Trading System #2–Consecutive Directional Close (Part 11)

Posted by Mark on December 5, 2012 at 06:10 | Last modified: November 23, 2012 05:07Back in http://www.optionfanatic.com/2012/10/31/trading-system-2-consecutive-directional-close-part-1, I stated the initial trading claims upon which the CDC trading system is based. I will now assess those claims.

The claims are as follows:

> From 1995-2007, after the SPX has dropped three days in a row, it has risen more

> than 4 times its average weekly gain over the next five trading days.

>

> And, after the SPX has risen three days in a row, it has on average lost money over

> the next five trading days.

My backtesting dates are from 1/29/1993 – 9/30/2012. I have included $8/trade commissions and delays for buy orders (i.e. buy at the next open). The backtesting includes long trades only.

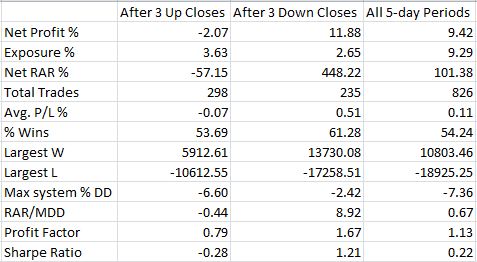

Here are the data for SPY:

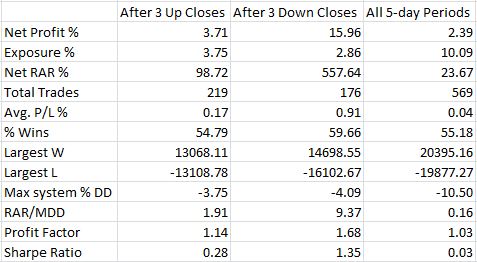

Here are the data for QQQ:

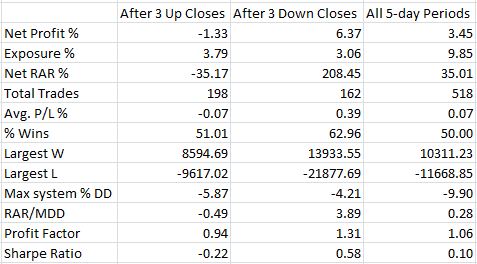

Here are the data for IWM:

The first claim is true. After falling on three consecutive days, the index rose over four, 22, and five times its average weekly gain for SPY, QQQ, and IWM respectively.

The second claim is also true: after rising on three consecutive days, SPY lost money on average over the next five days. This was also the case for IWM.

Categories: System Development | Comments (1) | Permalink