Meetup Update (Part 3)

Posted by Mark on August 17, 2015 at 04:40 | Last modified: October 12, 2015 15:34As previously discussed, the Tuesday Meetup included some boisterous, opinionated discussion along with a “professional quant” in attendance. Nothing there was actionable.

While I enjoy and recommend the Wednesday Meetup, I did not find that content actionable, either. While the title includes the words “investment academy,” this Meetup is an order of magnitude less specific than helping people to trade profitably. I do not fault the organizers since they cater to beginners. They did say on Wednesday one directive is to foster collaboration among the group, however. I will keep my eyes open over the next few events to see if we move any closer to fulfilling this actionable promise.

I have organized a small option trading group that meets every week. We have roughly six regular participants and a Yahoo! Group. I posted extensively about my losing weekly calendar and one other member posted about a losing monthly trade. Nobody else mentioned any losing trades. I thought back over the last few weeks and realized that while I post about my losing trades often, rarely does anybody else.

At the Wednesday Meetup, Mr. Know It All said he lost money that day in response to my direct questioning. Thinking such a wide-ranging market day would be good for day trading, I asked for details. He spoke for a couple minutes and then quickly changed the subject. Why he lost could have been precisely the kind of actionable information I seek but alas, that was not to be forthcoming.

On Tuesday night, I didn’t hear any meaningful discussion about losses aside from the Forex guy who is on a crusade. Contrary to my thesis, this might not be a reflection of inflated egos but it does make me wonder whether anybody is actually trading. The woman in attendance who I found to be extremely amusing said she was flat right now awaiting further direction by the market.

I will continue with my thesis on losses in the next post.

Categories: Trader Ego | Comments (2) | PermalinkGrow Up! (Part 3)

Posted by Mark on November 20, 2014 at 05:35 | Last modified: April 29, 2015 09:55The last post was my response to a disgruntled student trader who lost big money on a collar trade. I have one further critique for today: I don’t think her claim even makes sense!

JD tried to accuse X for big losses on a collar trade due to undisclosed risk of the collar trade itself.

