Grow Up! (Part 3)

Posted by Mark on November 20, 2014 at 05:35 | Last modified: April 29, 2015 09:55The last post was my response to a disgruntled student trader who lost big money on a collar trade. I have one further critique for today: I don’t think her claim even makes sense!

JD tried to accuse X for big losses on a collar trade due to undisclosed risk of the collar trade itself.

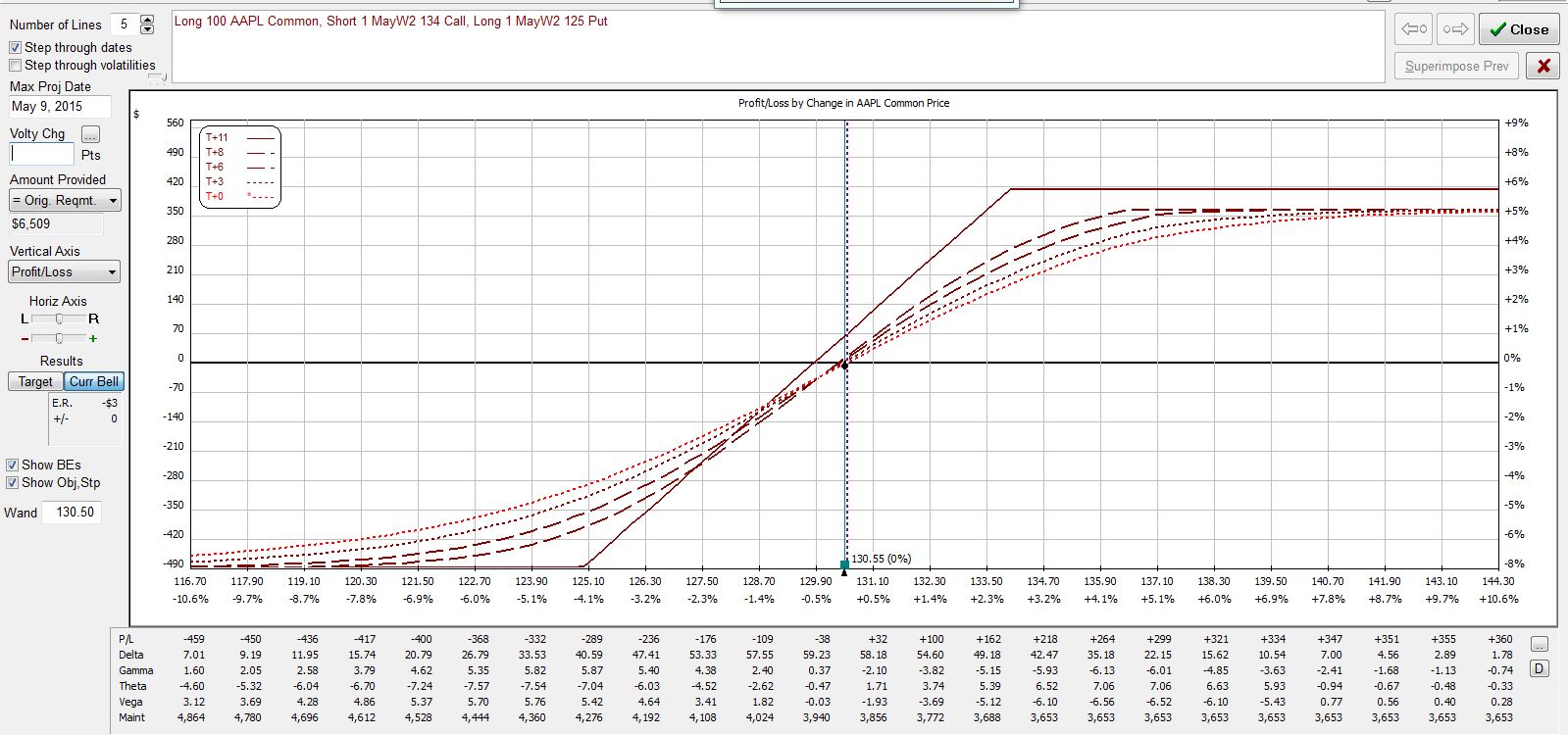

Here’s the risk graph for a zero-cost collar trade:

