Truth in Backtesting (Part 6)

Posted by Mark on December 21, 2012 at 02:47 | Last modified: December 7, 2012 13:24So far in this series (e.g. http://www.optionfanatic.com/2012/12/04/truth-in-backtesting-part-5/), I have discussed the misleading nature of EOD backtesting when trade delays are not used. Today I want to use the Consecutive Directional Close (CDC) system to start discussing another misleading aspect of backtesting: multiple positions.

Consider this the beginning of a new day. I wake up bright and early (well not so bright because I really do like to wake up extremely early), jump out of bed, and shake off all book knowledge pertaining to system development that I have accumulated over the past couple of years. My mind reverts to old patterns of knowledge. I just got AmiBroker and now I’m ready to play.

I start by coding the CDC system and setting the filter to S&P 500 stocks. I set initial equity to $50,000,000, maximum number of open positions to 500, number of CDCs to four, and length of trades to five. I set position size to $100,000 and I include a couple other filters in the buy and short conditions: Bollinger Band breakdown or breakout and price above or below the 200-SMA for long and short trades, respectively. I include a liquidity filter to make sure the position size divided by closing price is less than 1% of the average daily volume over the past 50 days. Backtesting dates are 1/1/1980 through 11/30/2012. Commissions are assessed at $8/trade. Buys and sells are executed at the next open.

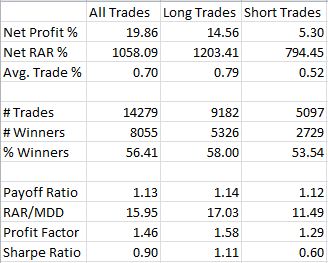

The results for backtest #21463 are as follows:

RAR = risk-adjusted return (i.e. performance if the system were in the market 100% of the time)

Payoff Ratio = average winning trade / average losing trade

RAR/MDD = the subjective function

I will use PF and SR as abbreviations for Profit Factor and Sharpe Ratio, respectively.

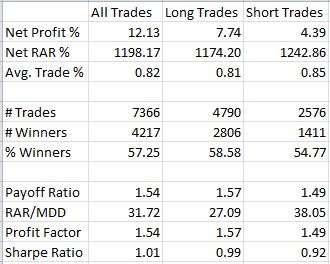

These results aren’t bad, but I want to see if I can make the system more efficient. I increase CDC to five. Here are the results of backtest #21464:

These results are better. While net profit is lower, the system has become more efficient (PF is higher along with payoff ratio, subjective function, and SR).

I will continue this analysis in my next post.

Comments (1)

[…] of the CDC trading system with S&P 500 stocks. I started with initial backtests in http://www.optionfanatic.com/2012/12/21/truth-in-backtesting-part-6/ and have continued to explore one or two modifications at a […]