Weekly Iron Butterfly Backtest (Part 6)

Posted by Mark on June 28, 2013 at 04:16 | Last modified: August 2, 2013 10:37In this blog series, I’m backtesting the weekly option trade described here.

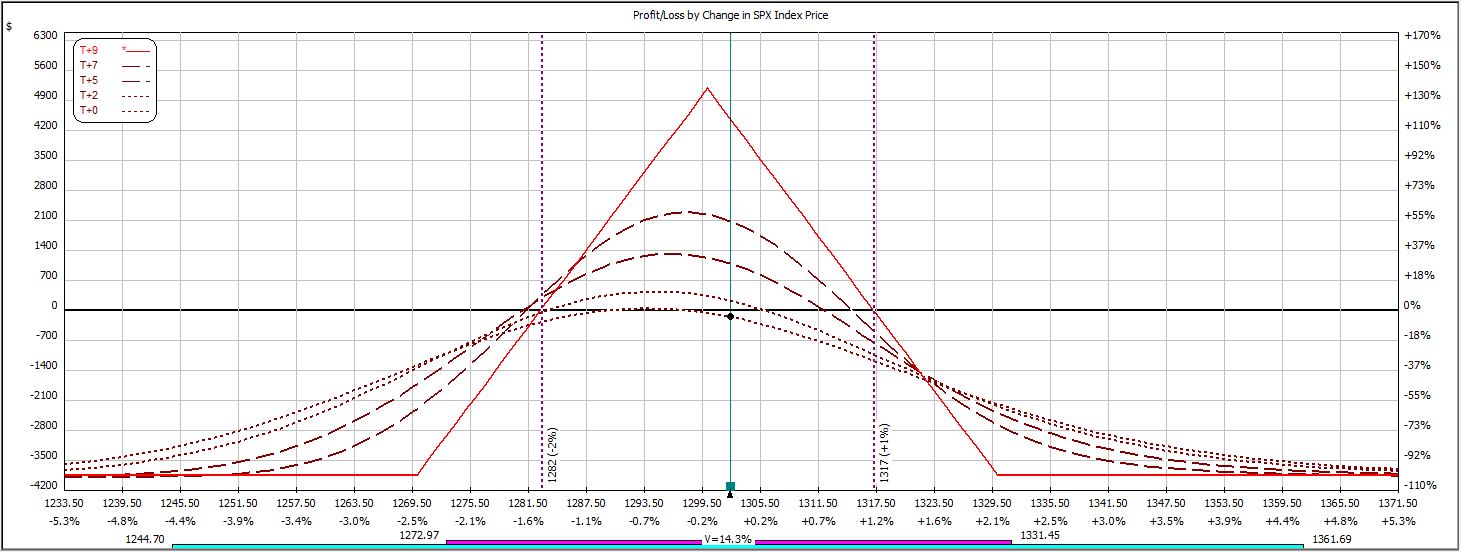

Week #5 is a loser. At inception, the trade looked like this:

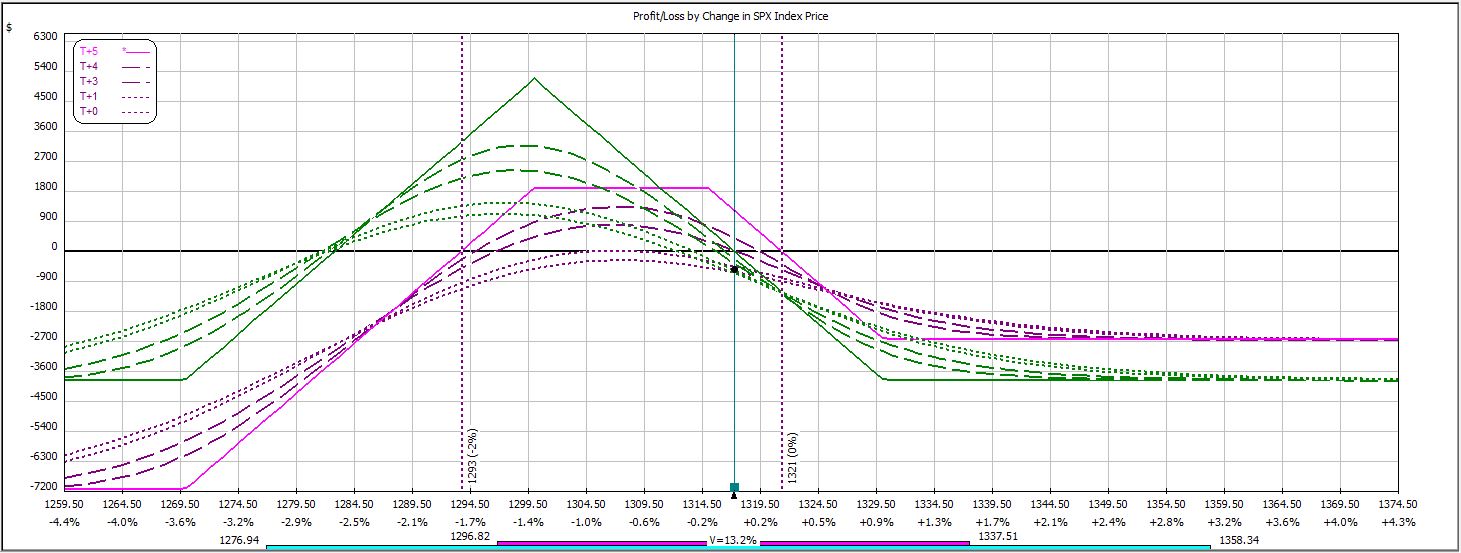

The market rallied 15 points to force an adjustment on Day #5. Shown in purple, I rolled the short calls up:

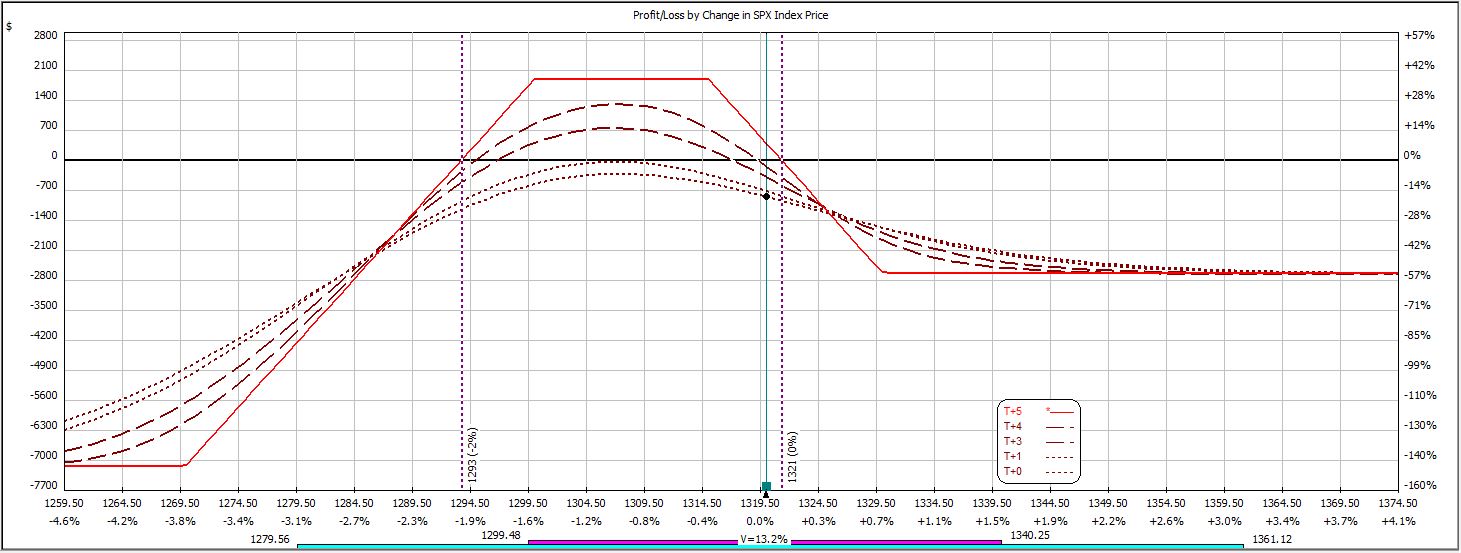

As the uptrend continued, max loss was hit soon after:

P/L on Day #1 ranged from -$177 to +$87 on $3,858 margin requirement for three contracts.

P/L on Day #2 ranged from -$90 to +$264.

P/L on Day #5 (nothing happened over the weekend) ranged from -$582 to -$837 (max loss), which is a loss of 11.7% on an adjusted margin requirement of $7,137.

In back-to-back weeks I have now seen sharp whippiness and strong trending cause this trade to lose. The win-loss record stands at 3-2.

Categories: Backtesting | Comments (0) | Permalink