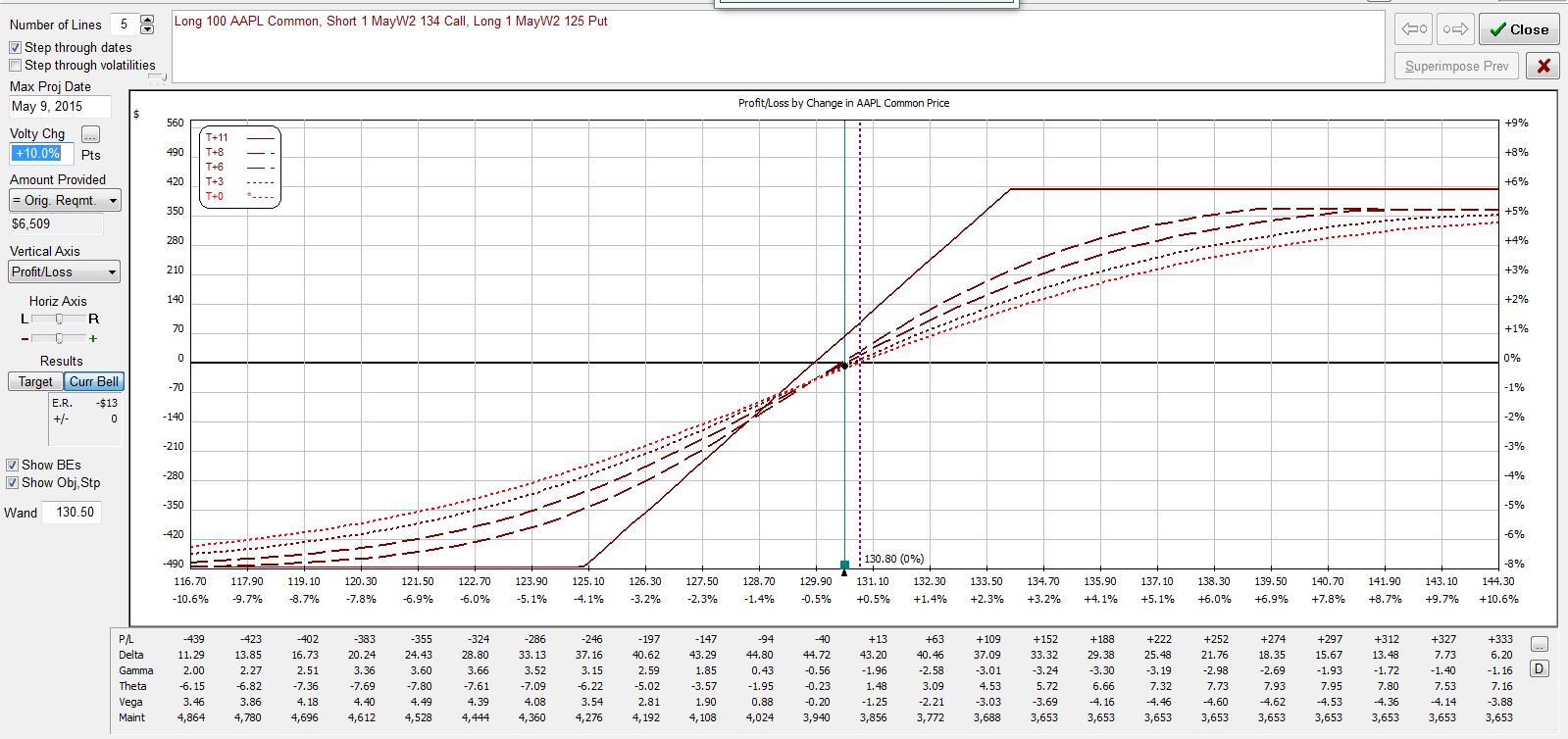

For her to lose on the trade, the stock must have gone down. If implied volatility increased by 10% then the risk graph would look like this:

