Position Sizing Implications of Multiple Open Positions (Part 3)

Posted by Mark on November 13, 2012 at 05:00 | Last modified: November 14, 2012 05:55In http://www.optionfanatic.com/2012/11/09/position-sizing-implications-of-multiple-open-positions-part-2, I continued exploration of problems presented with trading all S&P 500 stocks individually in lieu of the SPY ETF.

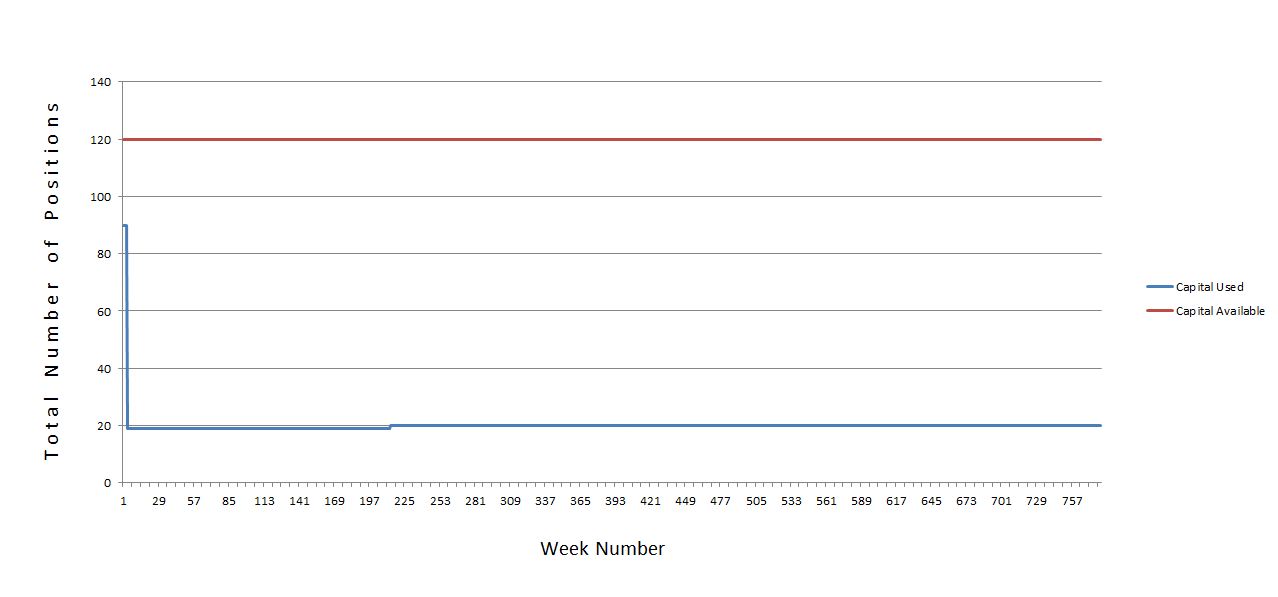

Last but certainly not least is the potential for large portions of capital to be sitting on the sidelines for extended periods depending on how the number of open positions is distributed over time. Suppose a 15-year backtest showed 90 trades to be open on three occasions for five trading days each and 20 positions to be open on average. To allow for a margin of safety, I might allocate for 120 positions. Here is a graphical representation of exposure:

Over 780 weeks (15 years), the space between the blue line and the red line represents capital sitting idle on the sidelines just in case the system ever needs it. That’s a lot of cash doing absolutely nothing but collecting 0.01% interest in today’s market environment.

Given this and the other problems/challenges discussed in the last two blog posts, my gut tells me to throw up my hands and say “forget it!”

Except for one thing. From http://www.optionfanatic.com/2012/11/08/position-sizing-implications-of-multiple-open-positions-part-1:

The goal of backtesting all S&P stocks and combining the results is to obtain data similar to trading SPY alone with a sample size large enough to be meaningful and not subject to outlier distortion. To do this, I will have to take every single trade since SPY is the composite of all 500 tickers.

I am not actually intending to trade all these individual stocks! I’m just trying to get results based on a large enough sample size to validate a SPY trading system. I don’t have to hold multiple positions. I don’t need a $50M account. I can let the computer simulate all this and then interpret the results for all 500 stocks as roughly equivalent (perhaps minus a constant tracking error for management fees) to the SPY ETF alone.

Categories: System Development | Comments (0) | Permalink