2017 Performance Evaluation

Posted by Mark on August 31, 2018 at 06:50 | Last modified: September 4, 2018 11:53As I am a proponent of performance reporting, today I discuss my 2017 trading performance (also see here, here, and here).

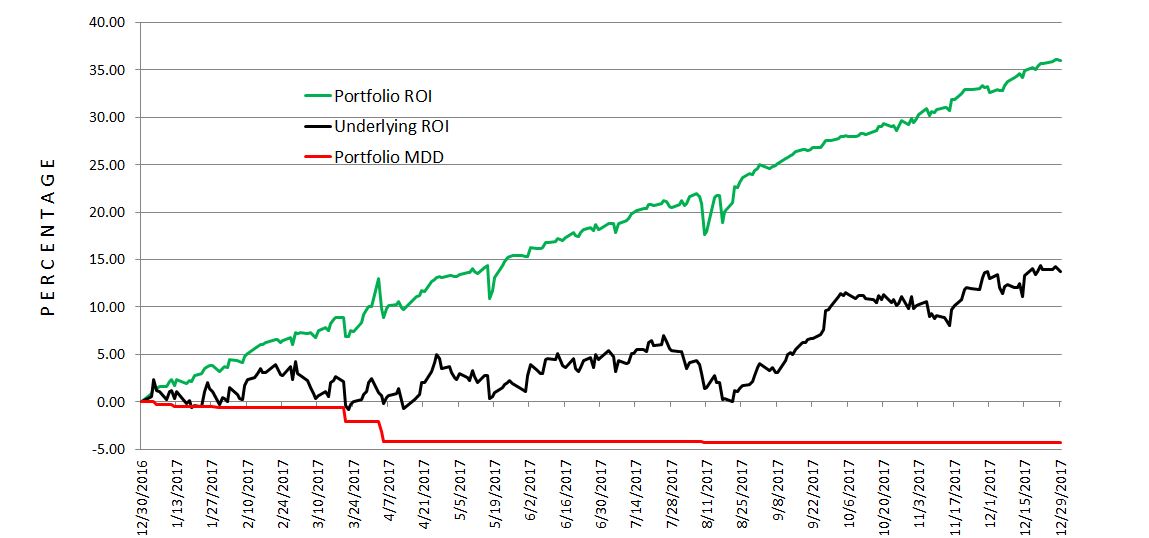

The green and black lines represent performance of my portfolio and the underlying, respectively. The latter is similar to a benchmark for comparison purposes without implementation of constant notional risk. MDD (red line) is maximum drawdown.

I generated +36% versus +14% for the underlying (dividend yield < 2% not included). My MDD was 4.3% versus 6.9% for the underlying, which gives me a risk-adjusted return (DD) 4.2x better. That is smashing. I also like to look at standard deviation (SD) of returns as a measure of risk. My portfolio posted a SD of 0.57, which is about 22% smaller than 0.73 for the underlying. This does not support my conclusion here, which I will soon update for a longer time frame. In the spirit of Sortino vs. Sharpe ratios, I looked at SD of negative returns (losing days) and found my portfolio with 0.60 to be 28% larger than 0.47 for the underlying.

I calculated a Sharpe-style (Sortino-style) ratio of 0.219 (0.208) for my portfolio versus 0.0738 (0.115). These calculations are based on daily returns rather than annualized but I think degree of outperformance is more important.

I also find it noteworthy that my portfolio had 83 losing days, which is ~26% fewer than 113 for the underlying.

Onward and upward, hopefully, for 2018!

Categories: Accountability | Comments (0) | PermalinkEnvestnet Case Study (Part 2)

Posted by Mark on August 28, 2018 at 06:38 | Last modified: January 26, 2018 12:57As my second TPAM to investigate, I began discussion of Envestnet before really scrutinizing their offerings. I now suspect them to be just another garden-variety, plain-vanilla IA that probably generates subpar returns and significant improvement.

Even though the website content is “for investment professionals only” (a topic I thoroughly covered beginning here), after a bit of digging I was able to find a performance chart to assess my suspicion. Because the website appeared current when I looked at it in November 2017, I was somewhat perplexed as to why 2016 was not included. In any case:

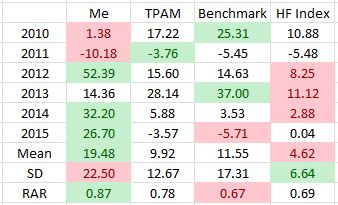

For comparison:

Green (red) shading is the best (worst) for each row. Risk-adjusted return (RAR) is average annual return divided by standard deviation (SD). Benchmark is a broad-based equity index. Hedge fund (HF) index is provided by Barclay Hedge.

