Time Spread Backtesting 2022 Q1 (Part 5)

Posted by Mark on July 5, 2022 at 06:25 | Last modified: April 15, 2022 15:51I’m in the process of manually backtesting time spreads through 2022 Q1 by entering a new trade every Monday (or Tuesday).

I left off describing the controversy of managing time spreads. Simply with regard to adjustment timing, I have mentioned:

- ROI% thresholds

- Repeating ROI% thresholds if PnL “recovers” (and the need to operationally define that word)

- TD

- Drawdown %

- Using the spread strike prices as adjustment thresholds

With SPX at 4474, trade #7 begins on 2/7/22 at the 4475 strike for $8,041: TD 46, IV 20.5%, horizontal skew -0.1%, NPV 367, and theta 47. This trade reaches PT on 24 DIT with one adjustment for a gain of 10.4%. Max DD is -12%.

With SPX at 4403, trade #8 begins on 2/14/22 at the 4425 strike for $5,528: TD 25, IV 23.5%, horizontal skew 0.1%, NPV 246, and theta 27. This trade reaches PT on 29 DIT with one adjustment for a gain of 12.4%. Max DD is -10.3%.

With SPX at 4292, trade #9 begins on 2/22/22 at the 4300 strike for $5,698: TD 37, IV 26.5%, horizontal skew 0.2%, NPV 246, and theta 32. This trade reaches PT on 15 DIT with no adjustments for a gain of 15.0%. Max DD is -3.7%.

With SPX at 4366, trade #10 begins on 2/28/22 at the 4375 strike for $5,998: TD 37, IV 26.1%, horizontal skew 0.2%, NPV 261, and theta 35. This trade reaches PT on 15 DIT with no adjustments for a gain of 10.7%. Max DD is -3.5%.

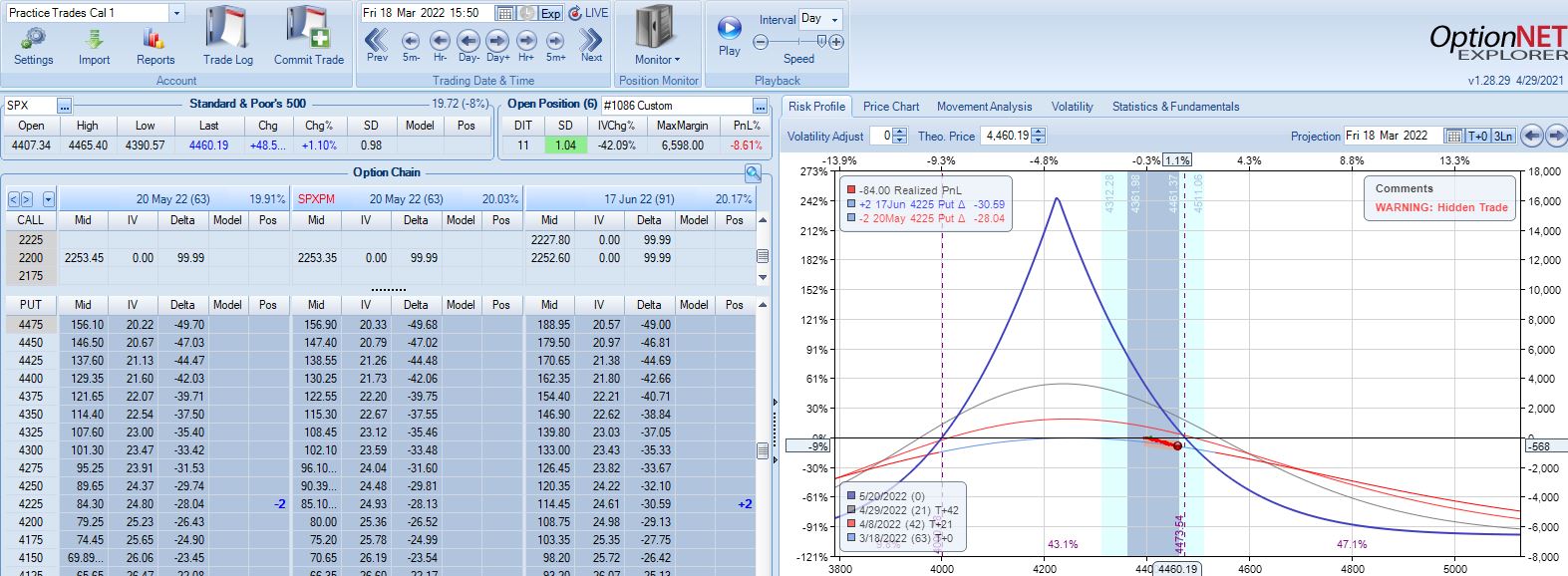

With SPX at 4201, trade #11 begins on 3/7/22 at the 4225 strike for $6,598: TD 37, IV 34.1%, horizontal skew 0.5%, NPV 262, and theta 48.