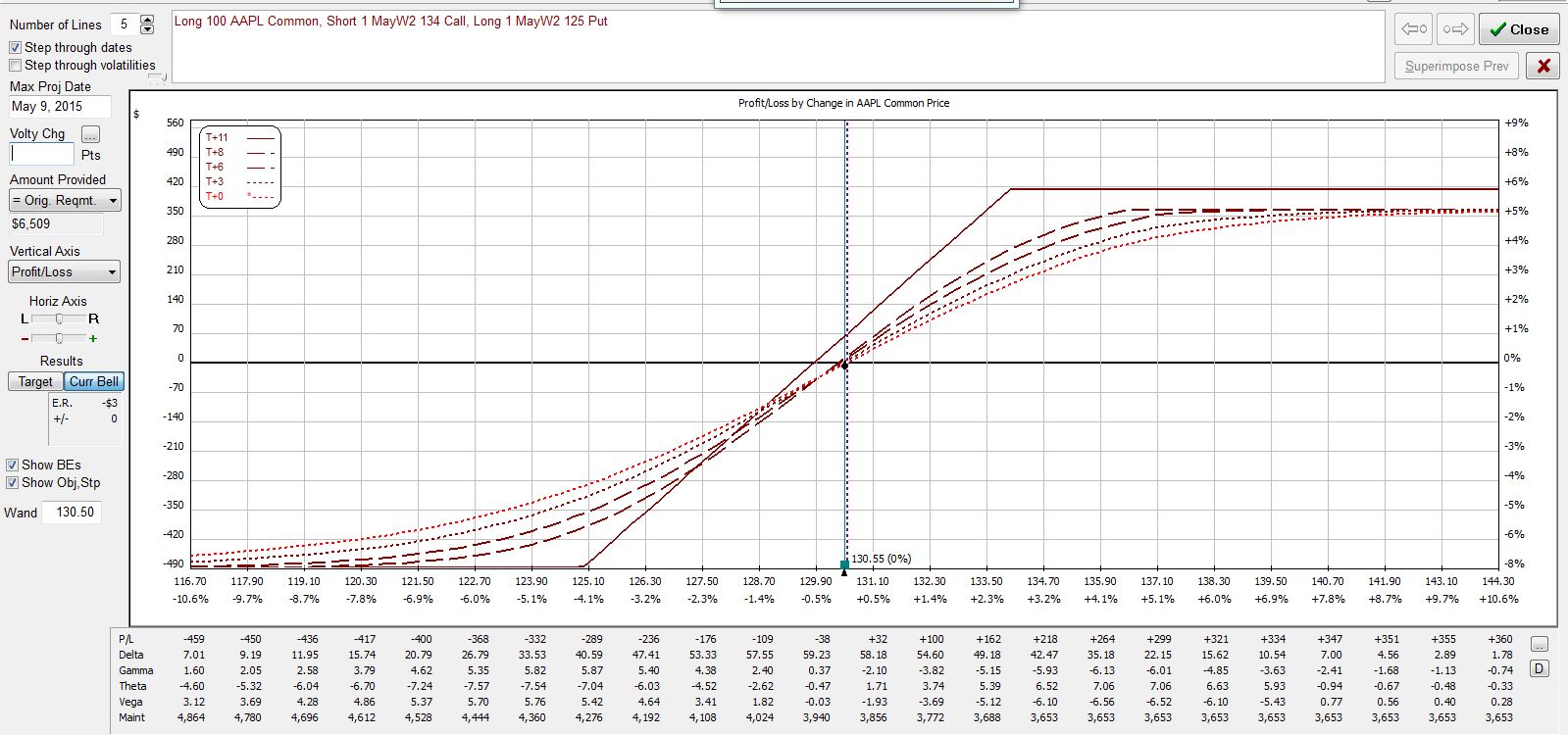

Here’s the risk graph for a zero-cost collar trade:

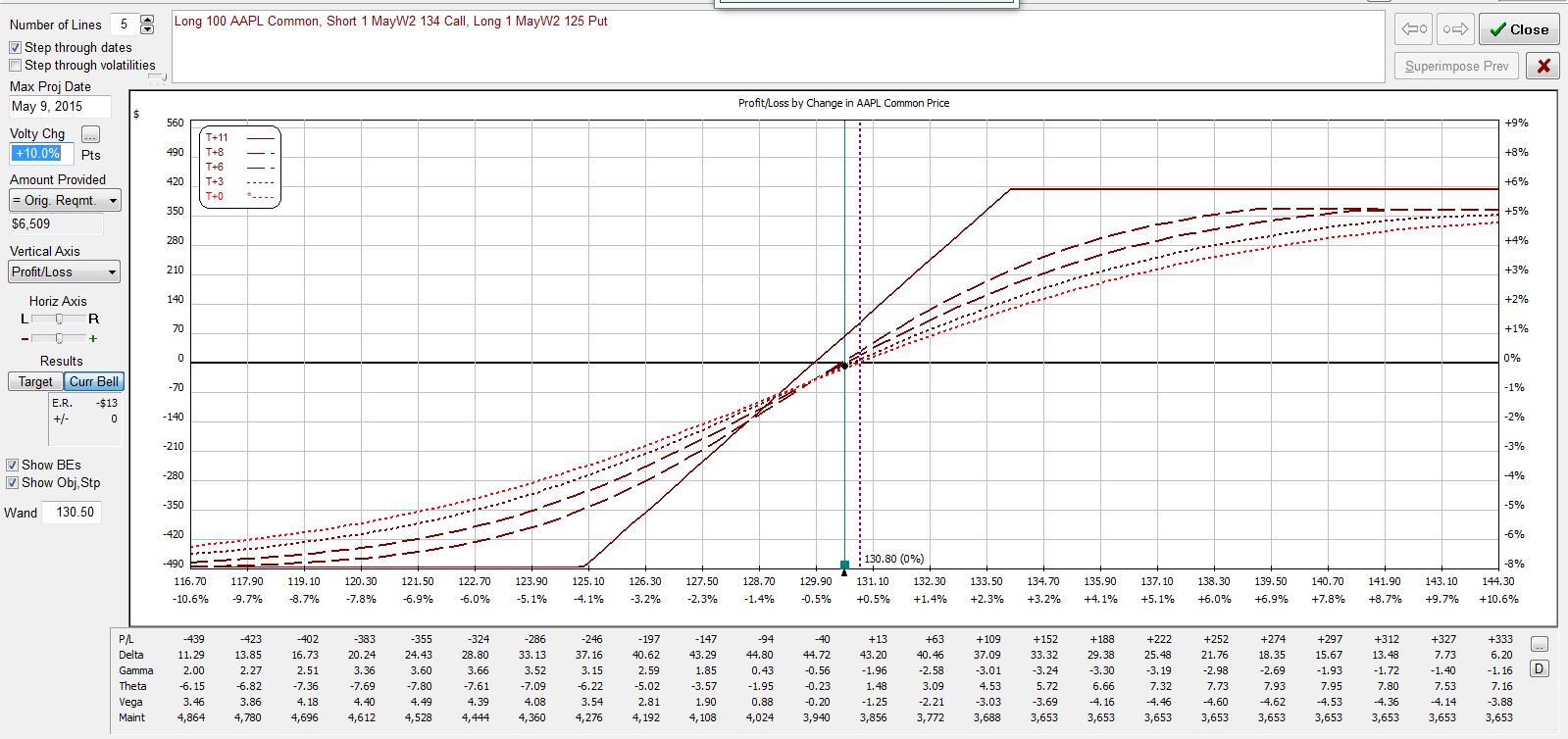

For her to lose on the trade, the stock must have gone down. If implied volatility increased by 10% then the risk graph would look like this:

