Naked Put Backtesting Methodology (Part 4)

Posted by Mark on August 19, 2016 at 07:10 | Last modified: July 15, 2016 11:26I continued last time talking about fixed notional risk. When backtesting this way, limited notional risk results in decreased granularity and significant error.

To better understand this, I listed the strikes used throughout the 15-year backtest in a spreadsheet. For each strike I calculated contract size corresponding to a defined notional risk. I then rounded and determined the error as a percentage of the calculated contract size. I started by keeping a cumulative tally of the error to see how that differed across a range of notional risk. Error may be positive or negative depending on whether the calculated contract size is rounded down or up, respectively. The cumulative tally therefore went up and down over the range of strikes and was not very helpful.

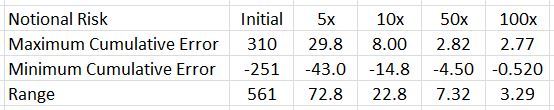

I then looked at the maximum and minimum values of cumulative error. This is what I found:

The greater the notional risk used, the lower the range of cumulative error. This illustrates the granularity issue. More granular (larger) position sizing means decreased error. Decreased error means more stability in notional risk, which I am attempting to hold constant throughout.

Backtesting my account size would have limited contract size significantly and introduced a large amount of error due to the lack of granularity. I therefore decided to increase notional risk (250x) to minimize error.

One question that remains is whether I have created an artificial situation that is incompatible with live trading. More than anything else, I am trying to get a good sense of maximum drawdown when trading this way and for this reason, I believe backtesting will provide useful information unlike any backtesting results I have seen before.