With SPX up 1.04 SD over 11 days, the first adjustment point is hit with trade down 9%:

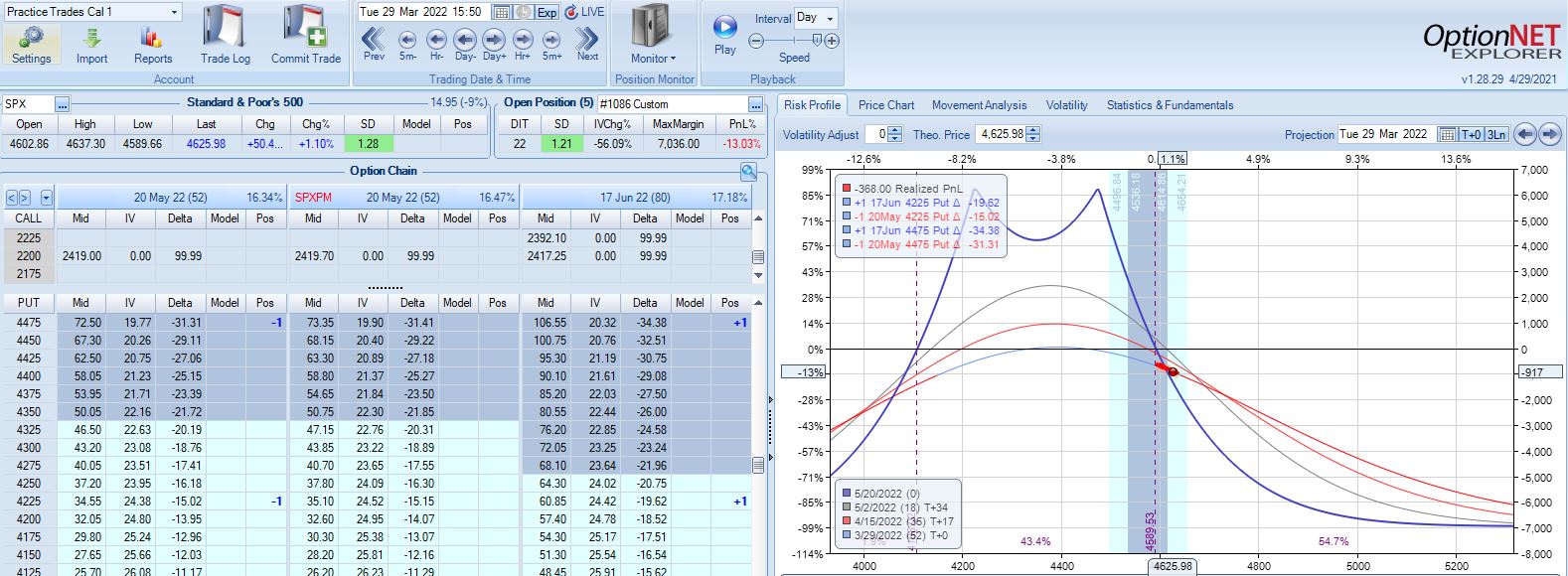

Trade down 13% after 22 DIT, but despite another scary look (see Part 4, first graph) this is not the second adjustment point:

PT is hit two weeks later with a gain of 11.3%. Max DD is the 13% shown above. Unlike trade #6, doing a pre-emptive adjustment this time is followed by max loss two weeks later (-20.1%).

I don’t necessarily think the base strategy is good or better just because trade management matters for trade #11. More than anything else, I feel lucky and I realize that at market pivots, I will feel equally unlucky going through other trades that proceed to lose.

While I await a larger sample size to make any determination about optimal strategy guidelines, I suspect this sort of ambiguity is what is what makes time spreads difficult to trade.

I will continue next time.