My RAR beat Benchmark by 0.20, which makes me think that I performed well. I did realize a higher volatility of returns but this can sometimes be worthwhile if justified by net return. Consider that a 25% smaller position size would have lowered SD below Benchmark while still realizing a 3% better annualized return. This is why I calculate RAR.

The TPAM fared better (RAR) than Benchmark but worse than me. Cutting my position size by 45% would have lowered SD below the TPAM while still realizing a better annualized return by 0.79%. I find that surprisingly close. To look at RAR and say “0.87 vs. 0.78 is a 10% performance improvement” is misleading.*

As another angle of comparison, remember XC’s claim of outperformance by 25-50 basis points. My response was that any self-directed trader should aim to outperform by more than that. 79 is not much better than 50. I would rather see at least 150 to justify a management fee at least 1% higher. Of course, as discussed here, even a tiny management fee of 0.11% could make sense for me given ample assets to manage and no additional overhead.

Contrary to my initial suspicion, I do not think Envestnet’s showing is subpar nor, therefore, garden-variety either. It would seem that I have to be impressed with them. As another way of describing RAR [normalized for SD],* they outperformed the index by 136 basis points. Now that’s what I’m talking about! Kudos to Envestnet.

So far in my exploration of TPAMs, I have seen one good, one bad, and two that provide significant improvement.

I will continue to do more performance research to determine whether my numbers are in the ballpark of what financial institutions might be looking for in a TPAM.

With regard to my own performance, the above table has more to offer. I will discuss that next time.

* I need to re-evaluate this performance metric, which has been a favorite of mine. It might come down

to a comparison of percent difference, which is a multiplicative measure, and the additive difference of

annual outperformance.

Why Can’t I Speak Directly to my Advisor about Investment Performance? (Part 3)

Posted by Mark on August 23, 2018 at 07:14 | Last modified: January 25, 2018 11:07Today I conclude discussion about why some investment advisers like First Ascent and Envestnet will not speak directly to the retail clients they ultimately serve.

Picking up where I left off, I responded to Sean Gillian of Longs Peak Advisory Services:

> Would CCO [Chief Compliance Officer] apprehension about

> performance reporting, which may lead to problems with the

> SEC if not done properly, be mitigated if IAs were willing to

> undertake the expense of becoming GIPS complaint and verified?

Gilligan responded:

> Some CCOs don’t want to be GIPS compliant… [and verified]…

> because they consider that a risk. False claims of compliance

> are a risk so they worry about taking on the additional

> burden of making sure they are complying with something they

> are not otherwise required to do. In reality the SEC likes

> GIPS, but they do take the claim very seriously to make sure

> you truly are compliant if you say you are.

I am reminded of a financial advisor perspective suggesting greater liability for publishing inferential statistics where I wrote:

> Advisers should not publish statistical analysis because they

> may overstate importance to the uneducated reader? In my

> opinion, statistical analysis is necessary to suggest a

> difference might be meaningful. And only the author can do

> the statistical analysis since the entire data set is rarely

> (if ever) presented in the article itself.

Backing claims with statistics is the right thing to do because empty claims are potentially contaminated with underlying motives of sales and marketing teams. Similarly, I believe [GIPS compliant and verified] performance reporting is the right thing to do for anyone investing money for others. In both cases, doing the right thing seems to be the risky alternative.

Are regulations to blame for this non sequitur? I asked Gilligan:

> Is it a matter of their compliance department (or firm) not

> having a full understanding of the regulations, which makes

> them recommend erring on the side of caution?

He said:

> It is… compliance wanting to keep their job simple.

I asked:

> Why are portfolio managers [PM] okay with this? Do they

> realize compliance directs them to operate in this way out

> of a desire to “keep their job simple?”

Gilligan responded:

> I wouldn’t say that PMs are okay with this. Many firms have

> an ongoing debate between PMs/Marketing and their compliance

> department regarding… [advertisement of performance]. Larger

> firms form working groups with representatives from both sides

> that work to determine a compromise that everyone can live

> with and that becomes their firm policy.

>

> I agree with you that GIPS compliance is best practice and

> there should be transparency, but unfortunately it gets more

> complicated when compliance people are overly scared of

> regulators finding deficiencies in what they do.

He also pointed out that GIPS compliance is separate from general regulatory compliance (e.g. SEC or state registration), which makes me wonder what compliance members get scared. I would not think a firm like Longs Peak gets scared of regulators finding deficiencies. Longs Peak has experience and specializes in GIPS compliance. If they have doubts about whether they can do their job properly then I certainly would not want to hire them!

Unanswered questions remain but compliance and regulations seem to be complicating matters about the right thing to do.

Categories: Money Management | Comments (0) | PermalinkWhy Can’t I Speak Directly to my Advisor about Investment Performance? (Part 2)

Posted by Mark on August 20, 2018 at 06:59 | Last modified: January 25, 2018 10:54First Ascent’s reason for not speaking to me directly made sense but I did not remember any such SEC requirement from my Series 65 study. Since I am trying to learn about the industry, I e-mailed Sean Gilligan of Longs Peak Advisory Services.