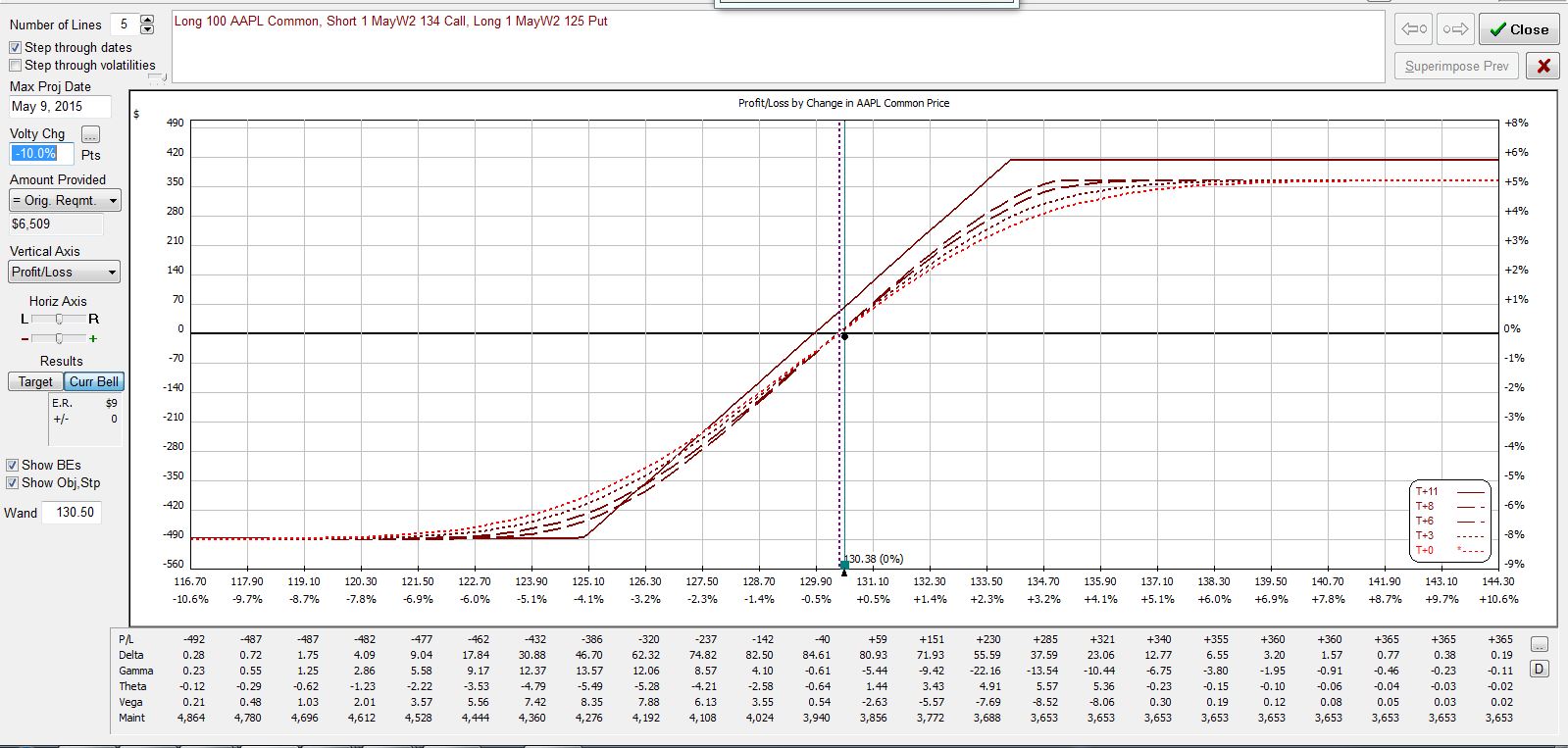

The T+0 line (today) actually flattens out, which prevents the loss from being as big! If this were earnings and implied volatility actually decreased by 10% then the risk graph would look like this:

Compared to the first image, losses along the T+0 curve are worse here. However, note that in all three graphs, the expiration curve is identical. Even if losses were worse today, in 11 days there would be no difference.

Aside from not blaming anyone but herself, the only thing JD really should have critiqued was her stock selection. This trade lost money because the stock went down: period! A collar trade is a collar trade: it caps potential losses. To blame the collar trade strategy for losses really makes no sense in any context.

