Weekly Iron Butterfly Backtest (Part 5)

Posted by Mark on June 26, 2013 at 05:55 | Last modified: August 1, 2013 10:21In this blog series, I’m backtesting a weekly option trade described here.

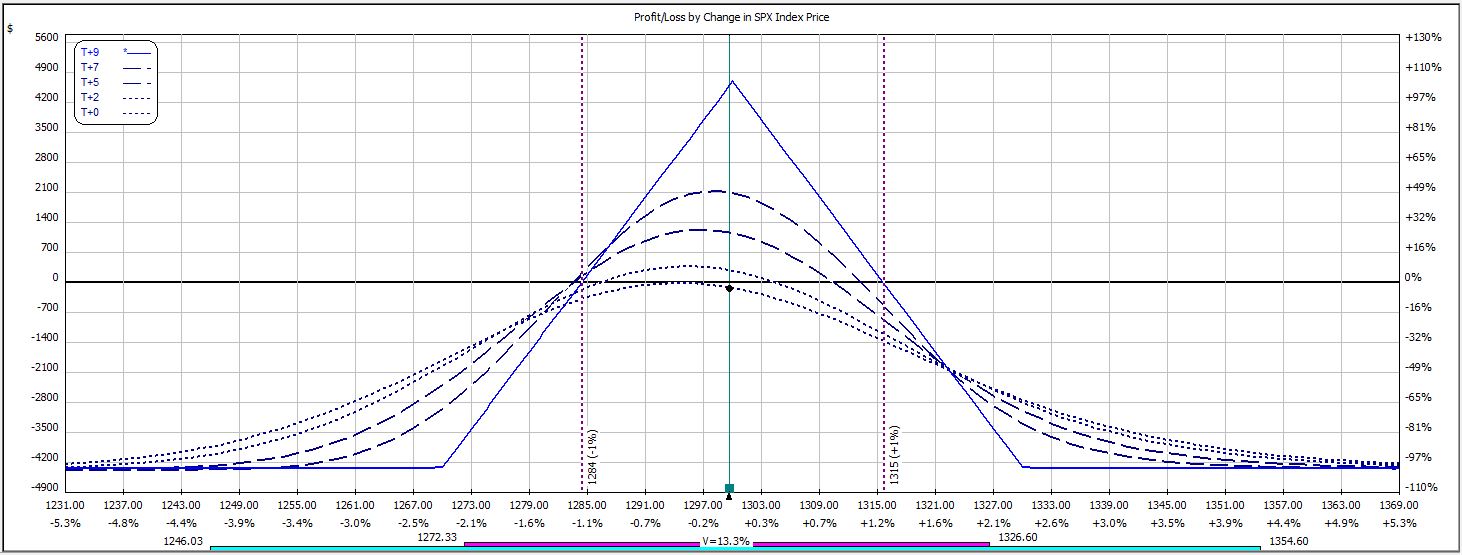

Week #4 presents the first loser of the bunch. At inception, the trade looked like this:

