Dynamic Iron Butterflies (Part 3)

Posted by Mark on February 10, 2017 at 06:58 | Last modified: December 7, 2016 15:25In the last post I suggested overstatement of transaction fees may have been the difference between a winning and losing dynamic iron butterfly (DIBF) backtest.

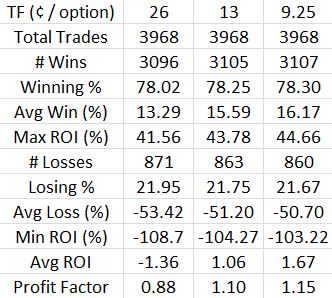

I crunched the numbers and can now speak definitively to that hypothesis. Here are the overall backtested trade statistics recomputed for different transaction fees (TF). The second column is the $0.26/option used in the original backtest:

Indeed, lowering the transaction fees does make this a profitable trade. While the profit factor of 1.15 is not nearly as impressive as the 1.58 seen for naked puts, it is at least profitable.

Put another way, these numbers provide reasonable doubt as to whether the DIBF is actually a losing trade. My preference is still to bias slippage in favor of loss and regardless of the heavy slippage applied, I want to see if I can do anything to boost the average trade and make this strategy more encouraging.

Doing the backtest helped me discover two potential problems.

First, the DIBF has a varied reward-to-risk ratio (RRR). I noticed at times the RRR was downright rotten (less than 1.0). This could be improved by decreasing the width of the put wing. I suspect a lower RRR might lead to a lower winning percentage and a longer time in the trade because the T+0 curve is particularly steep to the downside in relation to the limited potential profit at expiration. RRR was not tracked in the current backtest so my suspicion remains speculative.

My second issue with the strategy is the fact that it is a combination (of an iron butterfly and put credit spread). Selling an OTM long put and buying one further OTM—a credit spread—is what makes it “dynamic.” Before delving too much into the results of a combination strategy, I feel inclined to first study a plain iron butterfly. I may or may not do that before having the confidence to trade the DITM regularly.

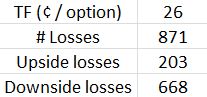

Thanks to Pete_UK for helping me calculate the directional breakdown of losses in a hurry:

This compounds my concern about adding a put credit spread to the iron butterfly.

Comments (3)

[…] last post was a hodgepodge of information about the dynamic iron butterfly (DIBF) backtest and I’m […]

[…] execution can definitely improve profitability of the dynamic iron butterfly (DIBF). This makes me wonder about placing the trade […]

[…] days so the main reason my backtest failed to impress is because the results were inconclusive. Slippage really made the difference between a trade that was profitable and one that was not. While tantalizing to think I can overcome […]