Weekly Iron Butterfly Backtest (Part 2)

Posted by Mark on June 19, 2013 at 06:53 | Last modified: August 1, 2013 07:40In this blog series, I’m backtesting a weekly option trade described here.

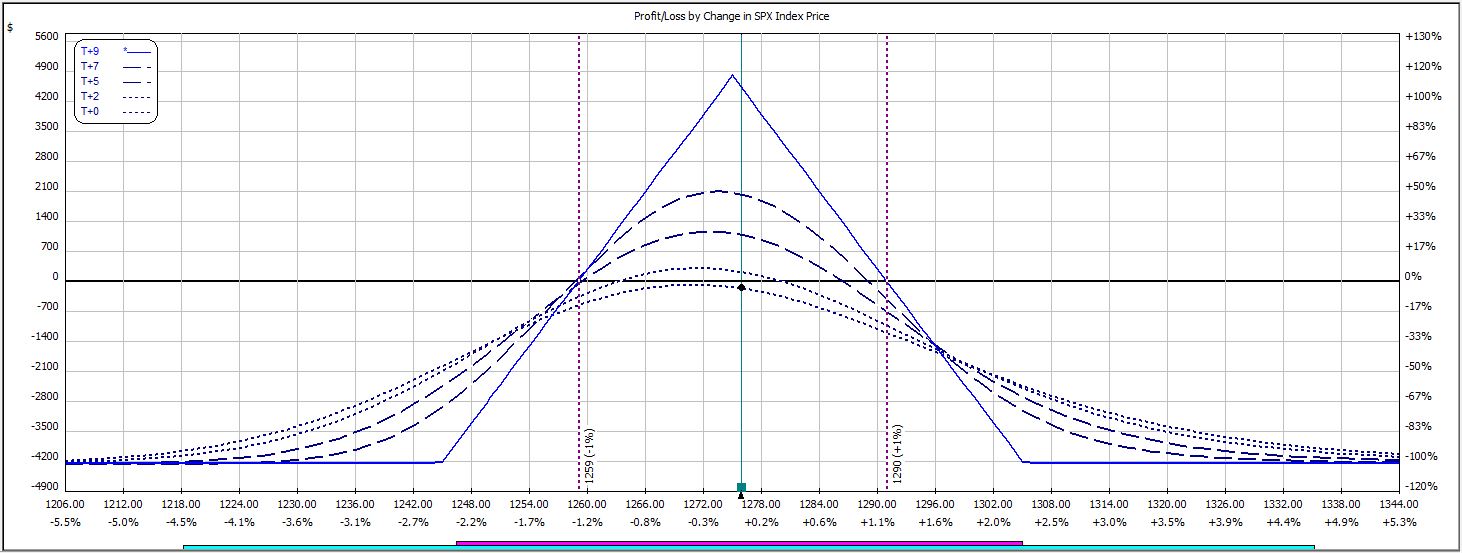

The first week was flawless. At inception, the trade looked like this:

P/L on Day 1 ranged from -$237 to -$12.

P/L on Day 2 ranged from +$18 to +$333.

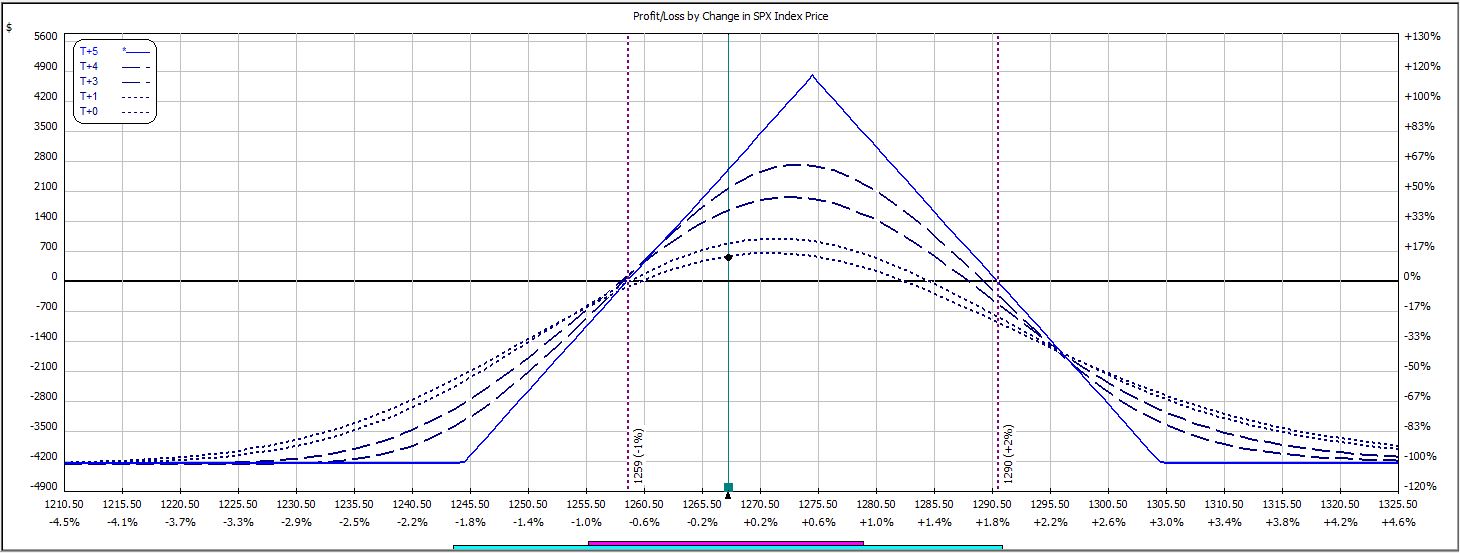

P/L on Day 5 (nothing happened over the weekend) ranged from +$123 to +$528. The latter included allowing the long call to expire worthless since it was listed at $0.15 upon trade close, which looked like this:

No adjustments were required for this trade. While the market was over 10 points from its starting point on Day 5, since the trade was still profitable I did not adjust.

Margin remained constant at $4,236 for three contracts. Return on investment was 12.5%.

Categories: Backtesting | Comments (0) | Permalink