Truth in Backtesting (Part 7)

Posted by Mark on December 24, 2012 at 04:49 | Last modified: December 7, 2012 13:36In http://www.optionfanatic.com/2012/12/21/truth-in-backtesting-part-6/, I hypothetically wiped the slate clean of all accumulated book knowledge to illustrate some other misleading applications of the system development process. I am currently applying the CDC system to S&P 500 stocks the way an average Jane might approach system development with analytical software.

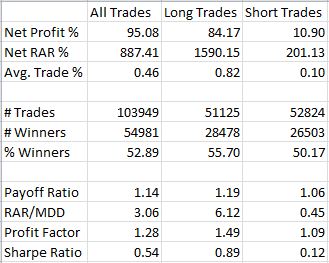

Backtest #21464 was an improvement over the one before it. The next step is to assess the impact of the Bollinger Band (BB) breakdown/breakout filter and 200-SMA filter by removing them. I also reset CDCs back to four. The following is backtest #21466 and should be compared to backtest #21463 (http://www.optionfanatic.com/2012/12/21/truth-in-backtesting-part-6/):

Net profit % and # trades are much larger, which suggests the filters had a dramatic effect. PF is down from 1.46 to 1.28 but for long trades, PF is 1.49 compared to 1.58 with the BB filter. That is not a big difference. In fact, everything about long trades here is much better than short trades: better RAR%, much better average trade %, much better subjective function, PF, and SR.

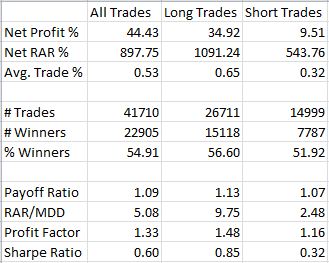

Since I made two changes to get these results, I will next reinstate the 200-MA filter. This is backtest #21467:

As with backtest #21466, long trades perform much better than short trades: average trade % is double, the subjective function is better than triple, PF and SR are all much improved.

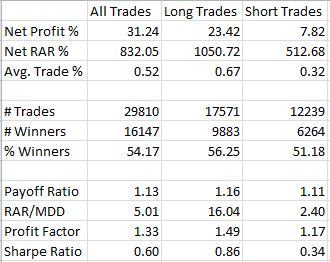

What if the 200-MA filter is shortened such that long (short) trades are only taken when price closes above (below) the 50-MA instead? This is backtest #21468:

This decreased the number of trades and net profit % compared to #21467. That makes sense since the 50-MA will track closer to price than the 200-MA and therefore may be more restrictive. The efficiency of this system is comparable to the 200-MA system, however, based on net RAR%, the subjective function, PF, and SR.

I will continue this analysis with my next post.

Categories: Backtesting | Comments (0) | Permalink