Backtesting Frustration (Part 1)

Posted by Mark on June 26, 2017 at 07:42 | Last modified: February 27, 2017 10:56On Saturday I started a backtest. I only got through 15 minutes before I quit in frustration. Today I want to explain why this happened and possibly flush out some insightful principles about the backtesting process as a result.

This is going to be a tough blog post to write. I just went for a dark chocolate mint 3 Musketeers bar. If I had candy corn here then I would have grabbed that. My best friends know what this means. Everyone else can probably guess.

I have brainstormed a good 1,200 words on this subject and full explanation of some of these concepts could be a lot lengthier. Some of these are lines of thinking having to do with statistics, trading system development, software, and intraday vs. end-of-day trading. If I can succeed in presenting the material in an organized fashion then at the very least it should be good fodder for discussion. At most it may serve as dynamic teaching material.

My first hassle when it comes to backtesting is how to label spreadsheet columns. What may seem like a simple detail really defines the whole thing. For the next few (to several) months I will be looking for and recording data defined by the column headers. If I get to the end and realize I forgot something critical then I may bang my head because I’ll be looking at months of additional work to go back and gather information rather than a few extra seconds per backtrade when I had the proper information on the screen.

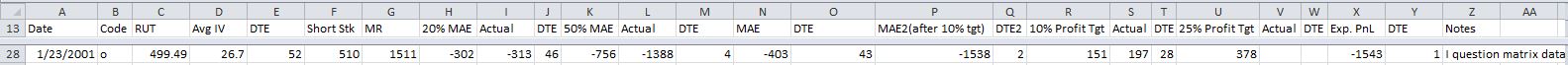

My intent this past Saturday was to backtest a symmetric butterfly strategy. Here were the column headers I chose:

Font too small? Welcome to my world of squinting eyes. If I make it bigger then fewer columns fit on the screen at once and I have to use the scroll bar to enter routine data. Each second this adds gets multiplied by up to 4,000 backtrades, which also gets multiplied by two (back and forth).

Column (“Col”) A is date of trade inception. Col B is a letter code used to identify each day’s trade from all the trades currently in the transaction log. In OptionVue (the software I use) parlance this is called the R-code. Col C is the underlying price, Col D is the average implied volatility for all options in the chain, Col E is days to expiration (DTE), and Col F is the short strike for this position. Col G is the initial margin requirement for this position.

I have covered enough ground to explain some frustrations I have with the software itself. I will pick up here next time.

Comments (5)

[…] #1 regards buggy R-codes (see last post), which has gotten worse over the last year’s worth of software updates. Positions displayed […]

[…] but some periodic comic relief along with that candy are what it’s taking to get me through a subject like […]

[…] has been a very beneficial exercise in expository writing because at the outset I was not sure I would ever get through. One question remains: why bother backtesting 2001 – 2003 if this part of the database has so […]

[…] thing that came to mind from my recent blog series on backtesting frustration was the distinction between end-of-day (EOD) and intraday […]

[…] I resume my series on backtesting frustrations by talking about the frustration of […]