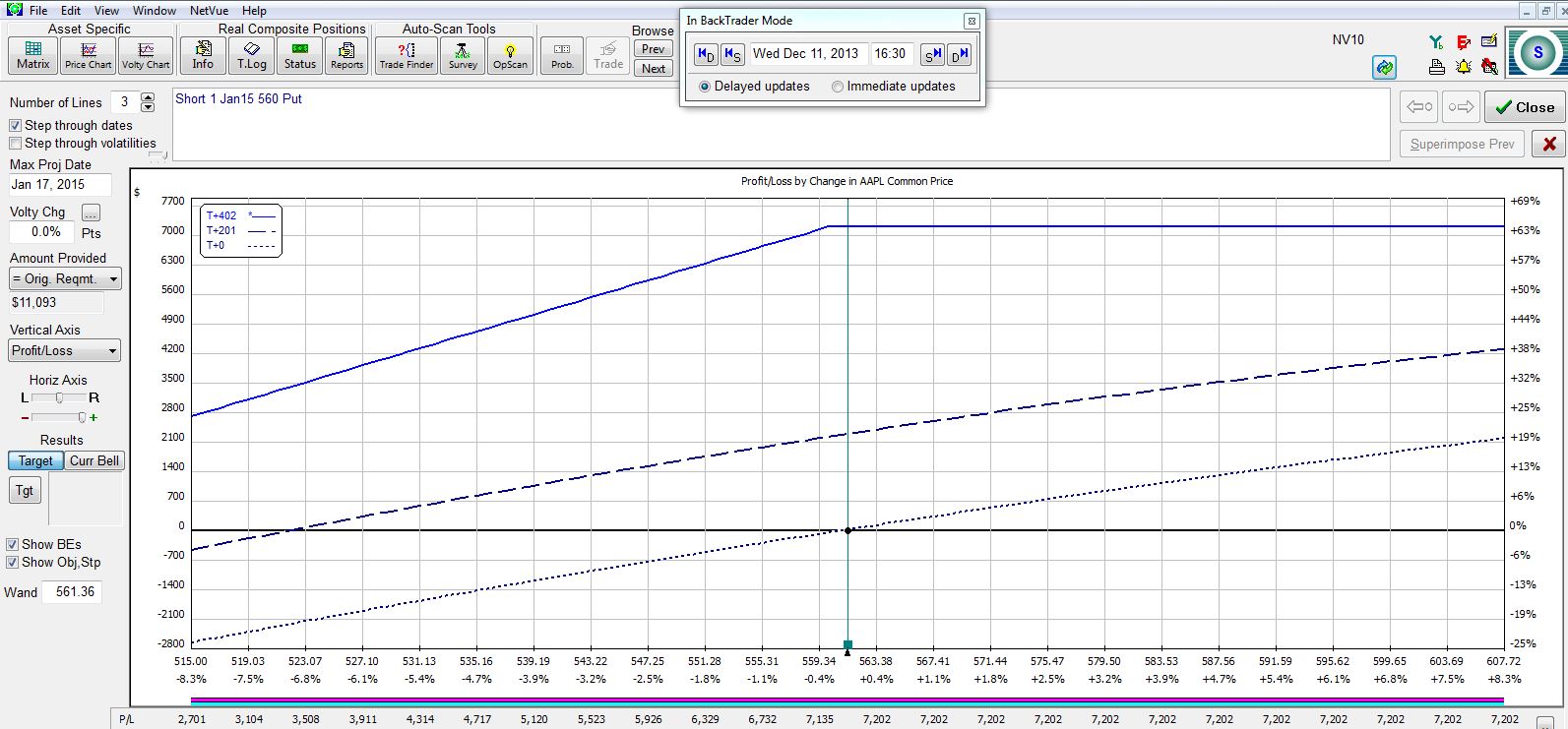

The January 2014 LEAPS at 402 DTE looks like this:

The following table summarizes the five potential trades:

Once again, I have tradeoffs to consider! The longer to expiration I sell, the greater my potential profit, the lower my breakeven, and the lower my annualized return. If I am extremely bullish on the stock then I might look to sell the shortest dated option and repeat the process every week or two to get the greatest annualized return and the least downside protection. If I think a market correction is around the corner then I might look to sell an option farther out in time to give me more downside protection in exchange for a lower annualized return.

As was the case with moneyness, no right answer exists. My personality or the overall allocation of my portfolio (e.g. diversification over time) might demand one over another.

I will continue with more discussion of the CC/CSP trade in my next post.

Categories: Option Trading | Comments (0) | Permalink