Gilligan wrote:

> The SEC does not require performance to be presented in a

> 1-on-1 setting, but they do deem anything… presented outside…

> a 1-on-1… to be an advertisement. Advertisements are subject to

> more rules and disclosures than what is required when meeting

> 1-on-1 for a customized presentation.

>

> Likely the performance they have available to show is model

> performance… [always highly scrutinized by the SEC] rather

> than a composite of all actual accounts, which is what GIPS

> would require… it is easier for them to have you sit down

> with an advisor… [who] can… explain… differences that…

> exist between… model and a live account than… to make a

> broadly distributed advertisement piece…

Sounds like a legal proceeding with attorney dictating what can or can’t be answered, how to phrase responses, etc.!

I replied:

> As an IA, I would want to publish performance without need for

> a 1-on-1 consult. Being GIPS compliant, would I be able to do

> this? What really frustrates me is the fact that if I were to

> hire an advisor who sold funds from this company, I could not

> directly speak with those executing discretion over my money.

I am not able to speak with traders at a mutual fund but I can call and speak directly with a fund representative!

Gilligan responded:

> To clarify, you can show performance outside a 1-on-1 as

> long as you have the right disclosures and have calculated

> performance in an acceptable manner (e.g. SEC requires

> broadly-distributed performance to be net-of-fees, while

> 1-on-1’s can be gross-of-fees). As a GIPS compliant firm you

> would be REQUIRED to distribute performance to all prospective

> clients… [this firm] you spoke with probably had an internal

> policy not to distribute performance. Many CCOs are very

> conservative… [on this] because they feel it is too high

> risk… [may lead to SEC issues if done improperly]. Most

> likely the firm’s CCO made a policy not to distribute and

> blamed it on the SEC when explaining… Truly they could if…

> they… [took] the time to include… necessary disclosures.

I don’t blame First Ascent for bending the truth. Simplified explanations are best for laypeople.

I will conclude next time.

Categories: Money Management | Comments (0) | PermalinkWhy Can’t I Speak Directly to my Advisor about Investment Performance? (Part 1)

Posted by Mark on August 17, 2018 at 07:29 | Last modified: January 24, 2018 06:35I want to be able to communicate with the entity responsible for investing my money. Like First Ascent, though, the Envestnet website says “for investment professionals only.” It is not intended for private investors. Private investors interested in their investment services are told to contact a financial professional.

I asked First Ascent about this and got the following response:

> We aren’t able to provide performance directly to clients

> without an advisor. Because we do not work directly with

> retail clients, and offer our strategies only through FAs, an

> advisor is required to… present gross-of-fee disclosures

> regarding advisory fees along with performance.

>

> If you are interested I’d be happy to have a call and answer

> any other questions that you have.

I prodded further and asked why they would not discuss performance with me directly.

> I apologize that we can’t provide performance directly. The

> reason is that the SEC requires performance be presented in

> a one-one-one conversation by an IA who can provide

> prospectuses of funds used and information regarding the

> structure and fees of the underlying ETFs and mutual funds.

>

> Our strategies may also vary in their underlying holdings

> based on the requirements or preferences of the advisors we

> work with, and some strategies are restricted to advisors from

> specific organizations, so performance may vary.

See my comments on separately managed accounts.

> Because of this we prefer to distribute performance directly

> through the advisors we work with who can provide these

> disclosures and make sure they are providing performance

> for the appropriate strategies that they use.

This actually seems like a decent argument to me.

> If you are interested in working with a financial advisor I

> am happy to provide the names of some firms that utilize

> our strategies in your area.

I give them kudos for being courteous.

All of this reminds me of behind-the-counter (BTC) products at the pharmacy. BTC has been controversial since 1984 when a proposal was filed to change ibuprofen from prescription to over-the-counter (OTC) status. Opponents argued the switch could cause patient harm. Instead of being granted OTC status, many suggested the drug be placed in a new class of medications to be sold only in pharmacies despite not requiring a prescription for purchase.

Proponents of BTC argued that pharmacist counseling would add a layer of safety.

BTC opponents included the pharmaceutical industry and clinical physicians. The former claimed pharmacist counseling would not benefit the consumer. The latter argued counseling and gatekeeping BTC drugs were tantamount to practicing clinical medicine, which pharmacists are not properly trained to do.

In the same way that I believe pharmacists can provide necessary education and enhance public safety by dispensing BTC products (e.g. insulin, Sudafed), I also believe it makes sense to have a financial [literate] professional [without underlying motives] present performance information to put it in the proper perspective.

I will continue next time.

Categories: Money Management | Comments (0) | Permalink