Investing in T-bills (Part 7)

Posted by Mark on February 27, 2024 at 10:26 | Last modified: March 25, 2024 15:04Before continuing to compare stock investing (S&P 500 ETFs and mutual funds, in particular) with synthetic long stock / T-bills, I have some other loose ends to tie up.

Let’s detail the first footnote from Part 4:

> The call is more expensive than the put because it includes over

> $2.00 intrinsic value. This is touched upon in the third paragraph

> here,but I would refer you to an introductory book/article on options

> for a more complete explanation. For at-the-money equity

> options, puts [premiums] are generally more expensive than calls.

The Options Playbook echoes this:

> If the stock price is above strike A, the long call will usually cost

> more than the short put. So the strategy will be established for a

> net debit. If the stock price is below strike A, you will usually

> receive more for the short put than you pay for the long call so

> the strategy will be established for a net credit. Remember: the

> net debit paid or net credit received to establish this strategy will

> be affected by where the stock price is relative to the strike price.

As I write in this sixth paragraph:

> Lots of ideas from financial professionals and investment gurus

> sound good, but I believe the only way to understand what has

> truly worked is to analyze the data.

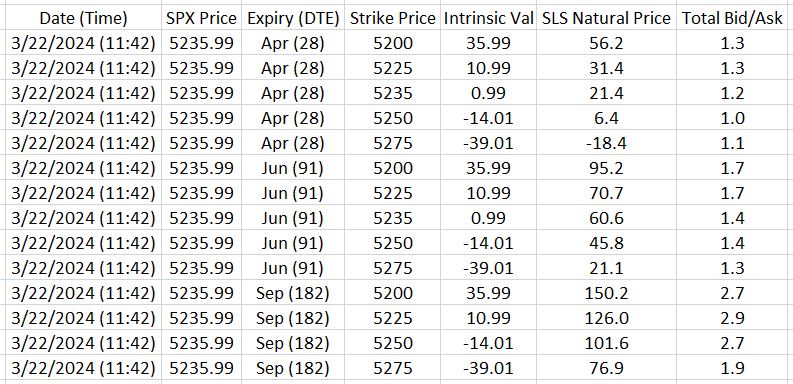