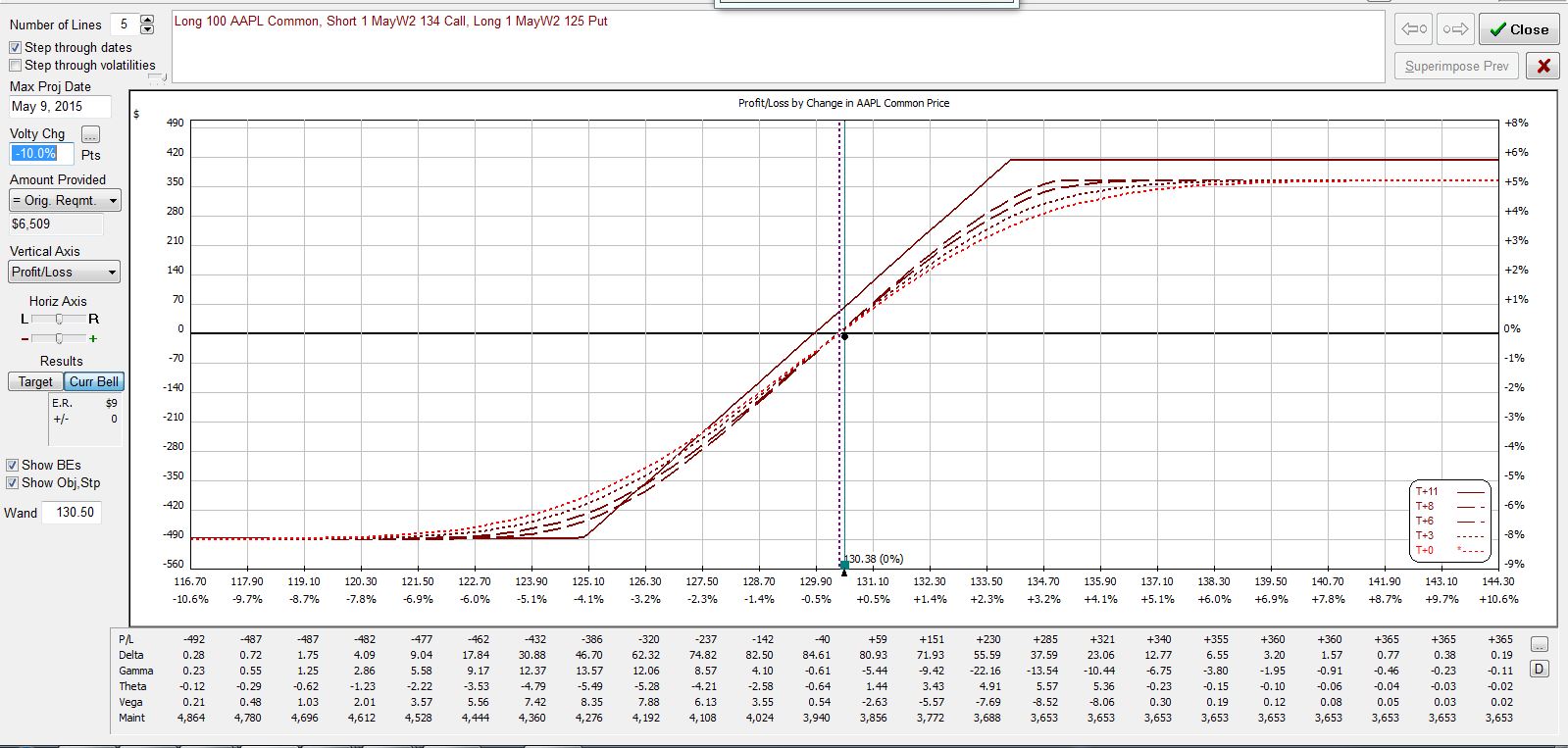

The T+0 line (today) actually flattens out, which prevents the loss from being as big! If this were earnings and implied volatility actually decreased by 10% then the risk graph would look like this:

Compared to the first image, losses along the T+0 curve are worse here. However, note that in all three graphs, the expiration curve is identical. Even if losses were worse today, in 11 days there would be no difference.

Aside from not blaming anyone but herself, the only thing JD really should have critiqued was her stock selection. This trade lost money because the stock went down: period! A collar trade is a collar trade: it caps potential losses. To blame the collar trade strategy for losses really makes no sense in any context.

The bottom line here is about trader psychology. I believe to be successful we must own responsibility for every trading-related activity we do. I am the only one who submits orders and clicks the execute button. If I am going to blame anyone then it should be me.

On another hand, I could just realize “you can’t win ’em all” and expect some trades to be losers. In that case, I have no need to blame anyone for trades that do not go my way.