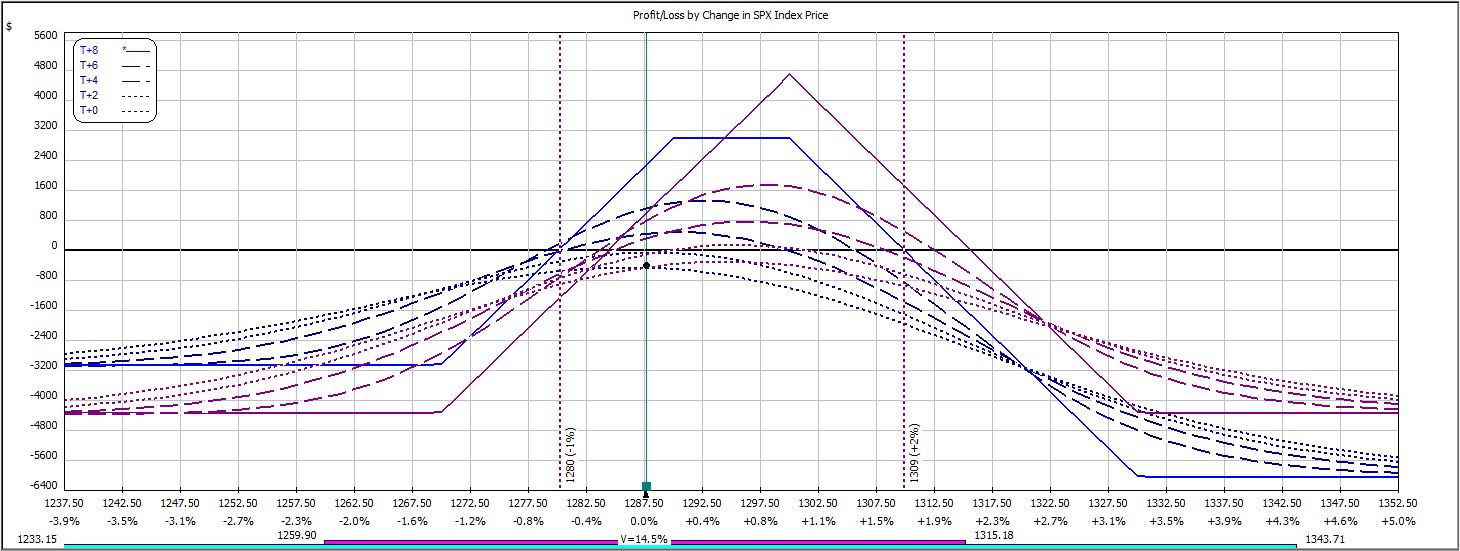

The market tanked on Day #2 forcing two adjustments. Adjustment #1 involved rolling down the short put 10 points. This is seen in blue:

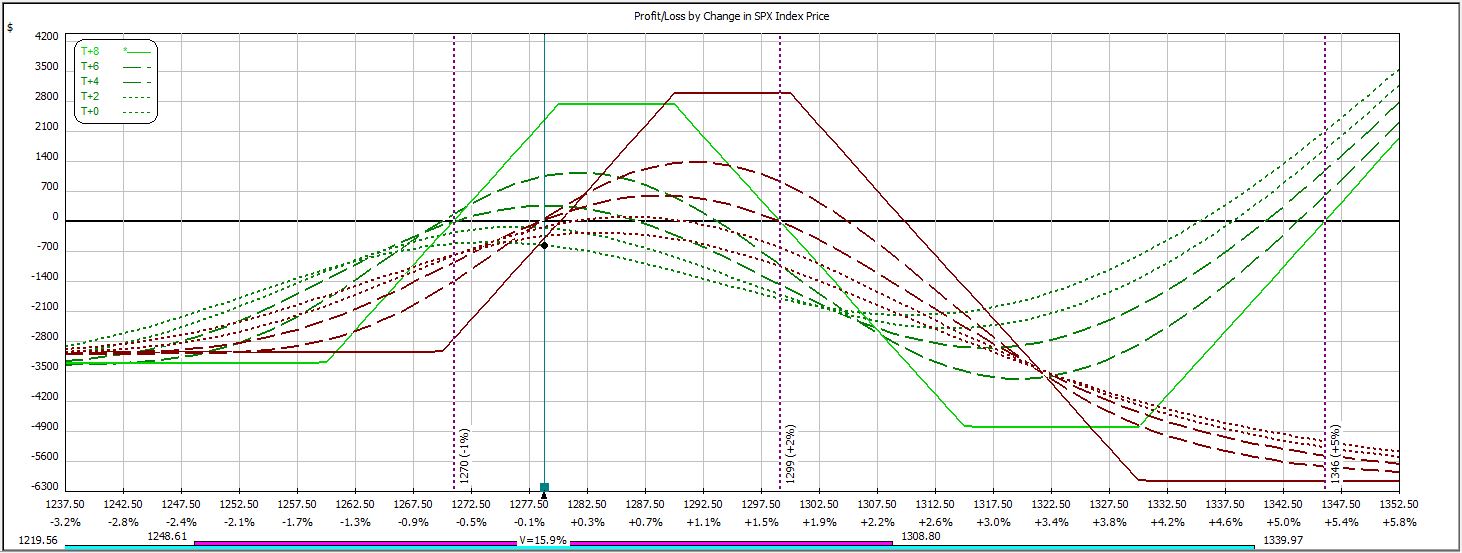

Adjustment #2 involved rolling down the put spread, rolling the short call 10 points closer, and rolling the long call 15 points closer. This is seen below in green:

