Trading System #2–Consecutive Directional Close (Part 3)

Posted by Mark on November 6, 2012 at 05:41 | Last modified: October 25, 2012 15:24In my last two posts, I talked about redundant trade signals. At this point I am going to ignore redundant signals to get a feel for how the Consecutive Directional Close (CDC) trading system performs all by itself.

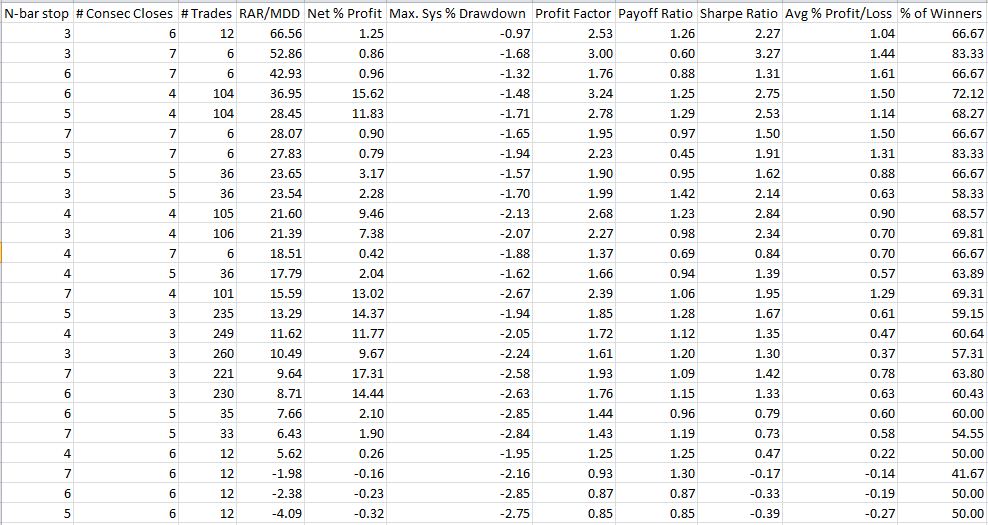

I began backtesting in http://www.optionfanatic.com/2012/11/01/trading-system-2-consecutive-directional-close-part-2 by studying x=3 and n=5. Now, I’m going to run an optimization to get a sense for backtesting results for x and n ranging between 3-7 (25 total systems). Just because I have another month of data, I’m going to extend the backtesting period to 9/30/2012:

Table 1

In contrast to http://www.optionfanatic.com/2012/10/02/trading-system-1-spy-vix-part-3-2, the first thing I notice here is that only 88% of these backtested systems were profitable. While 22 out of 25 is a high number, it falls short of the 100% I saw with the SPY VIX trading system.

The next thing I notice are some inconsistencies across x. This is a mean-reversion trading system and I would expect that more CDCs would result in larger returns. Indeed, the top three systems all had six or seven CDCs. However, the four worst-performing systems (including all three losers) also had six CDCs.

If I graph these numbers to check for plateau regions:

Figure 1

This is a much different graph than Figure 1 in http://www.optionfanatic.com/2012/10/11/the-subjective-function-part-5 where with a couple minor exceptions, the curve representing the most (least) extended trade condition was on top (bottom). Here, x = 6 starts out on top and dives into negative territory. x = 7 or x = 4 (can’t tell which) is below that followed by x = 5 and, as expected, x = 3 on the bottom (not really).

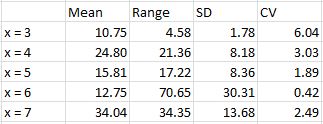

When I averaged across n-values, the statistics support the inconsistency:

Table 2

The huge range for x = 6 is seen here as it went from the best performing system to losing money. With higher CV (large mean and small SD) favorable, x = 3 looks impressive but its mean RAR/MDD is smallest and not very impressive.

I will continue this analysis with my next post.

Categories: Backtesting | Comments (2) | Permalink