Trading System #2–Consecutive Directional Close (Part 9)

Posted by Mark on November 23, 2012 at 03:18 | Last modified: November 23, 2012 05:03Back in http://www.optionfanatic.com/2012/11/16/trading-system-2-consecutive-directional-close-part-5, when facing an apparent sample size problem I suggested the inclusion of other broad based indices like QQQ and IWM for this trading strategy. It now appears that the problem may not only have been small sample size but also a difference between short and long trade performance. Today I will backtest QQQ.

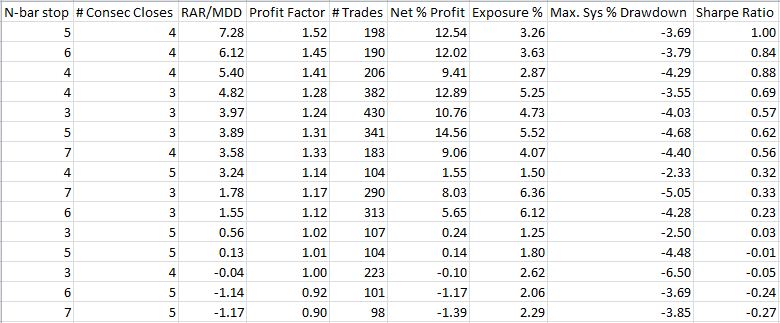

I will start by backtesting x = 3, 4, 5, 6, 7 and N = 3, 4, 5, 6, 7 with a minimum total number of trades of 55 (see http://www.optionfanatic.com/2012/11/16/trading-system-2-consecutive-directional-close-part-5). In lieu of my last post, I did include trade delays here for buy and short trades. Here are the results as sorted by subjective function (RAR/MDD):

All systems with x = 6 or x = 7 were eliminated due to too few trades.

Compared to other backtesting done so far, these numbers are weak. First, not all systems backtested here are profitable. Second, all RAR/MDD numbers are in the single digits. Third, no PF exceeds 1.60.

Certainly the results would be better with no trade delays but that is not necessarily realistic.

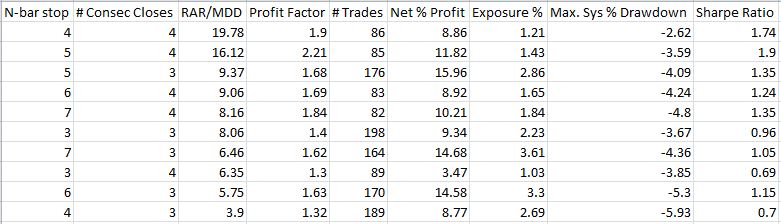

In http://www.optionfanatic.com/2012/11/19/trading-system-2-consecutive-directional-close-part-6, I concluded by suggesting development of the CDC system to continue with long trades only. If I eliminate all short trades:

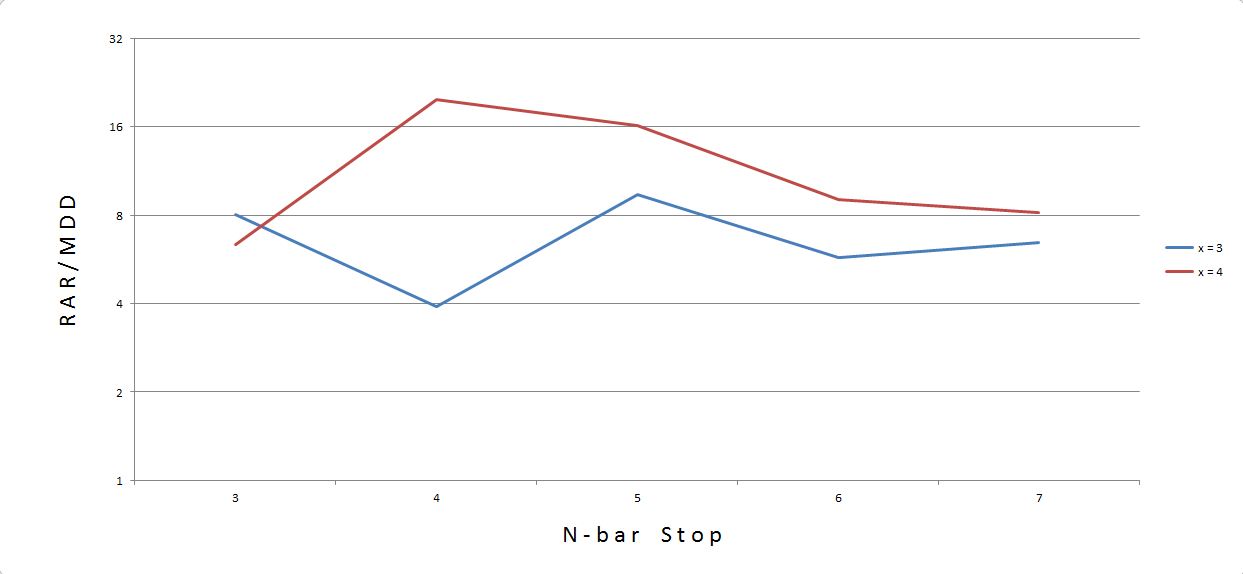

These numbers are an improvement. As a check for consistency/plateau region:

I would trade x = 4 since the red curve is above the blue curve for 80% of the data points (4 out of 5). Furthermore, with a 5-bar stop, I am in a somewhat stable area should performance be a bit better or worse than the backtested curve indicates.

In my next post, I’ll take a look at IWM.

Categories: Backtesting | Comments (1) | Permalink