Covered Calls and Cash Secured Puts (Part 25)

Posted by Mark on January 30, 2014 at 07:15 | Last modified: January 31, 2014 09:19I previously explained the RO & Up adjustment strategy for CCs. In the last post I explained the analogous strategy for CSPs. Today I want to flush out the risk in these strategies especially with regard to Rich MacDuff’s philosophy.

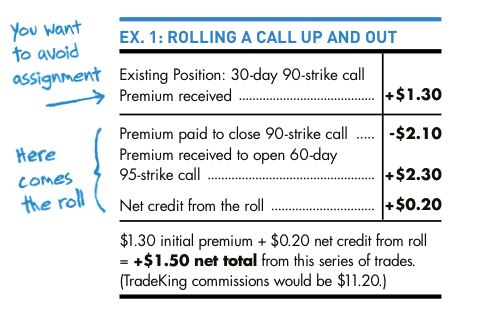

Here is another example of the RO & Up adjustment (courtesy of the TradeKing website):

Noted here are TradeKing’s commissions, which halve the $20 credit received for the adjustment. I recommend a brokerage that does not have a per trade [ticket] charge. Find a commission structure of $1.50/contract or less for small sized trades.

One maxim I hear repeated very often with regard to CCs is the following:

“If the stock moves through your short call strike then you can just RO & Up.”

People say this with confidence. They say it with simplicity… as if it the obvious course of action. Their nonchalance whispers, “it’s no big deal.”

I’m here to speak against every one of these people by saying it’s not always that easy.

Whenever I RO & Up, I may be taking a loss on the short call. Because the market still has time to move against me, I have secured no gains on the replacement call nor on stock appreciation. The future result could be compounding my losses.

Rather than rolling and feeling like I have just won the game, I should roll and immediately start planning what I will do next if the market moves against me again!

The worst case scenario involves the market rallying above my short call strike so fast that I scramble to find an option far enough out in time to recoup my loss and am unable to do so. In other words, no higher-strike call exists to sell for as much as my existing short call trades even in the most distant expiration month on the option chain.

Where are those nonchalant masters of the obvious now? They are not around to help me. That much is clear.

I will show an example of this in my next post.

Categories: Option Trading | Comments (1) | Permalink