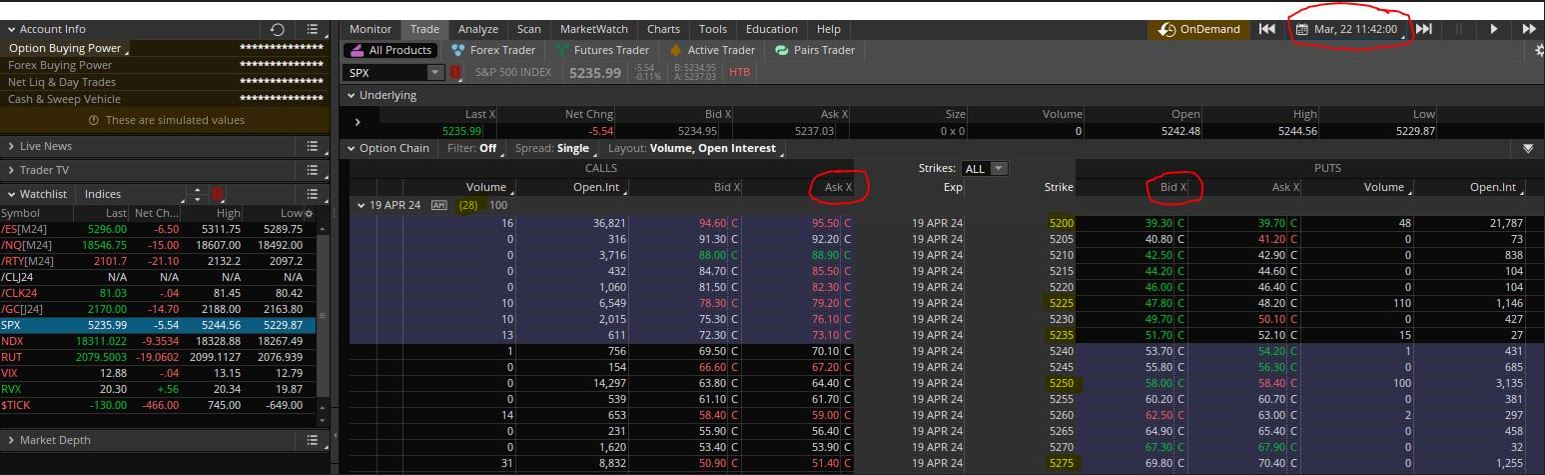

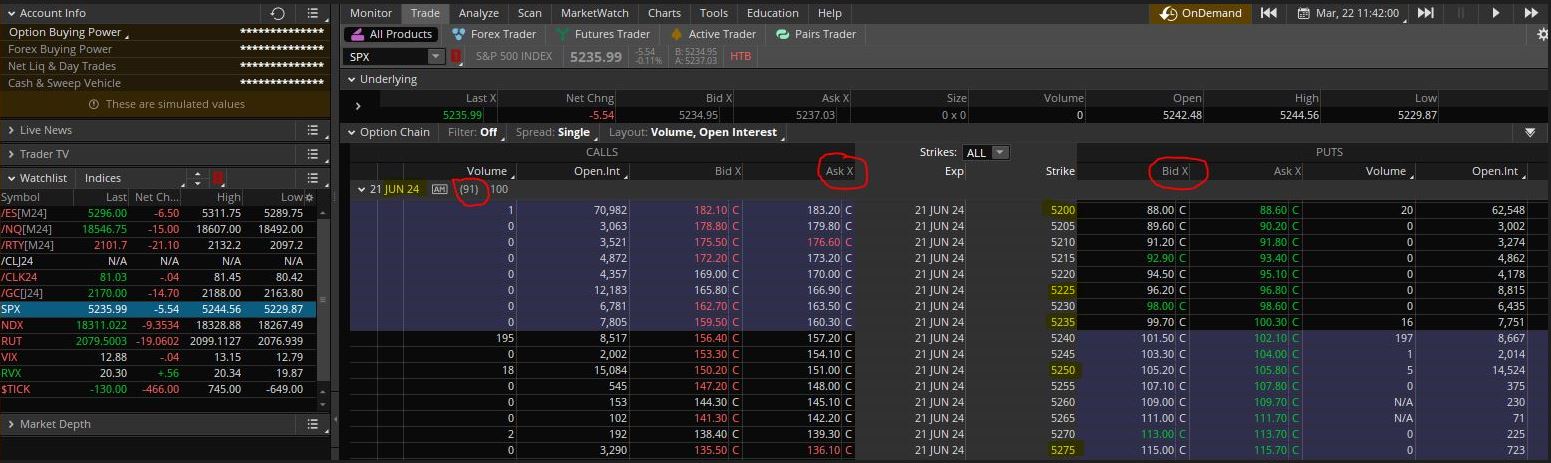

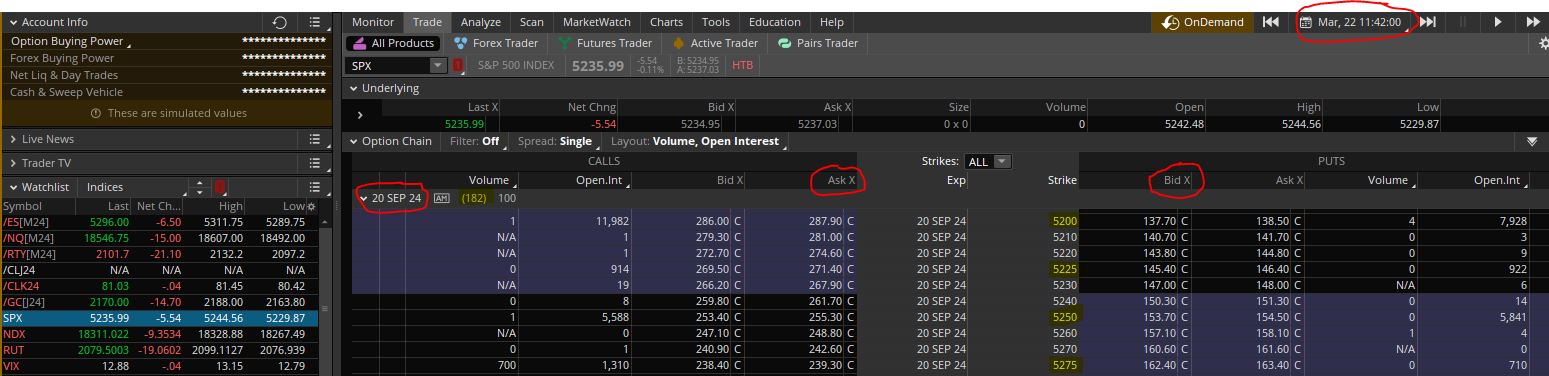

Let’s turn to some data in the form of option chains from three different expirations:

Extracting data from the circled columns, date, and highlighted strikes:

“SLS [Synthetic Long Stock] Natural Price” is the call [ask] premium minus put [bid] premium.

“Total bid/ask” is the sum of the ask premium minus bid premium for both call and put.

Although intrinsic value (strike price minus underlying price for puts and underlying price minus strike price for calls) is nonnegative, I have used a positive (purchase) and negative (sale) sign for calls and puts, respectively, in the “Intrinsic Val” column. This facilitates evaluation of the hypothesis that intrinsic value in calls (puts) makes SLS price higher (lower).

SLS price does indeed go down as intrinsic value shifts toward the puts.

In only one instance out of 14 is SLS price negative, however. I expected SLS of equal and opposite moneyness to have equal and opposite price (as Options Playbook implies above). A closer look at the option chains reveals calls in these near-the-money strikes to be more expensive than puts. This runs contrary to traditional wisdom about vertical skew ever since Black Monday (1987) and demands further research.

But wait: there’s more!

Next time I will continue with the most shocking revelation of all.

Categories: Option Trading | Comments (0) | Permalink