On the put side, although rolling the vertical rather than the short option alone increases downside risk, I had already cut downside risk with the previous adjustment. The net effect would leave downside risk roughly equivalent (in fact it was $3,276, which is still less than the original margin requirement).

On the call side, I rolled the short option closer to recoup some potential profit in the trade. I rolled the long option even closer to manage upside risk.

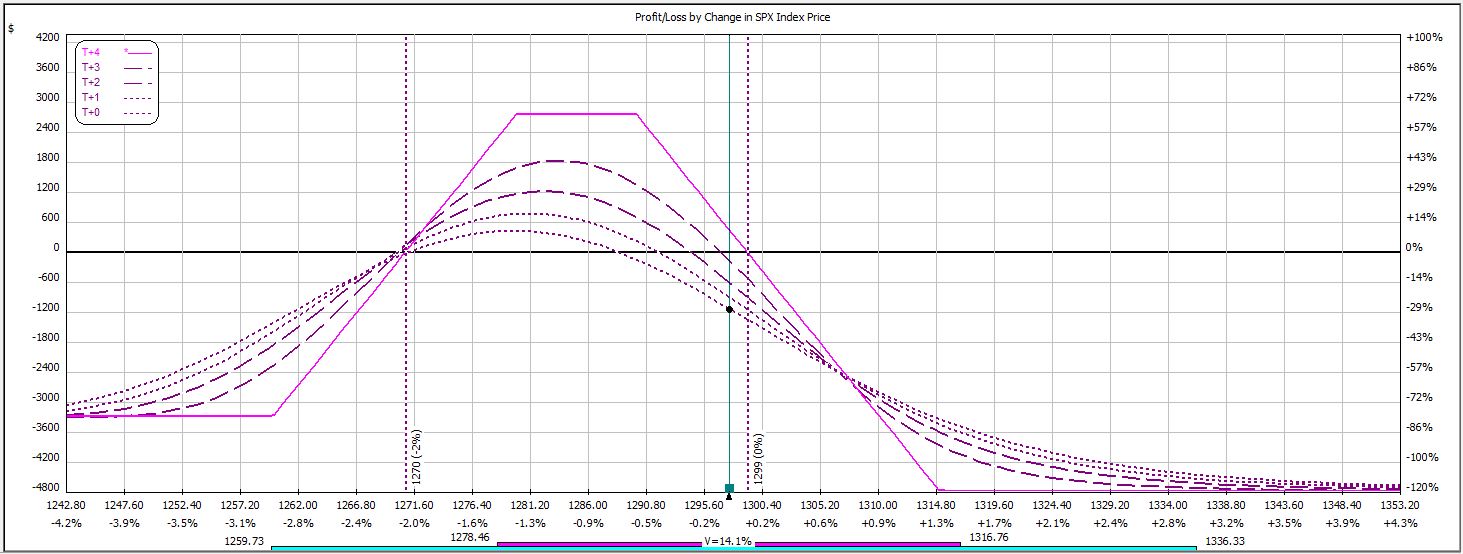

On Day #6, the market gapped higher forcing me to exit at max loss:

P/L on Day 1 ranged from -$387 to -$69.

P/L on Day 2 ranged from -$864 to +$102 and the margin requirement increased from $3,915 to $6,057 on three contracts.

P/L on Day 5 (nothing happened over the weekend) ranged from -$405 to -$234 on margin of $4,776.

Trade closed on Day 6 with a loss of $1,137, which is -18.8% on max margin.

Relative to the first three weeks, the market was very whippy during the short time period. This trade will not win in the face of such price action:

The “$6M question” is whether this is the exception or the norm.

Categories: Backtesting | Comments (0) | Permalink