Trading System #2–Consecutive Directional Close (Part 2)

Posted by Mark on November 1, 2012 at 07:12 | Last modified: February 4, 2015 10:11In http://www.optionfanatic.com/2012/10/31/consecutive-directional-close-part-1/, I introduced the Consecutive Directional Close trading system. Today I will begin the backtesting in order to see whether this might be worth trading live.

For starters, I will backtest SPY with x = 3 and n = 5. Recall that the two variables are number of consecutive closes (x) either up or down to trigger a short or long trade, respectively, and the number of days to hold the trade (n).

Other backtest settings include:

–Initial account value $1M

–Position size $100K

–$8 commission for each transaction

–Date range 1/29/1993 through 8/30/2012

–Subsequent buy/sell signals ignored once in a trade

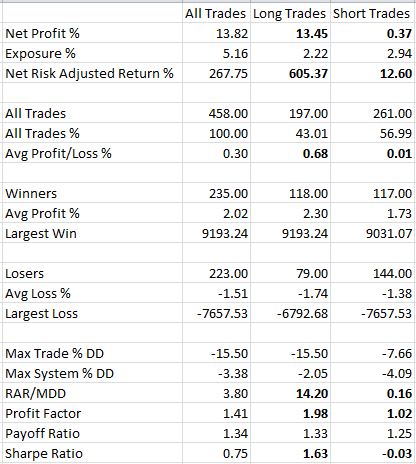

Here are the initial results:

With this variable combination, the system does look to be profitable but what really jumps out at me is a huge differential between long and short trades. Profit Factor for shorts is 1.02, which is barely profitable (probably not after slippage). Considering that 57% of all trades were short trades, I would strongly consider trading this long only, cutting exposure by 5.16% to 2.22%, and losing only a fraction of the net profit.

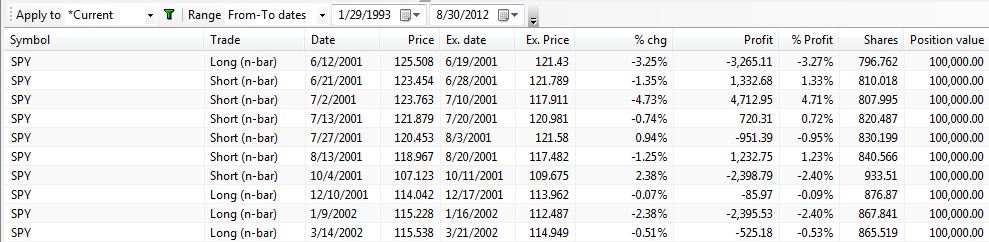

One thing I often wonder about is the final backtest setting to ignore subsequent signals once in a trade. Below are 10 consecutive trades beginning 6/12/2001 with this setting:

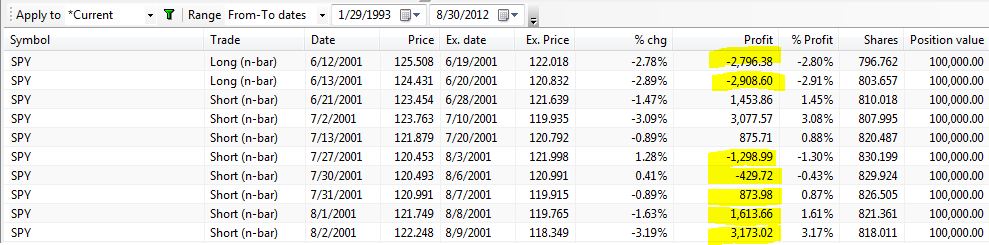

Contrast this with 10 consecutive trades beginning 6/12/2001 without this setting:

The yellow highlighting indicates subsequent trades that would not have been taken with the setting included. In the first case, an additional trade the following day compounded the initial loss. In the second case, additional trades taken on each of four successive days after the first resulted in a net profit rather than loss.

I will talk more about the implications of this in the next post.

Categories: Backtesting | Comments (3) | Permalink