The bottom line here is about trader psychology. I believe to be successful we must own responsibility for every trading-related activity we do. I am the only one who submits orders and clicks the execute button. If I am going to blame anyone then it should be me.

On another hand, I could just realize “you can’t win ’em all” and expect some trades to be losers. In that case, I have no need to blame anyone for trades that do not go my way.

Categories: Trader Ego | Comments (0) | PermalinkGrow Up! (Part 2)

Posted by Mark on November 17, 2014 at 07:21 | Last modified: April 29, 2015 09:28Today I continue with my response to a forum post from a disgruntled student of options trading:

> Disclaimer: I mean no offense here, JD, but I do hope you

> learn something.

>

> I believe your post is inappropriate. Your post does nothing

> less than blame X for losing money. As a student, you should

> only be doing paper trades for now and paper losses do not

> justify the harsh tone of your post. If this were a real

> trade then you deserve the consequences because you should

> not yet be trading real money! That has been repeated over

> and over and over around here. If you are a graduate of this

> program and do not know the real risk of collars then you

> clearly didn’t put much effort into learning the material

> and/or listening to lectures.

>

> Ultimately, if you’re going to be a successful trader then

> you need to take responsibility for yourself. You will have

> winning trades and you will have losing trades. The losing

> trades are not the market’s fault, not X’s fault, not a

> coach’s fault: they are your fault and your fault alone.

>

> Understand the responsibility and own it. If you traded

> too large and suffered a loss too great for you to bear

> then learn the lesson and vow to do better next time

> so it doesn’t happen again.

>

> In trader psychology terms, grow up JD.

That pretty much says it all.

I’ll save one more thought on this matter for the next post.

Categories: Trader Ego | Comments (1) | PermalinkGrow Up! (Part 1)

Posted by Mark on November 14, 2014 at 06:21 | Last modified: April 29, 2015 09:24My last series of posts was based on an e-mail correspondence I had a few years ago. Today I continue that “blast from the past” with a quick hitter: a forum post from March 2013.

This post was made in the forum belonging to an option education community. She wrote:

> The down side of collars

>

> I went to your summit lecture on collars and came away thinking

> this was a way to protect a position. No where did you explain

> about what you are risking by putting on a collar. So I put on

> a collar on ARMH since it’s PE is so high and there was some

> uncertainty about just how much the Arm chips would contribute

> to the Galaxy 4 announced Thursday.

>

> The result was I’ve now lost almost $13,000. You never said

> that the cost of the collar if the stock goes up is so high!

> Not only is there the cost of the options but all my gains

> from the stock going up are offset by the decline in option

> value. The collar is a dangerous trade unless you are really

> convinced that the stock is going down. Just my opinion but I

> really think you should have told us about the substantial

> down side of using options.

>

> Signed,

> JD

I will continue with my response in the next post.

Categories: Trader Ego | Comments (1) | PermalinkDo You Know if Successful Traders Exist?

Posted by Mark on March 7, 2012 at 15:13 | Last modified: March 7, 2012 15:35At first glance, successful traders are found and documented most everywhere you turn. Examples include folks who run mentoring programs or serve as trading instructors, profitable traders documented in literature (e.g. Master Traders, Market Wizards, Reminiscences of a Stock Market Operator), friends or third-hand acquaintances who have made great sums of money in the markets, ex-floor traders, etc.

An imbalance does exist, however, with regard to what it takes to garner a following in the stock markets and other disciplines. As a pharmacist, I usually had at least 10 people seeking my wisdom every single day about medications and supplements. To earn that coveted opinion, I worked my butt off for four long years of pharmacy school in exchange for a doctorate. Contrast this with the world of investing where trading gurus need only make claims of success, be convincing in their delivery, and perhaps show a profitable trade or two before others seek their direction to wealth nirvana. In many cases, people will purchase wares written by these trading gurus or pay good money to attend seminars.

Indeed, the credibility imbalance is real because it doesn’t take much to discount every category of “expert” mentioned in the first paragraph. How do you know said trading “mentors” or “teachers” ever made consistent profits on their own in the financial markets? The same applies to friends or third-hand acquaintances. Have you ever looked at their tax returns? Have you ever seen brokerage statements or trade confirmations? The same may be said of “great traders” written about in books. Jesse Livermore, in fact, went bankrupt in 1934 and was suspended by the CBOT. I know of a couple ex-floor traders who blew up accounts and chose to go into teaching.

What motives have these people to lie, you may ask. Two of them are money, fame, fame, and money. Who exactly can you trust when trying to measure up against these?

If testimony to financial market success in on trial then reasonable doubt certainly abounds with regard to its veracity.

Tags: critical thinking | Categories: Trader Ego | Comments (2) | Permalink