Naked Call Backtest (Part 4)

Posted by Mark on November 2, 2021 at 07:14 | Last modified: July 7, 2021 14:31Do you take it or leave it? I say the latter. With a couple changes, though, this trading strategy becomes a bit more enticing.

All of this exempts previously-addressed caveats having to do with dynamic strategy guidelines:

- Use OptionNet Explorer (ONE) between 3/23/2020 – 7/1/2021.

- Sell 10 naked calls in nearest weekly expiration (1 – 4 DTE) for just over $1.00/contract.

- Assess transaction fee of $16/contract for slippage and commission.

- Monitor market and/or trade once daily at 3:50 PM ET (3:45 PM ET starting Dec 2020).

- If ITM, roll to following weekly expiration as far OTM as possible for credit; increase size with discretion.

- Otherwise, rinse and repeat on expiration day with 10 new contracts.

With regard to (2), the target premium is $1.00 but I aim for ~$1.30 – $1.40 to offset transaction fees. If I have to pay material premium to close (e.g. more than $0.05) then I add to target premium in order to net target premium. For example, if I BTC for $0.75, then I will look to sell the next call for ~$2.00.

With regard to (5), I aim to increase size and leave sufficient cushion in case the market continues upward. What constitutes “sufficient” is what makes this discretionary.

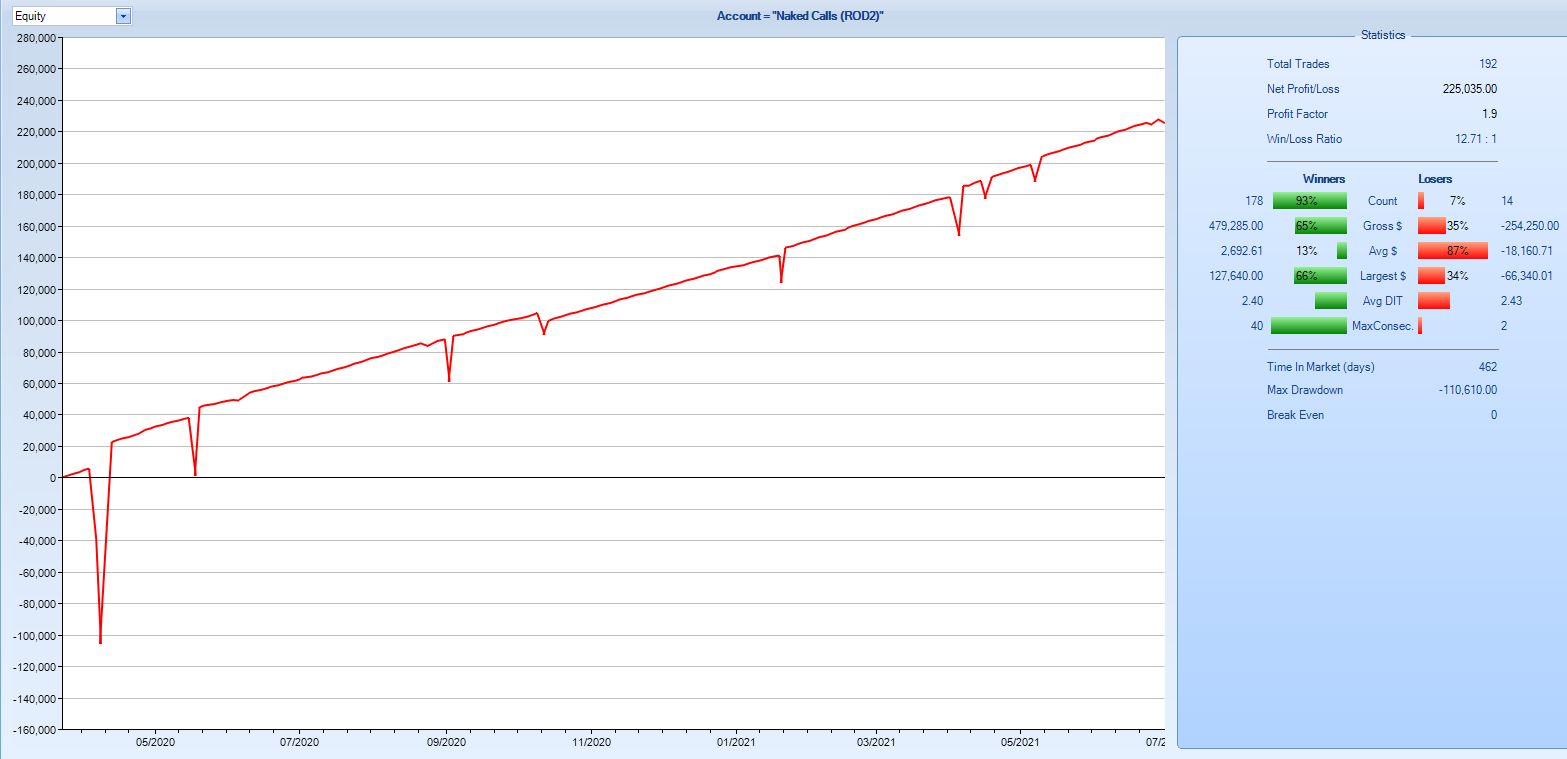

Here are the results:

Shocking improvement from Part 1! This equity curve climbs consistently with eight large, brief pullbacks. The average loss is about seven times the average win. While not so great, the strategy wins 93% of the time.

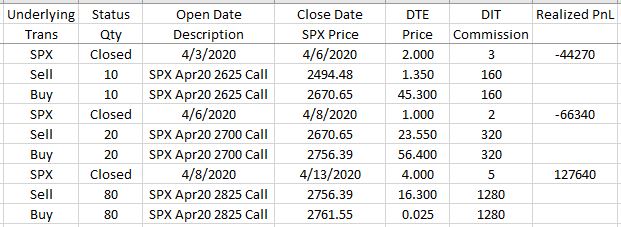

The maximum drawdown (MDD) occurs here:

Albeit confusing, SPX price increases 10% from April 3 – 14, 2020. I could have rolled the initial 10 to 40 instead of 20, but I would still have lost a second time and had to roll to 80 contracts. A market pullback allows for a profitable exit.

Is this a viable strategy for live-trading? Follow the logic:

- Contract size increases a maximum of eight-fold (significant improvement from 64-fold seen in Part 1).

- Err conservatively by position sizing for a 16-fold increase (one additional consecutive loss).

- Err conservatively by utilizing a 150-point call credit spread that costs an additional dime.

- Account for spread expense by subtracting ($0.10 + $0.16*) x 192 trades from $22,504 backtesting net profit.

- Max margin $15K/contract * 16 contracts = $240K.

- Net profit ~$17,500 in 16 months (rounding up) is ~5.6% annualized return (rounding down).

Given this may supplement a long portfolio, I am somewhat encouraged especially in comparison to the monthly approach.

Unfortunately, increasing position size is what makes this strategy work—not the strategy itself. When I apply constant position size throughout and add the additional cost to spread off risk, I get a profit factor of 1.03: dismal at best.

But, but… I’ll take any bonus return since I’m trading this sufficiently small to support a 16x increase in position size!

Is it conceivable that we could have more than four consecutive big up periods maybe lasting two weeks or more?

Could I go bust as a result?

Yes. Absolutely.

I will continue next time.

* — This is a very conservative estimate; with the option being $0.10, slippage would actually be half that.